If revenue feels “lumpy” even when demand is strong, the problem often isn’t your product. It’s the handoffs.

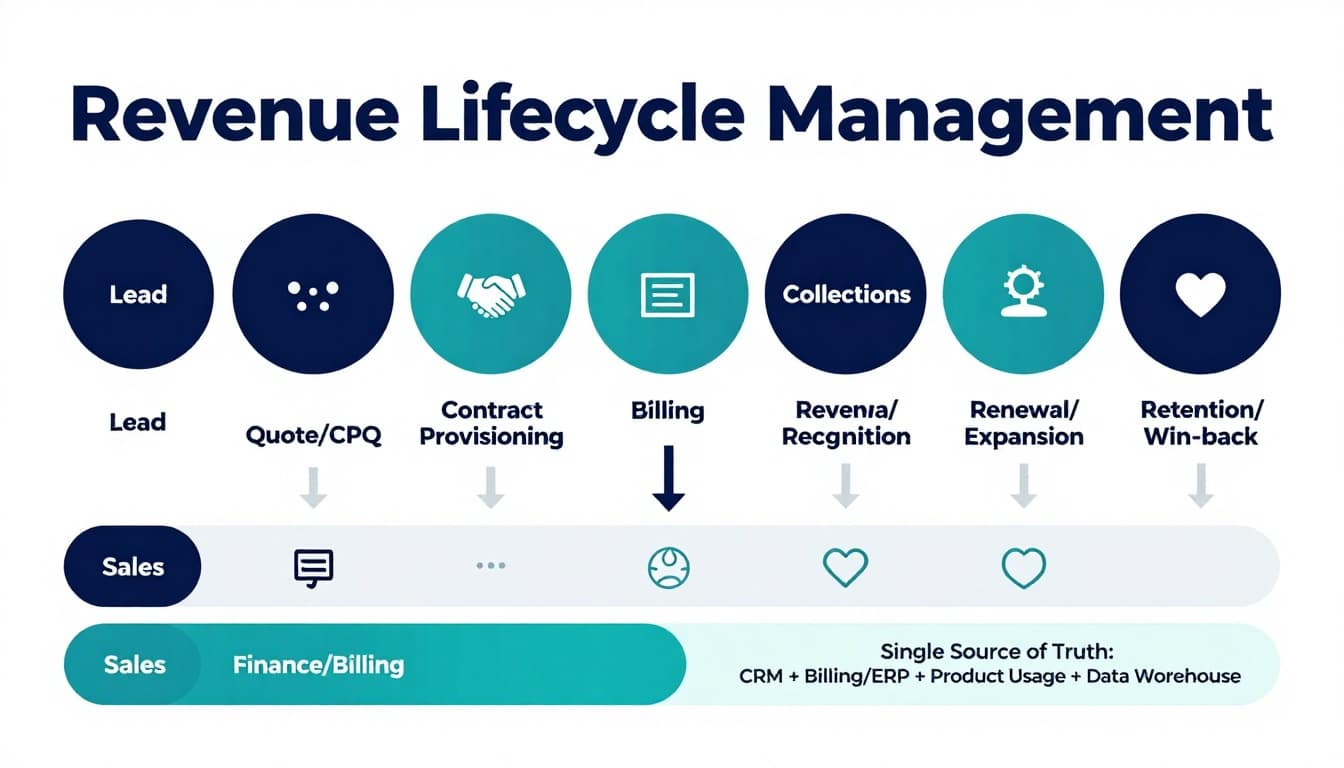

Revenue lifecycle management is the discipline of making sales, billing, and retention work like one connected system, not three departments passing a messy baton. When it’s done well, you get cleaner quotes, fewer billing surprises, faster cash collection, and renewals that don’t depend on last-minute heroics.

This matters for founders, marketers, and small teams because misalignment creates quiet leaks: discounts that never get approved, invoices that don’t match contracts, usage that isn’t billed, and customers who churn after a preventable billing fight.

What revenue lifecycle management actually covers (end to end)

Revenue doesn’t start at the invoice. It starts when a buyer first says, “This might work.”

A practical definition is “the connected process and data that moves a customer from lead to cash to renewal.” If you want a formal overview, DealHub’s breakdown of revenue lifecycle management aligns with how most teams frame it: one model that ties together the full customer and revenue journey.

Here’s the key idea: you’re not managing “steps,” you’re managing handoffs.

The real cost of misalignment (what it looks like in the wild)

Misalignment doesn’t always show up as a crisis. It shows up as friction.

Common symptoms:

- Sales promises “net 30” while billing sends “due on receipt.”

- A contract includes a ramp or add-on, but the invoice doesn’t.

- Customer success sees low usage, but finance doesn’t see risk until renewal month.

- Your churn story becomes “pricing,” when it was really confusion and trust loss.

Think of your revenue process like plumbing. You can pour more water in (more leads), but if your pipes leak, growth just makes the mess bigger.

The 9-stage revenue lifecycle (and who should own each part)

Most teams argue about ownership because the stages aren’t written down clearly. Start by mapping them.

| Lifecycle stage | Primary owner | What “good” looks like |

|---|---|---|

| Lead | Marketing/Sales | Clean attribution and lead source tracking |

| Quote/CPQ | Sales/RevOps | Approved pricing, clear scope, no “special terms” hidden in email |

| Contract | Sales/Legal | Terms match what was sold, signatures captured fast |

| Provisioning | Ops/Product | Customer gets access quickly, entitlements match contract |

| Billing | Finance/Billing | Invoice matches contract and usage rules |

| Collections | Finance | Fewer disputes, consistent follow-up, faster cash |

| Revenue recognition | Finance | Accurate mapping of contract to accounting rules |

| Renewal/Expansion | Customer Success/Sales | Renewal motion starts early, expansion is evidence-based |

| Retention/Win-back | Customer Success | At-risk accounts flagged early, saves are repeatable |

If you want a detailed “step-by-step” style model (from a different industry), AllTopBusiness has a useful reference on revenue cycle management steps. The workflows differ, but the lesson is the same: gaps between steps are where revenue gets lost.

Aligning Sales, Billing, and Retention: the three “contracts” you must keep

Alignment gets easier when you treat it as three promises you can’t break.

1) The promise made in Sales (the commercial contract)

Sales sets expectations on price, timing, and outcomes.

To keep it tight:

- Standardize discount rules and approvals.

- Define what can and can’t be customized in terms.

- Capture key fields once (billing cadence, start date, usage limits, add-ons).

If your pipeline is noisy, start by tightening how leads enter and move through sales. This guide to top sales prospecting tools can help you reduce “random” deals that blow up later because they were never qualified.

2) The promise enforced by Billing (the money contract)

Billing is where trust gets tested. Customers will forgive a slow feature. They don’t forgive a confusing invoice.

A simple billing alignment checklist:

- Invoices must match the contract language (not internal shorthand).

- Usage and overages need a clear rule, visible to the customer.

- Credits, proration, and renewals should follow written policy, not memory.

3) The promise proven in Retention (the value contract)

Retention is not a customer success “soft skill.” It’s the proof that what you sold is working.

Operationalize it:

- Define onboarding milestones that connect to the paid plan.

- Track product usage and adoption signals.

- Build an “at-risk” rule that triggers action long before renewal.

For SaaS teams, metrics are the glue between billing and retention. This roundup of critical SaaS metrics for growth is a helpful starting point, especially for churn, LTV, and net revenue retention.

The systems you need (without turning into an enterprise project)

You don’t need 12 tools. You need a clean source of truth and a few strong integrations.

Most small and mid-size teams run RLM across:

- CRM (accounts, opportunities, renewals)

- Billing or ERP (invoices, payments, dunning)

- Product usage (events, seats, consumption)

- Support and CS platform (tickets, health notes)

- Data warehouse or analytics layer (reports, cohorts)

When the CRM and billing system disagree, people “fix” it in spreadsheets. That’s how errors become normal.

If you’re building around Salesforce, it’s worth reviewing Salesforce CRM add-ons that improve data capture and workflow control (especially around approvals and quoting).

For a broader vendor view of RLM software categories, Conga’s overview of revenue lifecycle management is a decent reference for what platforms typically include (CPQ, contracts, billing connections, renewals).

A practical rollout plan for founders and small teams

RLM fails when it’s treated like “a big transformation.” Keep it small, then build.

Step 1: Pick one revenue leak and fix it first

Good first targets:

- Invoice disputes

- Discount approval chaos

- Renewal surprises

- Missing usage billing

Step 2: Define a “deal-ready” checklist

Make it impossible to close a deal without:

- Confirmed start date

- Billing cadence

- Signed terms

- Provisioning requirements

- Owner for onboarding

At minimum, track:

- Time from close to first invoice

- Days sales outstanding (DSO)

- Gross churn and net revenue retention

- Dispute rate (invoices with tickets attached)

Step 4: Assign a single owner for handoffs

Not a committee. One owner (often RevOps or a finance ops lead) who can say, “This is the process,” and keep it current.

Common mistakes that sabotage revenue lifecycle management

- Fixing tools before process: Automation can’t save a broken handoff.

- Letting exceptions become the norm: One-off terms pile up until billing becomes custom work.

- Treating retention as separate from billing: Many churn events start as billing confusion, not product failure.

- Waiting until renewal month to act: Renewal is a result, not a moment.

Conclusion: Make revenue feel predictable again

When sales, billing, and retention share the same rules and data, revenue stops feeling like guesswork. You close cleaner deals, bill what you sold, collect faster, and renew customers who actually trust you.

If you want a single goal for the next quarter, make revenue lifecycle management visible: map the handoffs, fix one leak, and build a cadence where every team sees the same truth. That’s how small teams grow without revenue chaos.

Adeyemi Adetilewa leads the editorial direction at IdeasPlusBusiness.com. He has driven over 10M+ content views through strategic content marketing, with work trusted and published by platforms including HackerNoon, HuffPost, Addicted2Success, and others.