You’ve developed a million-dollar idea, created a product or perfected service and have done your market research. Great, now you’re ready to start making those conversions and hitting those first and second-year targets.

There’s just one rather large obstacle in the way. The funds required to get started are indeed lacking. Unsurprisingly, most startups will require some financial assistance in getting started.

Startup capital is used to pay for any required expenses that come with creating a new business. These can take the shape of renting office spaces, licenses, research and market testing, product manufacturing and almost anything else.

Startup capital is a term used often but mistakenly synonymously with seed money. Whilst seed money is technically a form of startup capital, it is a more modest sum that’s mainly used to help create a business plan. This, in turn, is used to present the business idea to investors for capital.

Competition for investment is fierce.

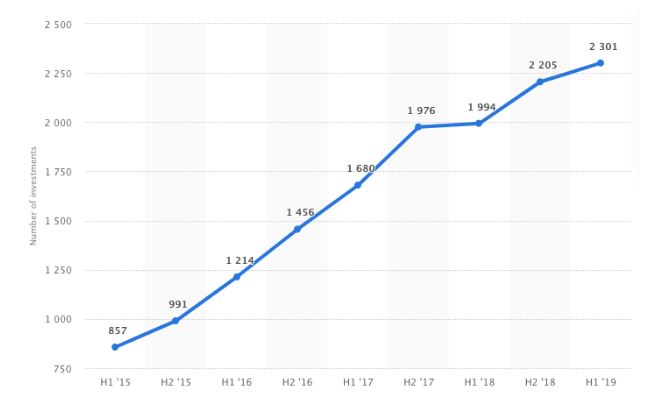

The graph below illustrates the European startup investment scene, with more than 2,300 recorded investments in 2019 (Statista). It reached a record value of 16.9 billion euros in the first six months.

This upward trend is forecast to continue as more companies enter the market and startup initiatives grow. As such, it’s more important now than ever for startups to have a clear appreciation for the different sources of startup capital.

So, what are the financing options available to a startup company? The list below should highlight different methods, and make clear which is most suitable for young entrepreneurs entering into a new market.

1. Bootstrapping

If you have tonnes of motivation, are ready to budget tightly, and embrace the difficulty of using limited funds to create something that’s all yours – bootstrapping your business is the way to go.

Essentially, it’s a method of getting your startup off the ground with little to no money. In other words, the founder of business will be left to their own financial devices, without the help of venture capital or angel investment.

The funds come from the money generated by a business, which is then pumped back into its operations to sustain growth. There are typically few opportunities to raise significant profit or expand too quickly.

Step one begins with seed money. Ultimately, this is a relatively small accumulation of money from personal savings and funds from friends and family. Where this isn’t an option, seed money can also come from side hustles and day jobs to fund new early development.

Step two involves the process of actually making sales. Customer funded money should keep operations running. This step is tentative as a business should be generating enough interest in its early days to make the sales.

It’s an extremely difficult method, but highly rewarding.

2. Crowdfunding

A popular option for creatives and entrepreneurs. Crowdfunding is ideal for raising money for entrepreneurs to get their idea on their feet. It typically involves a process of collecting small amounts of funds from a large number of contributors.

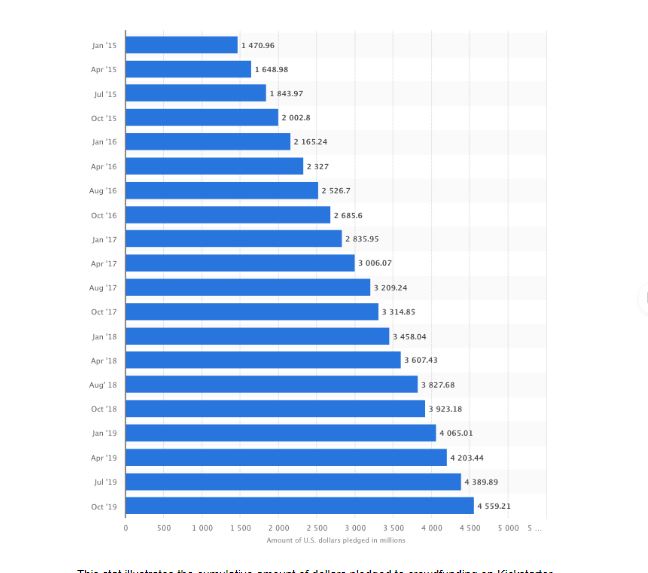

This stat illustrates the cumulative amount of dollars pledged to crowdfund on Kickstarter alone, from Jan 2015 to Oct 2019 (Statista). It’s visibly clear that crowdfunding is growing rapidly popular. As of the last project period, more than 5.65 billion dollars was pledged. This, at the very least, puts into perspective the international source of capital available via crowdfunding

There are hundreds of different crowdfunding platforms that make it easy for entrepreneurs to pitch their business ideas to the largest investor community. Anyone can pitch and anyone can donate.

This alternative financing method is perfect for young, new entrepreneurs with no industry experience and often faces trouble being granted traditional business loans. Crowdfunding is a relatively new financing method but has proved successful and has transformed the way startup companies raise capital.

3. Angel Investors

Angel investors are typically wealthy individuals who invest capital in startups and early-stage small businesses. Generally, a business becomes an attractive investment opportunity for angel investors when they become profitable but need money in order to grow.

This transaction is typically accompanied by the exchange of ownership equity in the company. Funds provided may well be a one-off occurrence, or regular injections of cash to support and carry the business through to its next stage.

It’s not uncommon for young entrepreneurs to be put off the average internal rate of return at 22 percent. This figure would probably look appealing to investors but deemed perhaps too high for entrepreneurs. However, cheaper sources of finance such as business loans aren’t always available. Making angel investors a perfect source of finance for those who are still financially lacking.

4. Venture Capital

Startups seeking financing often turn to Venture Capital firms for cash, strategic assistance, introductions to key stakeholders. It is a common form of private equity financing and one that investors will generally only provide startup companies with long term growth potential.

Whilst cash injections are needed to get a business back on the road to long term growth, VC isn’t solely monetary assistance. Perhaps most importantly, it can provide both technical and managerial expertise. This is particularly invaluable for entrepreneurs with less business experience.

Venture capital is becoming an increasingly popular and essential source of finance for companies with a limited operating history. Often these companies will lack access to capital markets, bank loans, and other debt instruments. Whilst the VC will gain equity in the company, their knowledge and expertise could make it a price many entrepreneurs are willing to pay.

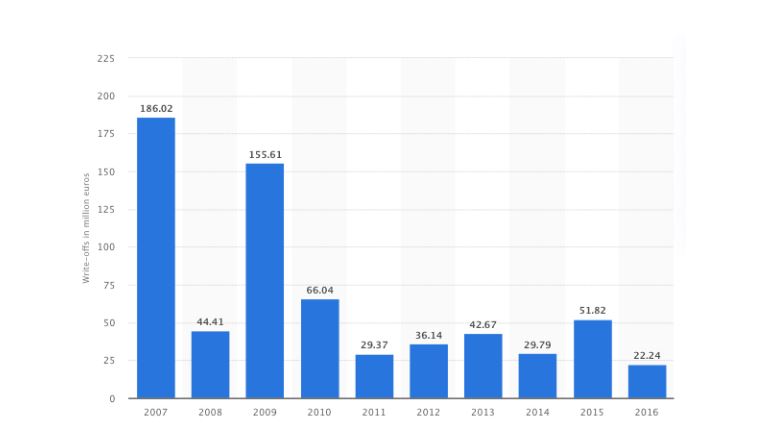

There appears to be a growing trend in VC confidence. The figures here show the total value of VC capital divestment write-offs in the UK 2006 – 2016. A VC investment write-off accounts for the belief of the venture capitalist that their investment will not return any money and therefore is of zero value. 2007 displayed the highest value of VC write-offs and has gradually decreased as we near recent years.

5. Government Grants and Subsidies

Grants are considered to be publicly funded schemes that include cash, equipment, tools, and training to young entrepreneurs and small business owners. Depending on the scheme, cash rewards range from hundreds to hundreds of thousands. Better yet, these are often completely interest-free and sometimes, you won’t have to pay it back at all.

As with most good things in life, government grants are extremely competitive and difficult to obtain. So, be prepared to demonstrate how your startup has the capacity to make a positive difference in your industry.

There is a range of government grants available:

- Direct grants- cash sum awarded to businesses to carry out a specific project. There will often be terms and conditions attached. Like, the need for you to raise a matched amount.

- Resources and training grants – innovation vouchers to enlist the help of an expert, local advice support in the form of workshops, training and expert advisory services.

- Soft loans- a loan where the terms and conditions of repayment are ‘softer’, e.g low-interest rates.

- Business grants for women – give opportunities to and encourage women entrepreneurship.

- Young people grants – E.g. The Prince’s Trust offers mentoring, support and funding to entrepreneurs between 18-30.

- Business grants for social entrepreneurs, unemployed entrepreneurs and those with bad credit.

6. Bank loans

Government-backed personal loans are a traditional finance method for new businesses to get on their feet. The loan typically has a fixed interest rate of 6 percent per annum with 1 – 5-year repayment terms.

The key criteria to be eligible for such a loan is that you are either starting a new business or have been trading for less than two years. In other words, all young entriewp[reneurs and startup businesses could consider this option.

One of the best things about this type of bank loan is that it’s unsecured. Meaning there’s no need to provide assets as security. This is particularly useful for startups given most tend not to have valuable assets or that they have been tied up in other financial commitments.

7. Product pre-sales

A less conventional and slightly higher risk source of capital for startups is by making product-pre sales. When done effectively, this can be an incredibly useful pool of funds to dip in to for business development.

It’s a simple premise based on the selling of a product before officially launching your product on a larger scale. It’s an excellent approach to building your brand and consumer confidence. It also lets you size up the demand for your product or service, to avoid overproduction.

My name is Daglar Cizmeci, and I’m a serial investor, founder, and CEO with over 20 years’ industry experience in emerging tech, aviation, logistics, and finance. I’ve graduated from the Wharton School and Massachusetts Institute of Technology (MIT). Chairman at ACT Airlines, myTechnic and Mesmerise VR. CEO at Red Carpet Capital and Eastern Harmony. Co-Founder of Marsfields, ARQ and Repeat App.