Business owners today have to wear multiple hats. From logistics and procurement to marketing, they must look after different business operations single-handedly.

Likewise, they must manage business finances smartly to keep the company out of trouble. However, financial management isn’t a walk in the park; it involves comprehensive record-keeping, documentation, and in-depth analysis.

Naturally, most entrepreneurs without a financial background struggle in this area; some misallocate budgets, whereas others become dependent on debt. In some instances, businesses fall into liquidity crises due to insufficient funds.

All these problems stem from financial instability, meaning financial management should be every entrepreneur’s utmost priority. So, how to handle it effectively?

International Accounting Standards (IAS) and International Financial Reporting Standards (IFRS) have laid out all principles for financial management. Therefore, go by the rules and incorporate similar practices. Further, find drawbacks and gaps in your bottom and look for resolution.

Here we have outlined six ways to manage your business finances effectively.

1. Learn Financial Accounting Basics

Running your business involves several unavoidable bookkeeping, tax, and accounting tasks. It might seem daunting initially, but these tasks are crucial to keeping your business safe from a compliance perspective.

Therefore, become hands-on with accounting basics. You can enrol in a few short accounting-related courses or explore different accounting degree types to learn the ropes.

Besides this, recruit a team of experts consisting of bookkeepers, financial analysts, and accountants. Remember, the goal isn’t to hire a huge team but a few well-versed people with accounting and financial expertise.

If the workload seems massive, integrate cloud accounting software to simplify day-to-day accounting tasks.

2. Prepare Financial Documents

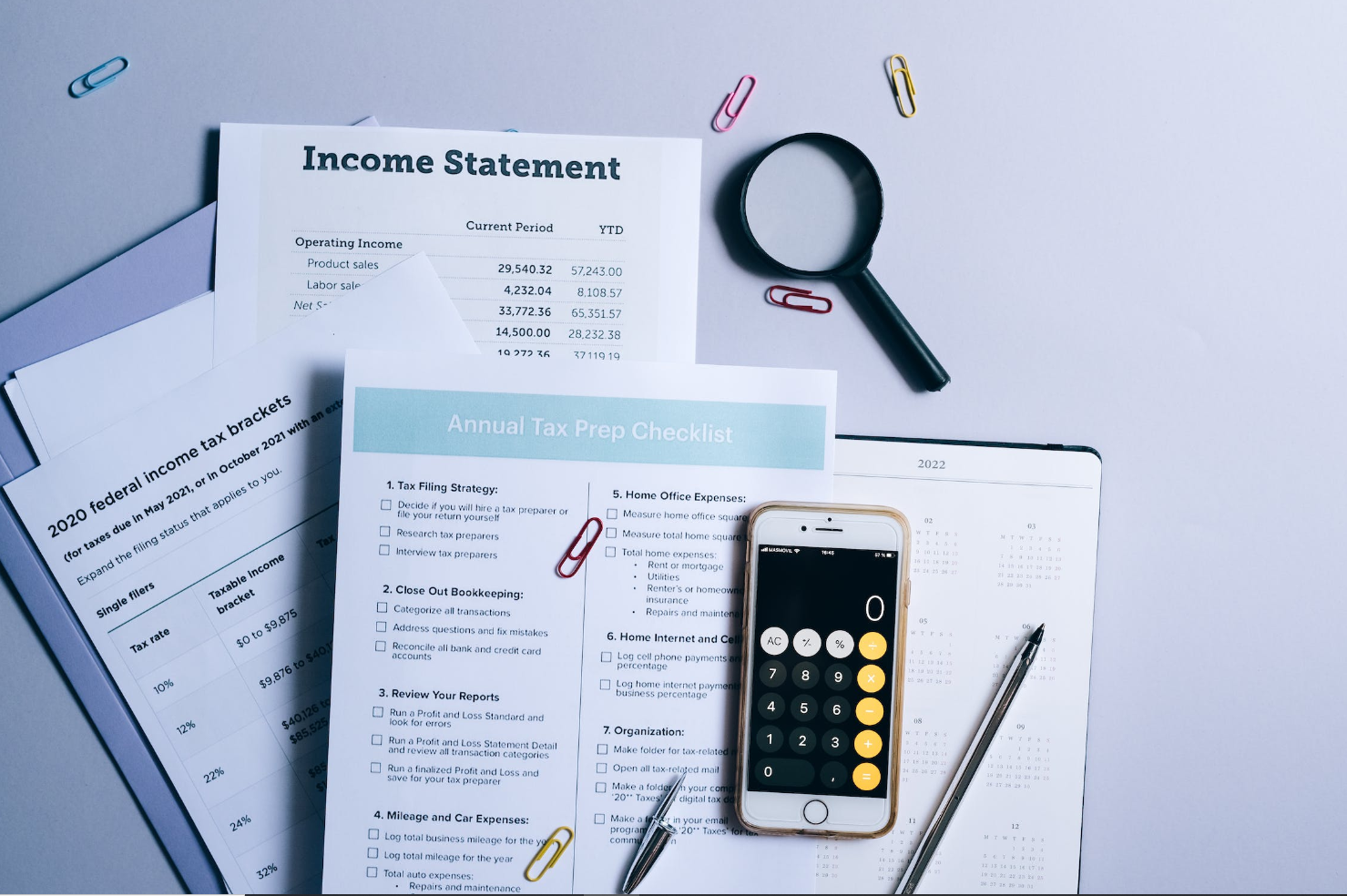

Do you maintain financial documents? These documents can provide a lot of insight into your company’s financial health. Here are two standard financial statements you must prepare.

Balance Sheet: It shows your company’s net worth – the number of assets it owns and the liabilities it owes. It also reflects the business’s equity, the difference between assets and liabilities.

In short, the money you will have if the company gets sold, you can use these numbers to determine where your business stands and if there is any scope for expansion in the future.

Income Statement: An income statement, also known as a profit and loss statement, shows your revenues and expenses. It sums them together to calculate business profit monthly, quarterly, and annually.

Analyzing this statement can help in determining the beneficial business aspects. Likewise, you can identify areas consuming the most money, allowing you to cut costs.

3. Manage Cash Flows

Financial management is pretty complex. After all, a profitable business can also run out of money in no time – all credit to cash flow problems.

Believe it or not, massive gaps in cash flow can drown the company into a liquidity crisis soon before anyone realizes it. Hence, every entrepreneur must manage cash flows to avoid such problems. And the best way to keep a close eye on cash inflows and outflows is to create a cash flow statement.

Your financial documents can give an overview of your monthly cash flow – a total of expenses and income. Once you have the details available, think about the payment terms.

Often cash flow problems arise because customers refuse to pay timely. It also leads to delays in payments to creditors. Perhaps, you can offer debtors cash discounts on early payments to encourage timely payments.

Lastly, ensure cash isn’t tied up in inventory. You can install inventory management software to ensure you have sufficient stock. It will help you match demand with stock levels, reducing inventory accumulation and cash flow problems.

4. Mitigate Supply Chain Risks

At times, supply chain disruptions can impact businesses’ bottom line. Delays aren’t only costly but lead to loss and damage of products, costing the company millions.

The only solution to mitigate this risk is by closely working with suppliers to reduce risk to product access. For this, you must adjust your supply chain strategies. Begin by tracking the existing orders and contracts. Likewise, look for backup suppliers to prevent disruptions affecting revenue and sales projections.

In addition, review your overall business and supply chain plans. You can enable a live tracking option for logistics. It might lead to additional costs but can improve savings in the long term. After all, it will track the lost products, saving the company from massive losses.

5. Explore Business Financing Options

Most business owners are afraid of taking debt. Some are unsure about repayments, whereas others can’t bear the interest expense every month.

Surprisingly, taking a loan is one of many options you have to finance the business. Debt financing is one of the ways to raise capital by taking money from a financial intermediary. However, you can always opt for equity financing if you need more appetite for taking a debt.

Equity financing involves raising funds by selling the company’s shares. It means you must share your organization’s ownership to finance the business. Even though you don’t have to repay the money, you can lose control if 51 per cent of shares are sold.

Likewise, you have to offer shareholders dividends in exchange for their investment in the company. Remember, these dividends aren’t a business expense; they get deducted from your profit after tax.

6. Invest in Growth

Do you want to expand revenue streams? Business profits are the sole source of income for most entrepreneurs.

It might be sufficient to keep the company running, but you must diversify risk by looking into new growth opportunities. It will enable your business to thrive and move in a healthy financial direction. So, why not buy a few bonds or treasury bills?

Financial securities offer a higher interest rate than the market, enabling you to earn high returns with minimal risk. Similarly, you can also put some money into the stock market for long-term gains. It will give you another company’s ownership and a yearly dividend.

You can sell the shares to earn massive premiums if the share price spikes. Different income streams can create more value for the business, enabling you to expand operations.

How to Manage Your Business Finances Effectively?

Even though getting acquainted with financial principles and jargon can be tricky, it goes a long way in stabilizing money-related matters.

Healthy financial management keeps the business operations in order while maintaining a positive cash flow. Therefore, every business should maintain records, prepare statements, and mitigate risks to ensure smooth operations.

In addition, you will also feel at ease having a clear picture of business finances every month.

I am Adeyemi Adetilewa, the Editor of IdeasPlusBusiness.com. I help brands share unique and impactful stories through the use of online marketing. My work has been featured in the Huffington Post, Thrive Global, Addicted2Success, Hackernoon, The Good Men Project, and other publications.