If revenue feels like a leaky bucket, you’re not alone. Many founders and marketers keep pouring money into ads, content, and sales outreach, only to watch customers buy once, then disappear.

That’s why customer lifetime value matters. It turns growth into a math problem you can manage, not a guessing game you hope works out.

This guide shows how to measure it, improve it across the customer lifecycle, and build long-term revenue you can count on.

Customer lifecycle value vs. customer lifetime value (and why you should track both)

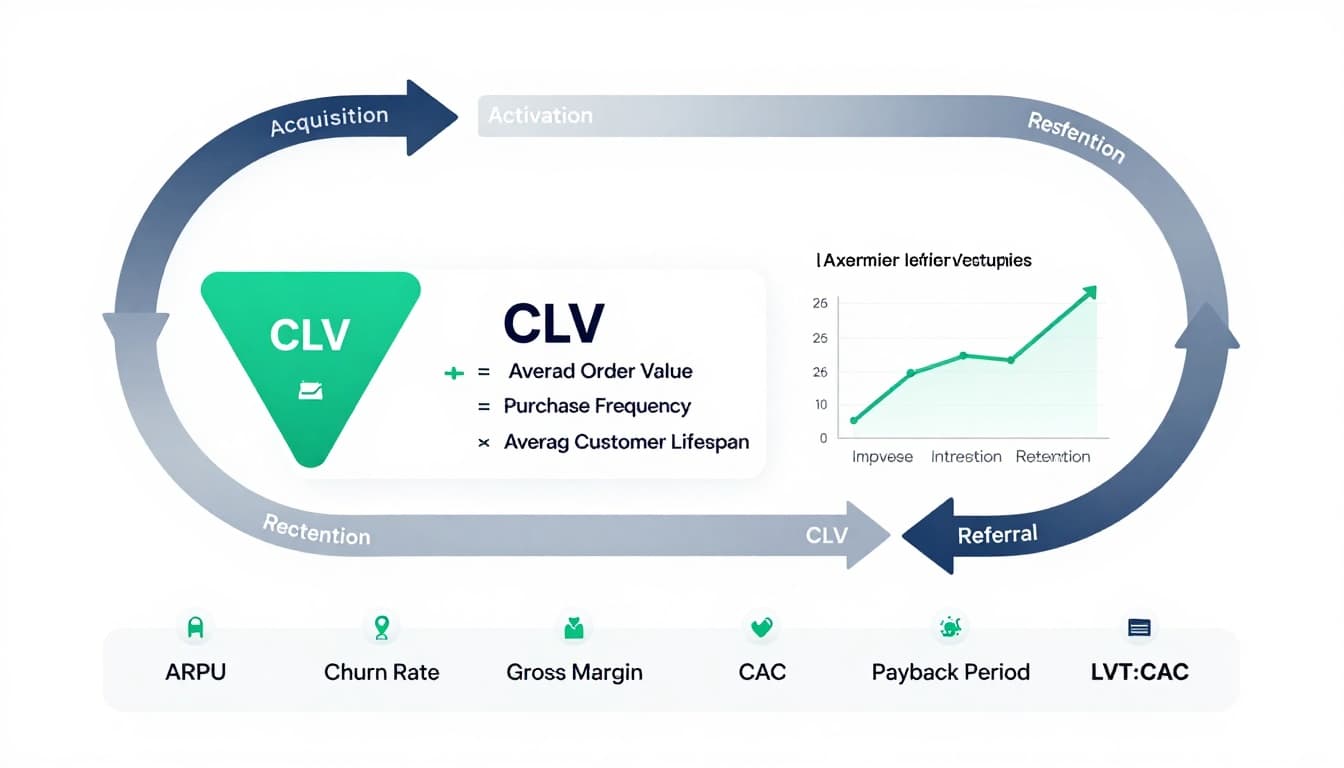

Customer lifetime value (CLV) is the total value a customer brings over their relationship with you.

Customer lifecycle value is how that value is created step-by-step, from first touch to repeat purchases, upgrades, and referrals. Think of it like a road trip: CLV is the total miles driven, lifecycle value is what happens at each stop that keeps the engine running.

CLV is powerful because it changes how you make decisions:

- It stops you from celebrating low-quality growth that churns fast.

- It helps you spend more confidently on acquisition when retention is strong.

- It shows where to fix the journey, not just where to “get more leads.”

If you want a quick refresher on CLV definitions and use cases, Salesforce’s overview is a solid starting point: customer lifetime value guide.

How to measure customer lifetime value (without overthinking it)

You don’t need a data science team to get a useful CLV number. You need clean inputs and a consistent method.

The practical CLV formula most small businesses can start with

A straightforward approach looks like this:

CLV = (Average order value × Purchase frequency × Gross margin) × Average customer lifespan

This is intentionally simple. It’s not perfect, but it’s a dependable baseline that gets better as your tracking improves. For ecommerce brands, “purchase frequency” is orders per customer per month or year. For SaaS, it’s often ARPU and retention.

For a deeper walkthrough of CLV calculation, including ecommerce examples, Klaviyo breaks it down clearly: how to calculate CLV.

The CLV inputs you should define (and where founders slip)

Here’s a quick cheat sheet you can share with your team:

| Input | What it means | Where to pull it from |

|---|---|---|

| Average Order Value (AOV) | Revenue per order | Shopify, Stripe, POS reports |

| Purchase Frequency | Orders per customer in a period | Ecommerce analytics, CRM |

| Gross Margin | Revenue minus direct costs | Accounting, COGS reports |

| Customer Lifespan | How long customers stay active | Subscription logs, cohort reports |

Two common mistakes to avoid:

Using revenue instead of gross profit. A “high CLV” on low-margin products can still lose money.

Relying on one blended average. Averages hide the truth. Segment your CLV by channel (organic, paid, referrals), by plan tier, or by first product purchased.

Pick the right CLV method for your stage

- Early-stage (limited history): Start with historical CLV, then segment as data grows.

- Subscription businesses: Add churn rate and expansion revenue to get a truer picture.

- High-ticket services: Use contract length and renewal rates, not “orders.”

If your business is subscription-based, cancellation patterns are often the clearest CLV warning sign. This breakdown of common reasons for subscription cancellations and retention fixes can help you spot what’s driving churn before it spreads.

How to optimize CLV across the customer lifecycle (acquisition to referral)

Here’s the simplest way to grow CLV: improve the parts of the journey that decide whether a customer sticks, buys again, and tells others.

Acquisition: bring in customers who can actually stay

Not all revenue is good revenue. If a discount-heavy campaign attracts price hunters, your CLV will sag.

What to do instead:

Tighten targeting: Aim ads and content at problems your product solves best.

Qualify leads earlier: Clear pricing, clear “who it’s for,” clear outcomes.

Track CLV by channel: Keep the channels that produce long-term customers, cut the rest.

Activation: get customers to value fast

Activation is the “aha” moment. Miss it, and retention becomes an uphill climb.

Simple activation moves that work across industries:

- A short onboarding checklist (3 to 5 steps)

- One fast win in the first day (or first week)

- Proactive help when users stall (email, SMS, live chat)

Retention: fix the leaks that quietly kill revenue

Retention is where long-term revenue is made. Improving retention often beats “more leads,” because it compounds.

Strong retention usually comes from basics done well:

Reliable support: fast response, clear answers, real ownership.

Product or service consistency: the customer gets what they expected, every time.

Follow-up rhythms: check-ins, usage tips, reorder reminders, renewal prep.

If you need a practical reminder of how service quality fuels loyalty, this is worth bookmarking: why good customer service drives retention and LTV.

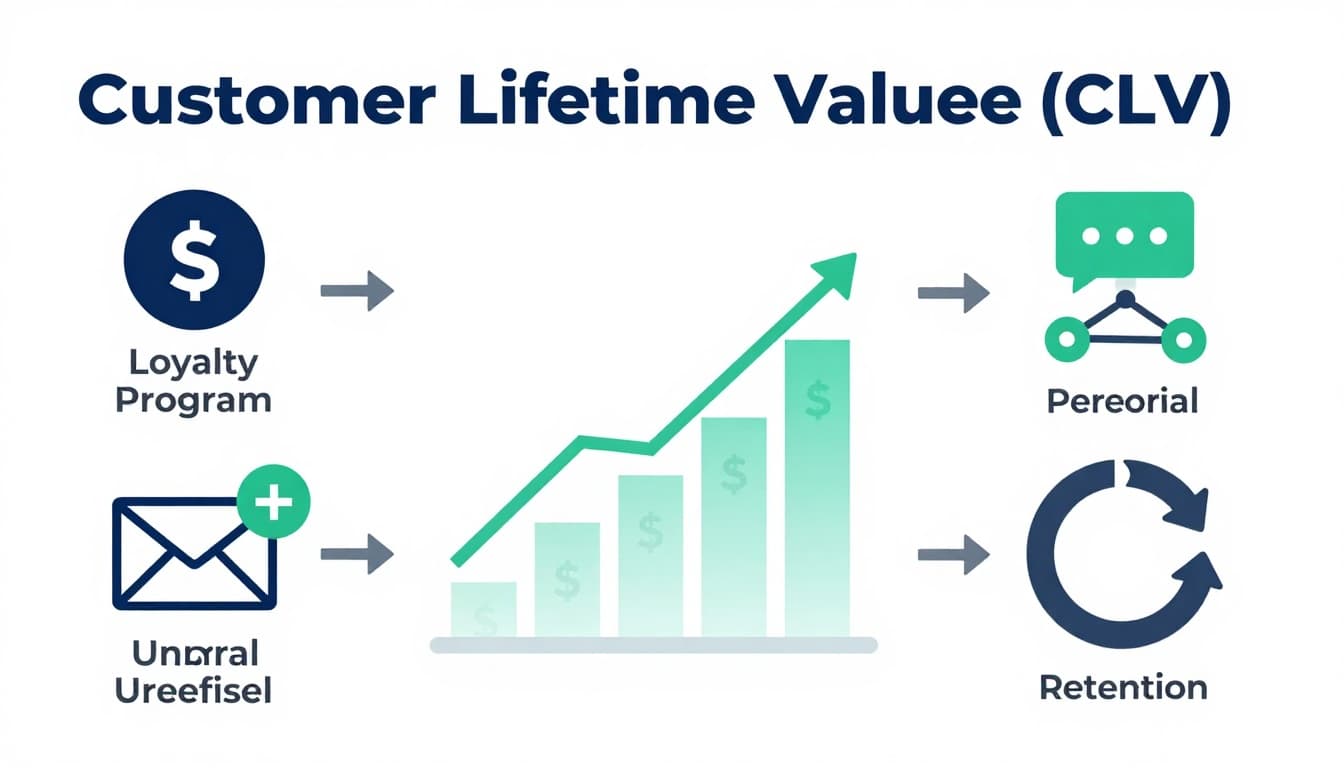

Expansion: increase value without annoying customers

Expansion is how you grow revenue without restarting the acquisition cycle.

Good expansion feels like helpful guidance, not pressure:

Upsells that match the moment: “You’re hitting limits, here’s the next tier.”

Cross-sells that reduce friction: add-ons that save time or bundle well.

Annual plans: better cash flow for you, often a discount for them.

Referral: turn happy customers into a low-cost growth channel

Referrals lift CLV because they reduce acquisition costs and often bring in higher-trust customers.

Make referrals easy:

- A simple “give $20, get $20” offer (or service credit)

- Ask right after a win (delivery, onboarding success, support resolution)

- Build shareable proof (reviews, case studies, before-and-after stories)

A simple 30-day CLV improvement plan (for busy teams)

You don’t need a massive overhaul. You need one focused cycle.

Week 1: Measure and segment

Calculate CLV for your top 2 customer segments (by channel or plan tier).

Week 2: Find the retention break

Identify where customers drop off (first 7 days, first 30 days, first renewal).

Week 3: Ship one retention fix

Examples: better onboarding email series, clearer cancellation save offer, faster support routing.

Week 4: Add one expansion trigger

Examples: usage-based upgrade prompt, bundle offer, reorder reminder, annual plan push.

If you run SaaS, you’ll get extra clarity by pairing CLV with churn, NRR, and CAC. This overview of retention metrics every SaaS business should monitor is a helpful checklist.

Common CLV mistakes that make “growth” look better than it is

Even smart teams get tripped up by these:

Counting customers you can’t serve well. If delivery or support is overloaded, retention drops.

Not factoring in margins. CLV should reflect profit, not just revenue.

Ignoring payback period. If it takes too long to earn back CAC, cash flow tightens fast.

Conclusion: make customer lifetime value your growth compass

CLV isn’t just a metric, it’s a decision filter. When you track the lifecycle, you can see what’s working, what’s leaking revenue, and what to fix first.

Start simple, measure consistently, and improve one stage at a time. Over a few cycles, customer lifetime value becomes less of a number on a dashboard and more like a steady engine for long-term revenue.

What would happen to your business this year if retention improved by just a little each month?

Adeyemi Adetilewa leads the editorial direction at IdeasPlusBusiness.com. He has driven over 10M+ content views through strategic content marketing, with work trusted and published by platforms including HackerNoon, HuffPost, Addicted2Success, and others.