A deposit flow is like a bouncer at a packed venue. Let too many people in without checks and you’ll get trouble. Check everyone like it’s a crime scene and the line wraps around the block.

That’s the daily tension in 3D Secure iGaming deposits: stop fraud and chargebacks without tanking conversion and approval rates. The trick isn’t “use 3DS” or “don’t use 3DS.” It’s knowing when to step up, when to stay frictionless, and how to feed issuers the right signals so good players get through.

This guide breaks down practical step-up logic, common traps, and an operator-friendly playbook you can apply this quarter.

What 3D Secure changes in an iGaming deposit

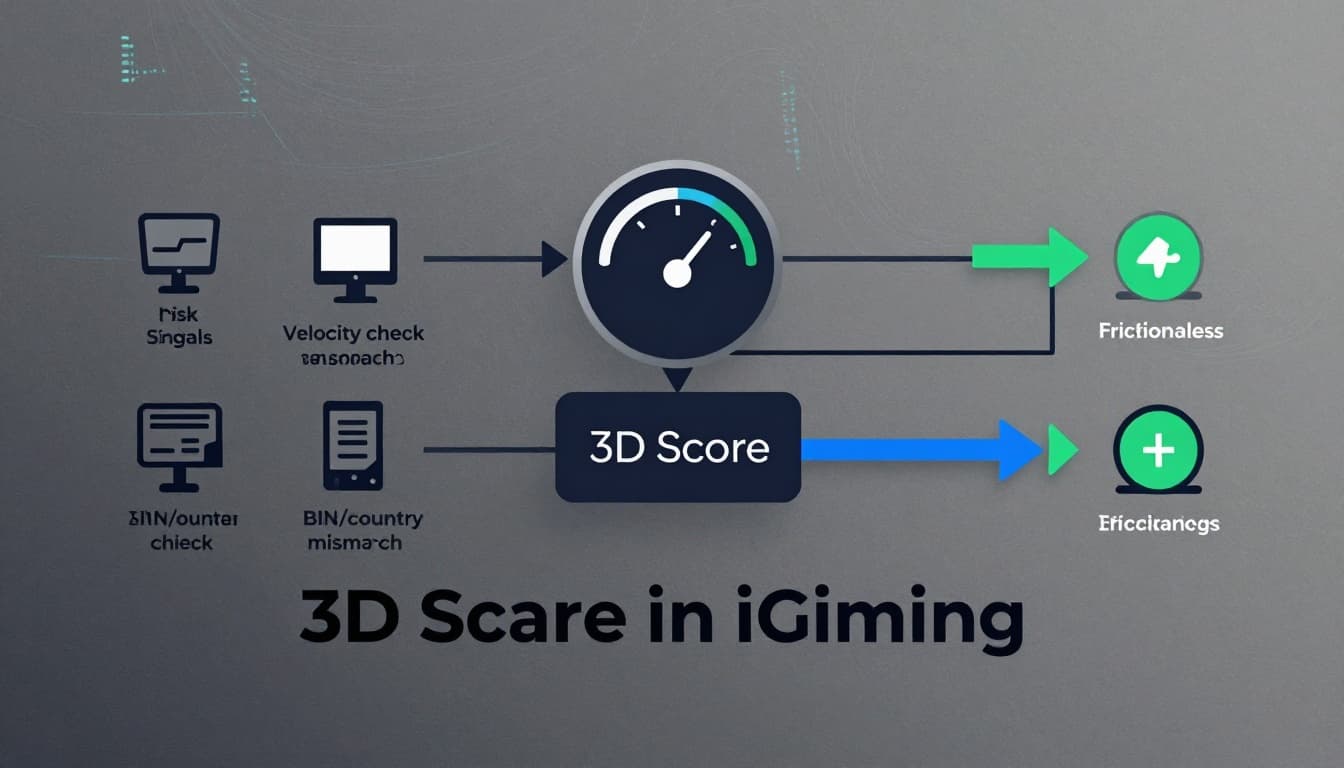

3D Secure (3DS) adds an extra authentication layer between the player, the issuer (the cardholder’s bank), and the merchant. In 3DS2, that “extra layer” can look like either:

- Frictionless authentication: the issuer approves based on data shared in the background.

- Challenge flow: the player must verify (for example, biometric, OTP, or banking app approval).

In iGaming, where deposit intent is time-sensitive, challenges can cost you. But so can skipping 3DS when the issuer expects it. Many operators see declines rise when they treat 3DS like a blunt instrument instead of a targeted control.

For a useful perspective on how frictionless 3DS can protect conversion, see this explainer on frictionless 3DS and approval rates.

Step-up vs frictionless: the trade you’re really managing

Think in three metrics, not one:

- Authorization rate: how many deposits get approved by issuers.

- Completion rate: how many players finish the deposit flow.

- Net revenue quality: approved deposits that don’t turn into chargebacks or bonus abuse.

A heavy challenge rate can improve fraud outcomes but lower completion. Too little step-up can boost completion short-term, then drag you down with disputes, blocked BINs, and stricter issuer behavior later.

One practical mindset shift: 3DS is not just fraud tooling, it’s issuer communication. Your job is to send enough trusted context that the issuer feels safe approving, without forcing unnecessary player effort.

(If you want a high-risk payments view of why approvals are tougher in gambling MCCs and what affects auth outcomes, this breakdown on authorization rates for high-risk payments is a solid reference.)

When to step up 3DS for iGaming deposits (high-signal moments)

Step up when the story of the transaction looks inconsistent. These are moments when a challenge is more likely to be accepted by real players and more likely to block fraud.

High-confidence step-up triggers (practical and common)

First-time depositor + high amount: New account, large deposit, limited history is a classic risk pattern.

Velocity spikes: Multiple deposit attempts in minutes, repeated card testing behavior, or rapid card changes.

Geo and device mismatch: IP in one country, BIN issued in another, device language and timezone don’t line up.

Account takeover signals: Password reset followed by a deposit, new device, new payout method, or sudden gameplay change.

Bonus abuse patterns: Multiple sign-ups from the same device fingerprint, referral loops, or suspicious promo redemption.

A quick way to operationalize this is to map triggers to actions:

| Signal at deposit | Suggested 3DS action | Why it works |

|---|---|---|

| New player, low amount, clean history | Prefer frictionless | Keeps conversion high where risk is low |

| New player, high amount | Step up | Higher downside, higher payoff for verification |

| Multiple declines then retry | Step up or route review | Common with card testing and fraud |

| Geo/BIN mismatch | Step up | Issuers often treat mismatches as higher risk |

| Returning player, same device, same pattern | Avoid step up | Don’t punish known-good behavior |

When not to step up (and what to do instead)

The easiest approval win is avoiding “busywork challenges” that issuers don’t need and players don’t want.

Situations where step-up often backfires

Low-risk repeat deposits: Returning players on the same device, same region, stable deposit size.

High-trust cohorts you’ve already verified: Players with completed KYC checks and consistent payment behavior.

Markets where challenges are known conversion killers: This varies by issuer behavior and local banking habits, so measure it by country and BIN.

Instead of stepping up, tighten controls that don’t add player friction:

Smarter velocity rules: Block obvious card testing while allowing normal retries.

Device intelligence: Use device ID and behavioral signals to separate humans from scripts.

Routing and acquiring strategy: Better local routing can reduce issuer suspicion and unnecessary declines.

For context on how blanket 3DS can affect conversion by region, this older but still useful analysis from Adyen on the impact of 3D Secure on conversion rates is worth skimming.

How to keep iGaming deposit approval rates high (without turning off 3DS)

Approval gains usually come from small fixes stacked together. Here’s a field-tested playbook operators and payment teams use.

Tune your “step-up rate” like a product metric

Track step-up rate by country, BIN range, issuer, deposit amount band, and player lifecycle stage. Your goal isn’t the lowest step-up rate, it’s the best mix of approvals, completion, and disputes.

Treat 3DS soft declines as a routing problem, not a dead end

Issuers may decline and request authentication (often called a “soft decline”). If your flow can’t recover cleanly, you’ll lose players who were actually willing to verify.

Make sure your cashier UX can:

- Explain the extra step in plain language.

- Keep the player in the same session (avoid reloading loops).

- Support mobile-first challenges smoothly.

Send clean transaction data to the issuer

Frictionless approvals depend on trust signals. If your data is inconsistent (billing, device, customer identifiers), issuers have less to work with and lean toward declines or challenges.

If you’re also reviewing your payment stack, this guide to top ecommerce merchant accounts for secure payments can help you think through provider features that affect security and acceptance.

Use analytics to predict trouble spots before they cost you

A simple operator workflow: review weekly bins where challenge rate is rising but approvals aren’t improving. That’s often a sign your step-up rules are too aggressive or your issuer-side data quality is weak.

If your team is exploring smarter risk scoring, this primer on machine learning applications in sports betting is a useful way to think about pattern detection, without getting lost in theory.

Keep the cashier conversion story intact

Players don’t wake up wanting “authentication.” They want their deposit to work. Improve the full deposit experience alongside 3DS settings: fewer fields, clearer error messages, local payment options, and smarter retries.

Nuvei shares several operator-focused ideas on improving cashier conversion in this post on boosting iGaming player conversion rates.

A simple example: step-up done right

A returning player deposits $50 every weekend from the same phone. Suddenly, there’s a $500 deposit attempt from a new device, with three quick retries, and the IP country doesn’t match the card BIN.

That’s a clean step-up moment. If the player passes the challenge, you keep the revenue and lower dispute risk. If it’s fraud, the challenge blocks it. Either way, your approval rate stays healthier because issuers see disciplined authentication, not random friction.

Conclusion: build a step-up strategy that feels invisible to good players

The best 3DS programs are the ones players barely notice. Step up when the signals are loud, stay frictionless when trust is earned, and monitor your step-up rate like it’s part of product performance.

If you want a practical north star, aim for fewer unnecessary challenges, cleaner issuer data, and faster recovery from soft declines. Do that, and 3D Secure iGaming deposits can raise both safety and approvals without pushing players away.

Adeyemi Adetilewa leads the editorial direction at IdeasPlusBusiness.com. He has driven over 10M+ content views through strategic content marketing, with work trusted and published by platforms including HackerNoon, HuffPost, Addicted2Success, and others.