If you’ve got more than one product (or you’re testing new business ideas alongside your core offer), your biggest risk usually isn’t competition. It’s confusion.

Product portfolio management becomes hard when every product sounds “important,” every stakeholder has a favorite, and your roadmap turns into a junk drawer. That’s where product portfolio lifecycle management earns its keep: it forces clear choices across the full product life, from idea to retirement.

This guide breaks down the strategy, the most useful models, and practical best practices you can apply in a startup, a growing SMB, or a multi-product company.

What product portfolio lifecycle management actually means

Product portfolio lifecycle management is the discipline of managing multiple products across different lifecycle stages so your company invests in the right work at the right time.

Think of it like running a restaurant, not a single dish. One item pays the bills, one draws new customers, one is seasonal, and one should’ve been removed months ago. A portfolio view stops you from cooking everything at once.

It matters because it improves three things that decide your growth rate:

- Resource allocation: money, people, and time go where they produce returns.

- Focus: fewer “maybe” projects, more committed bets.

- Timing: you push, hold, or retire products before they drain margin.

For a clear overview of how teams structure product portfolios in practice, monday.com’s guide is a helpful reference: product portfolio management explained.

The lifecycle lens: stages, decision gates, and “truth metrics”

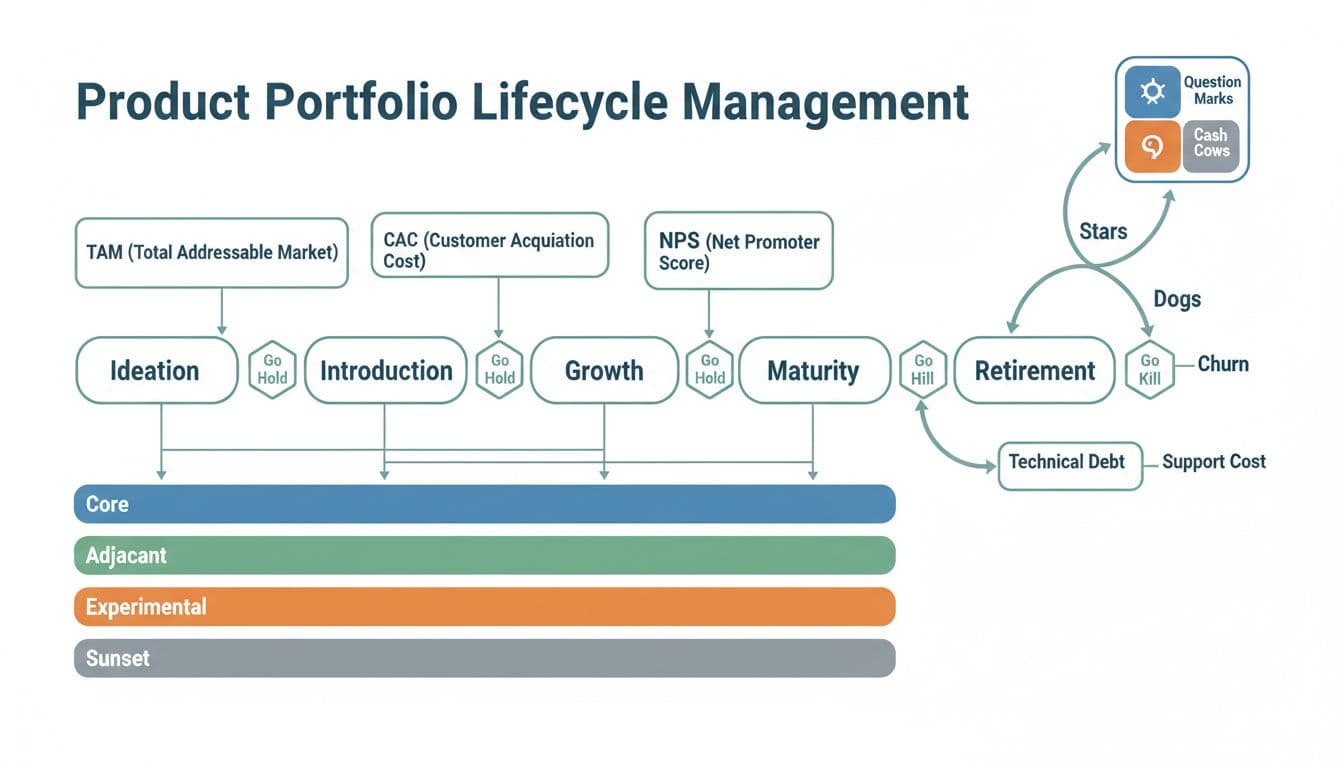

Most teams know the classic lifecycle stages, but they don’t attach decisions and metrics to them. Lifecycle management works when each stage has (1) a goal, (2) a small set of KPIs, and (3) a gate that forces action.

A practical stage-and-gate table you can use

| Lifecycle stage | Primary goal | “Truth” KPIs to watch | Typical gate decision |

|---|---|---|---|

| Ideation | Validate demand | TAM signal, problem frequency, willingness to pay | Go, Hold, Kill |

| Introduction | Prove adoption | Activation rate, time-to-value, early retention | Go, Hold, Kill |

| Growth | Scale efficiently | CAC to LTV, conversion rate, capacity constraints | Go, Hold, Kill |

| Maturity | Maximize profit | Margin, NPS, attach rate, renewal rate | Invest, Maintain, Simplify |

| Decline | Control drag | Churn, support cost, sales cycle length | Fix, Harvest, Sunset |

| Retirement | Exit cleanly | Migration rate, risk exposure, tech debt | Decommission, Replace |

The gate questions that prevent “zombie products”

At each gate, ask questions that are hard to wiggle around:

- Is the problem still urgent? Urgency can fade even if usage looks fine.

- Is the unit economics story getting better? If not, growth may be a trap.

- What’s the opportunity cost? The best alternative use of the same team matters.

A simple habit helps: write the “kill criteria” during ideation, not during decline. It’s easier to be honest before anyone falls in love.

Portfolio strategy: balance your bets, not just your roadmap

A lifecycle view is descriptive. Portfolio strategy is prescriptive. It answers: “What mix of products are we building and why?”

A strong strategy usually balances four buckets:

- Core: the product(s) that fund the company today.

- Adjacent: expansions for existing customers (new use cases, new segments).

- Experimental: smaller bets to find new growth curves.

- Sunset: products you’re intentionally shrinking or exiting.

Here’s the catch: balance isn’t about equal funding. It’s about intentional funding. Many companies starve the core while over-funding experiments, or they over-feed the core and slowly lose relevance.

A simple allocation rule that works in real teams

If you need a starting point, try a rough split and adjust quarterly:

- 60 to 70% Core improvements and retention work

- 20 to 30% Adjacent growth plays

- 5 to 10% Experiments (time-boxed)

- 0 to 10% Sunset and migration (depends on backlog of debt)

The goal isn’t perfection. The goal is to stop accidental strategy.

Portfolio models that help you make decisions (without overthinking)

Models don’t decide for you, they give you a shared language. Two frameworks show up in product portfolio discussions because they force trade-offs.

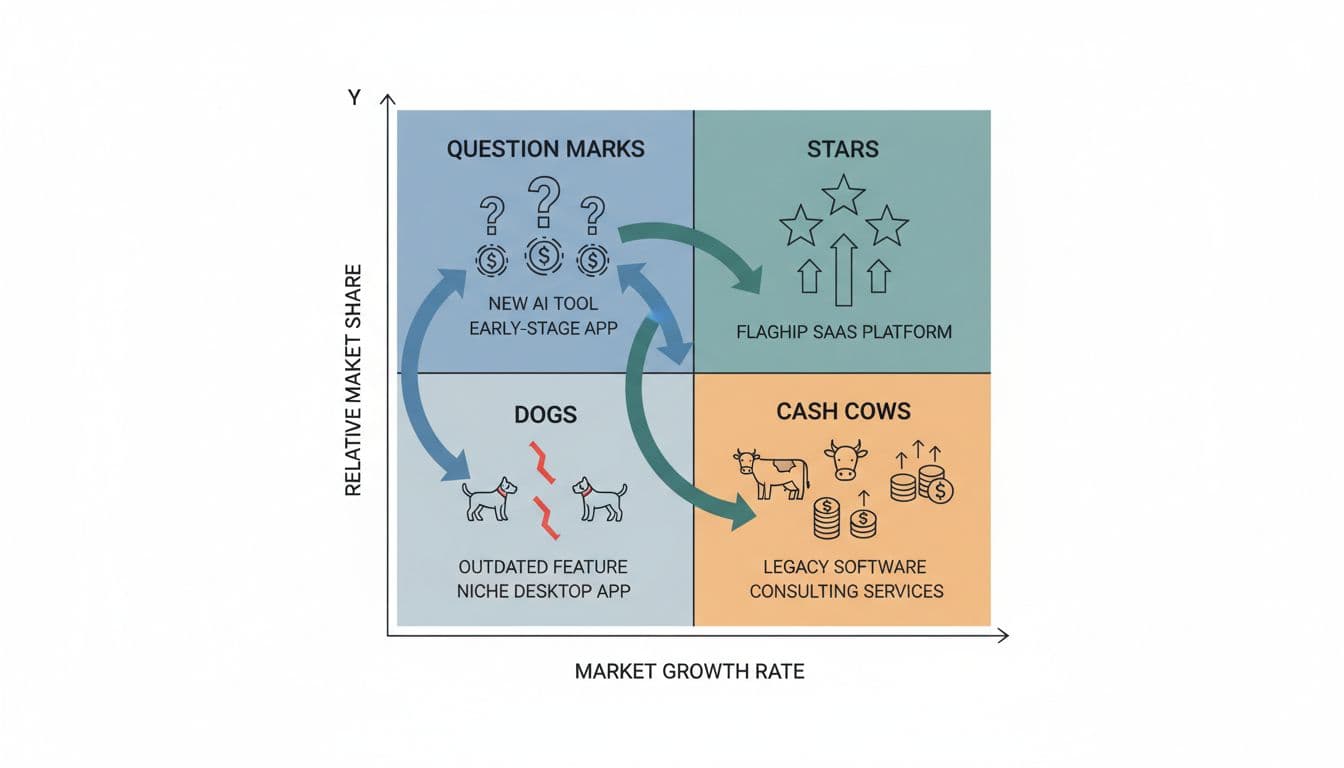

The BCG matrix (quick, imperfect, still useful)

The BCG Growth-Share Matrix groups products into:

- Stars: high growth, high share (invest to keep lead).

- Cash Cows: low growth, high share (optimize profit, fund bets).

- Question Marks: high growth, low share (choose, invest or exit).

- Dogs: low growth, low share (sunset or harvest carefully).

Used well, it stops teams from treating every product like a “Star.” Used poorly, it becomes a label maker. Keep it tied to real numbers and real constraints.

If you want a deeper portfolio-oriented product management perspective, Productboard’s overview is solid: product portfolio management 101.

Lifecycle mapping (the missing link most teams ignore)

A practical upgrade is to map each product to both:

- its lifecycle stage (Growth, Maturity, Decline), and

- its portfolio role (Core, Adjacent, Experimental, Sunset)

That combo reveals hidden problems fast. Example: an “Experimental” product in “Maturity” is often a sign you never made a decision, you just kept maintaining it.

Best practices that keep the portfolio healthy

Set portfolio governance that matches your company size

You don’t need a committee. You need a recurring decision meeting with the right inputs.

A workable cadence for most SMBs:

- Monthly: portfolio health check (top KPIs, risks, major changes)

- Quarterly: investment shifts (fund, pause, kill, sunset)

- Annually: strategic resets (market moves, category bets, pricing strategy)

If you’re looking for an operations-focused approach to formalizing these steps, QAD outlines a useful flow: steps for effective product portfolio management.

Use a “one-page” scorecard per product

Long decks hide weak logic. A one-page scorecard forces clarity:

- Target customer and job-to-be-done

- Lifecycle stage and portfolio role

- 3 to 5 KPIs that matter now

- Current investment (team, spend)

- Next gate date and decision criteria

Keep it brutally short. If it can’t fit on a page, it’s not decision-ready.

Treat sunsetting as a product, not a cleanup task

Retirement fails when it’s handled like a tech chore.

A clean sunset plan includes:

- Customer segmentation (who’s affected, how badly)

- Migration path (tools, services, incentives)

- Timeline and communications

- Risk management (compliance, data retention, contracts)

The best time to plan this is while the product still has goodwill.

Don’t let technical debt become a portfolio blind spot

Decline often looks like “the market changed,” but sometimes it’s self-inflicted. Support cost climbs, bugs pile up, and shipping slows down. That’s portfolio debt.

Track support cost and engineering drag as first-class metrics, not afterthoughts.

The tool stack: keep it simple and connected

You don’t need fancy software to start. You need visibility, version control, and a single source of truth.

A practical setup:

- Work management for portfolio views and capacity planning

- Product discovery and feedback for demand signals

- BI dashboards for consistent KPI definitions

Tooling only helps when your lifecycle gates and scorecards are already clear.

Conclusion: make portfolio decisions on purpose

When your portfolio grows, indecision gets expensive. Product portfolio lifecycle management gives you a repeatable way to invest, pause, or retire products based on evidence, not noise.

If you take one step this week, build a one-page scorecard for each product and set a quarterly gate review. You’ll feel the clarity fast, and your product portfolio management will stop being reactive and start paying for itself.

Adeyemi Adetilewa leads the editorial direction at IdeasPlusBusiness.com. He has driven over 10M+ content views through strategic content marketing, with work trusted and published by platforms including HackerNoon, HuffPost, Addicted2Success, and others.