A “helpful” friend funds a player’s account, then the player requests a fast withdrawal. Sound harmless? In third-party deposits iGaming, that one action can trigger fraud risk, AML questions, chargeback exposure, and regulator scrutiny.

If you run an operator, payment team, or platform, you need two things: a clear rule your team can follow every time, and a review process that’s fast enough to avoid killing conversions. This guide gives you both, plus ready-to-use wording you can drop into your payments policy and internal SOP.

What counts as a third-party deposit (plain-English definition)

A third-party deposit is any account funding where the payer is not the verified account holder. That can include:

- A card or bank account in someone else’s name

- An e-wallet owned by another person

- A business account funding an individual player

- A “family member topping up” scenario

This touches the same risk themes regulators discuss in guidance on payment intermediaries and third-party payment flows, such as the FFIEC overview of third-party payment processor risk.

Why third-party deposits cause outsized risk in iGaming

Think of identity and money flow like a luggage tag at the airport. When the name on the bag doesn’t match the ticket, someone’s going to pull it aside.

In iGaming, third-party funding can be linked to:

- Chargebacks and friendly fraud (the payer claims they never authorized the transaction)

- Money mule patterns (someone moves funds through a player account to cash out)

- Bonus abuse rings (many payers feeding many accounts)

- Weak audit trails during regulatory reviews

Your transaction monitoring rules should also account for unusual deposit behavior. If you’re building a lightweight system, start with these practical iGaming deposit monitoring rules and add third-party deposit triggers on top.

Policy stance: choose one clear rule and defend it

Most teams struggle because they try to handle third-party deposits “case by case” without boundaries. Instead, pick a default stance and define exceptions.

A simple, workable approach:

Default: Third-party deposits are not accepted.

Exception: Allowed only in narrow cases, after verification, with documented approval, and with limited withdrawal rules.

This mirrors the broader idea behind handling suspicious third-party fund transfers, where controls and documented steps matter as much as the final decision (see Lexology’s discussion on handling suspicious third-party fund transfers).

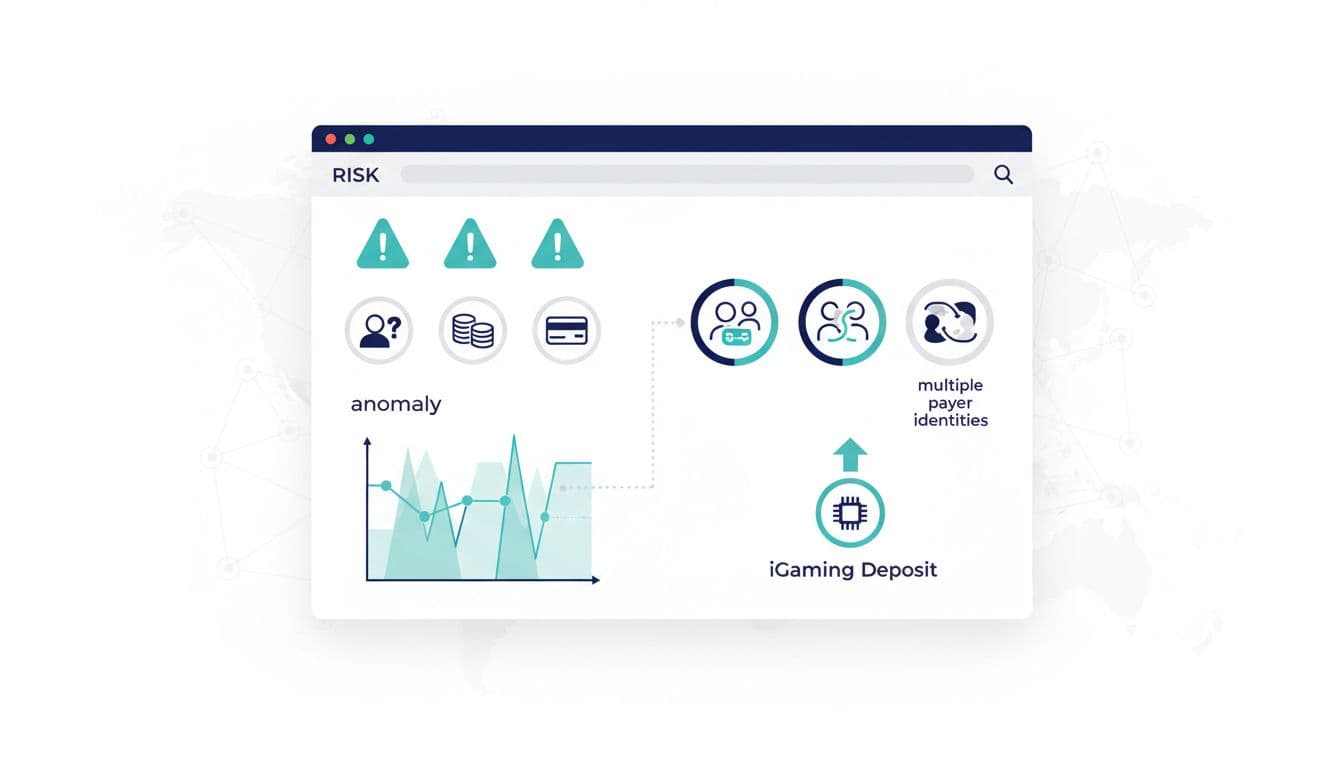

Risk signals and red flags your team should spot quickly

Third-party deposits aren’t always illegal or abusive, but the patterns below deserve attention:

- The payer has funded multiple player accounts

- The player requests withdrawal soon after deposit, with limited play

- Multiple failed deposit attempts, then success from a new payer

- Player refuses verification but keeps trying new funding sources

- The deposit arrives from a different country than the player’s profile

- The player claims the payer is “a friend,” but can’t prove a relationship

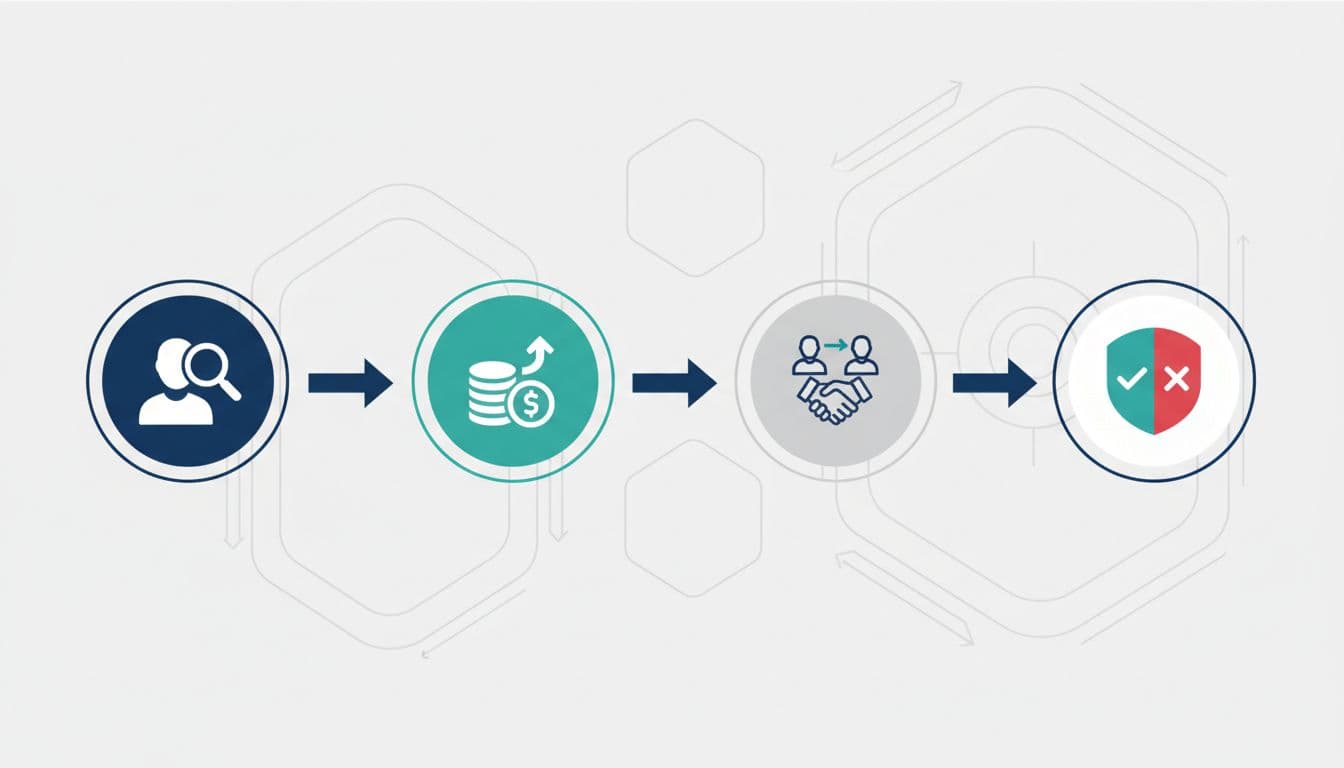

Third-party deposit review steps (a practical workflow)

Use a consistent flow so reviewers don’t improvise under pressure. Here’s a fast, regulator-friendly process that works for lean teams.

Step 1: Detect and label the event

Tag the transaction as “third-party suspected” when the payer name, BIN data, bank account, or wallet identity differs from the player’s verified profile.

Step 2: Apply a short hold and stop withdrawals

Pause withdrawals until the review is complete. If your jurisdiction has specific expectations around withdrawals, align your timing and customer messaging with regulator guidance (for UK-facing operations, see Gambling Commission AML guidance).

Step 3: Collect minimum evidence (don’t over-collect)

You want enough proof to justify the decision, not a mountain of files. A tight evidence set looks like this:

| Evidence item | What it proves | Typical source |

|---|---|---|

| Player KYC verified | Who the player is | ID, selfie, address |

| Payer identity match | Who paid | Cardholder or wallet owner details |

| Relationship proof (if allowed) | Why payer is involved | Shared address, legal relationship, signed declaration |

| Source of funds trigger check | Whether SoF is needed | Pay history, bank statement excerpt (risk-based) |

For KYC basics in iGaming, this guide is a helpful reference point: KYC in online casinos and iGaming (2025).

Step 4: Decide using a simple rule set

Keep the decision logic tight:

Approve (rare) when the relationship is credible, evidence is complete, the payer is not linked to multiple accounts, and the deposit size fits the player’s profile.

Decline or reverse when identity can’t be confirmed, the story changes, or the pattern fits known abuse.

Step 5: Lock withdrawal routing

If you allow exceptions, withdrawals should go back to the original funding method where possible, and only to an account in the player’s name once checks are complete (and allowed).

Step 6: Document the decision in one page

Record: what happened, what you checked, what you found, who approved, and what action you took.

Step 7: Add monitoring rules for repeat patterns

If the payer appears again, or multiple players share the same payer, escalate quickly. This is where your fraud and AML monitoring meet.

Ready-to-use policy wording (customer-facing and internal)

You can paste the text below into your payments policy, house rules, or terms. Adjust for local law and your PSP rules.

Customer-facing wording (Terms / Payments Policy)

Third-party deposits: Deposits must be made using a payment method registered in the name of the verified account holder. We don’t accept deposits made on behalf of a player by another person or entity.

If a third-party deposit occurs: We may place the account under review, request additional information, and restrict withdrawals until checks are completed. Where permitted, we may return funds to the original payment method.

Exceptional cases: In limited situations, we may consider allowing a third-party deposit (for example, from an immediate family member) if we can confirm the relationship and the legitimacy of the funds. Approval is at our discretion and may include deposit limits and withdrawal restrictions.

Internal SOP wording (for Payments, Fraud, and Compliance)

Policy rule: Third-party deposits are not permitted unless an exception is approved by Compliance.

Minimum checks: Confirm player KYC status, verify payer identity, assess relationship evidence (if exception requested), review prior payer activity across accounts, and check deposit-to-withdrawal behavior.

Actions: Place a withdrawal hold during review. If declined, initiate refund or reversal where possible, and record rationale. If approved, apply exception limits and enhanced monitoring.

Player support script (short, calm, usable)

Thanks for your message. For safety and compliance, deposits must come from a payment method in your own name. Your account is under review while we confirm details. Please share the requested documents so we can resolve this as quickly as possible.

Audit trail and “show your work” expectations

When a regulator or banking partner asks “why did you allow this,” you should be able to answer in minutes. Save:

- The deposit identifier and payer details available to you

- The exact evidence requested and received

- The decision, approver, and timestamp

- Any refunds, reversals, or post-decision monitoring notes

Conclusion

Third-party deposits can look like a minor payment edge case, but they often act like a stress test for your whole risk program. A clear policy, a repeatable workflow, and consistent records keep teams aligned and reduce surprises later. If you tighten your approach to third-party deposits iGaming now, you’ll spend less time firefighting, and more time building a payments operation partners can trust.

Adeyemi Adetilewa leads the editorial direction at IdeasPlusBusiness.com. He has driven over 10M+ content views through strategic content marketing, with work trusted and published by platforms including HackerNoon, HuffPost, Addicted2Success, and others.