A withdrawal is the moment of truth. Players want speed, finance wants clean reconciliations, and compliance wants proof that money is going to the right person for the right reasons.

That’s why iGaming withdrawal risk checks can’t be “someone takes a look when it feels weird.” They need a repeatable SOP that tells your team what to check, when to place a hold, who can approve, and how to release funds without leaving gaps in your audit trail.

This guide gives you a practical, step-by-step SOP you can plug into operations, whether you’re a startup sportsbook or a multi-brand casino group.

What “withdrawal risk checks” really cover (and why operators get burned)

Think of withdrawals like airport security. Most people are fine, but you still need the same gates, the same rules, and a clear path for extra screening.

In practice, withdrawal risk checks typically combine:

- Identity and age verification status (is the player fully verified, still pending, or expired?)

- Payment integrity checks (does the withdrawal method match the deposit method and account owner?)

- Fraud and abuse signals (bonus hunting patterns, chargeback exposure, multiple accounts)

- AML and sanctions screening and case handling (risk-based CDD or EDD where needed)

If you want a current overview of KYC expectations in the sector, this KYC in online gaming guide is a helpful baseline, especially for explaining the “why” to non-compliance teammates.

For smaller brands, your withdrawal SOP should also line up with the same triggers used in monitoring, otherwise you’ll approve payouts that your alerts already flagged. This is where a tight ruleset helps, see simple transaction monitoring rules for iGaming.

Risk tiers for iGaming withdrawal risk checks (Low, Medium, High)

Before you write steps, set risk tiers that decide the route: auto-approve, manual review, or hold with enhanced checks. Without tiers, every withdrawal becomes a debate.

A simple tier model you can document in policy:

| Risk tier | Common signals (examples) | Default action |

|---|---|---|

| Low | KYC approved, consistent device and location, same payment rail, normal velocity | Auto-approve (system) |

| Medium | KYC pending refresh, mild method mismatch, unusual withdrawal timing, moderate velocity | Manual review (risk) |

| High | Sanctions/PEP hit, strong bonus abuse pattern, “deposit then withdraw” behavior, multiple accounts | Hold, EDD, possible reject |

For AML and sanctions concepts (and what regulators tend to expect from a risk-based approach), this overview is a good reference: AML and sanctions compliance in iGaming.

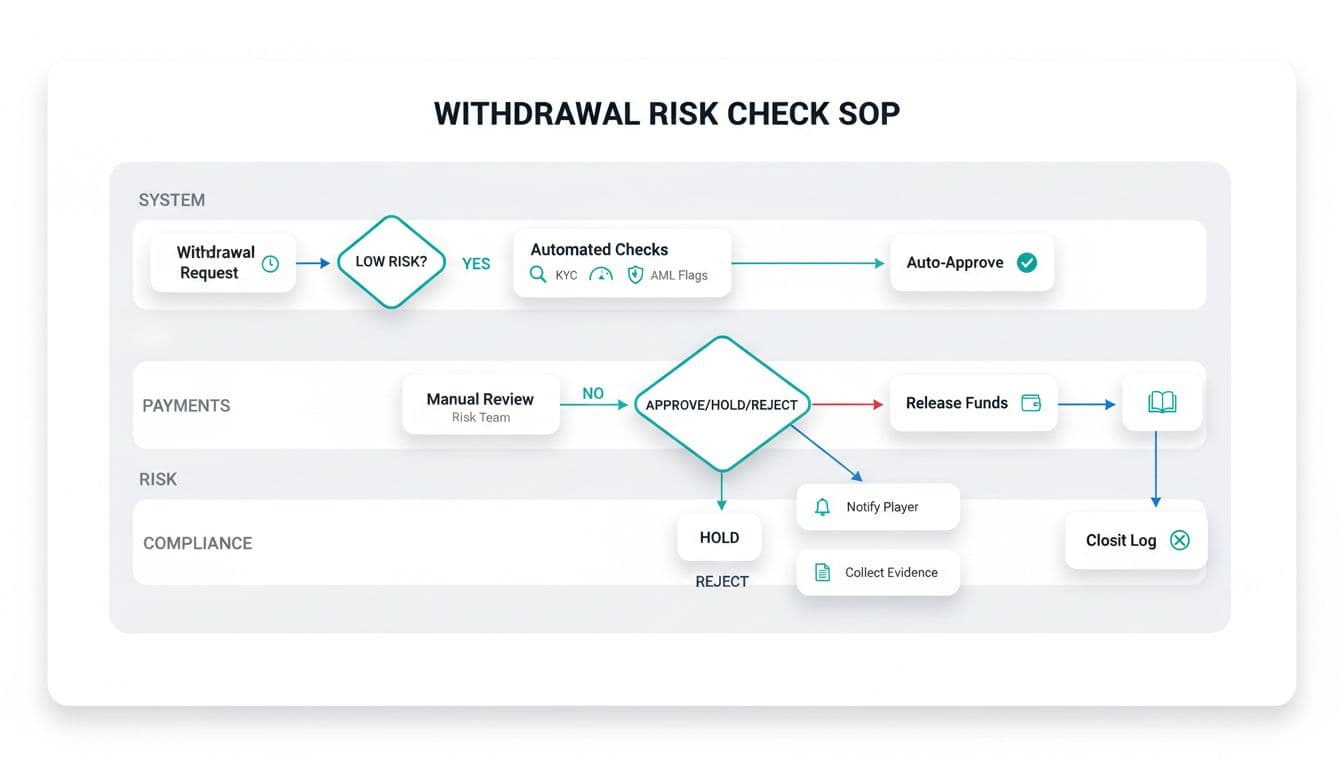

SOP overview: the flow from request to audit log

This SOP assumes a “maker-checker” control (one person prepares, another approves) for anything that isn’t low-risk auto-approval.

Step-by-step SOP for approvals (with ownership and evidence)

Step 1: Intake and case creation (System)

Create a withdrawal case ID at the moment the player requests a payout. Attach: player ID, amount, method, timestamp, session identifiers, and any open alerts.

Rule: no off-platform approvals. If it isn’t in the case tool, it didn’t happen.

Step 2: Hard blocks (System)

Auto-block and route to Compliance if any of the following are true:

- Sanctions or PEP match above your match threshold

- Account is self-excluded, suspended, or under an active RG restriction

- KYC is failed (not pending)

Step 3: Automated checks (System)

Run and log results for:

- KYC status and document validity (expiry, name match)

- Deposit-to-withdrawal method consistency (including ownership where supported)

- Velocity and pattern checks (withdrawal frequency, recent deposit spikes)

- Device, IP, and geolocation consistency (against recent history)

Step 4: Assign routing (System to Risk)

Route by tier:

- Low risk: auto-approve

- Medium risk: manual review queue

- High risk: hold queue (Compliance co-owns)

Step 5: Manual review (Risk)

Risk analyst reviews the full picture, not just the latest withdrawal:

- Account history (age, prior withdrawals, behavior changes)

- Payment history (failed attempts, reversals, method switches)

- Promo and bonus interactions (abuse indicators)

- Related accounts (shared device, shared payment instruments, shared identifiers)

Output: a written decision note that references signals, not gut feel.

Step 6: Maker-checker approval (Payments plus Risk)

- Payments prepares the release (maker)

- Risk or Compliance approves (checker), based on tier and amount thresholds

Set clear approval limits (example: Risk can approve up to X, Compliance required above X, Finance required above Y). Document those limits in policy, not in someone’s memory.

Step 7: Execute payout (Payments)

Payments executes through PSP or bank rails, then updates the case with:

- Processor reference

- Execution time

- Any exceptions (retries, partial failure)

Step 8: Close case with audit-ready notes (Risk or Compliance)

Close with a short template:

- Decision (approve, hold, reject)

- Reason codes (selectable plus free-text)

- Evidence list (attachments and system logs)

- Approver identity and timestamps

Holds: how to place them without creating player-support chaos

A hold is a tool, not a punishment. Done badly, it looks like stalling. Done well, it’s controlled friction with clear next steps.

When to place a hold

- High-risk tier triggers

- Material mismatch (name mismatch on method ownership, location anomalies)

- Unresolved KYC, source-of-funds, or affordability steps (where required)

- Strong fraud indicators (multi-account patterns, bonus abuse clusters)

How to run the hold

- Set a hold reason code that support can repeat in plain language

- Notify the player with a checklist of what you need (not a vague “we’re reviewing”)

- Set a review SLA and escalation path (example: Risk 24 hours, Compliance 48 hours if EDD needed)

If your KYC process itself is messy, withdrawals will suffer. This iGaming KYC workflow audit guide is a practical way to find gaps before they turn into payout backlogs.

For player-friendly context on why verification happens at withdrawal, this guide helps explain the common ID check flow: casino verification and withdrawal checks overview.

Release vs reject: how to document the outcome (and sleep at night)

Release steps (after hold clears)

- Confirm the required evidence is present and valid

- Re-run key automated checks if the case is older than your SLA window

- Record the rationale, then release through Payments with maker-checker

Reject steps (when risk stays high)

- Record the policy basis (terms, AML policy, method ownership rules)

- Provide a support-facing explanation that avoids tipping off bad actors

- Keep all evidence and decision logs in the case file

- If required in your jurisdiction and risk assessment, escalate internally for regulatory reporting processes

A good rule: if you can’t explain the decision to a regulator using only your case file, the process isn’t finished.

Approval checklist your team can use every time

Use a consistent checklist so reviews don’t vary by analyst mood:

- KYC verified and documents in date

- Source of funds evidence where policy requires it

- Device/IP consistency with recent play history

- Chargeback exposure reviewed (player and instrument level)

- AML flags cleared or documented with EDD outcome

- Responsible gambling notes checked (limits, exclusions, vulnerability markers)

Closing thought: turn iGaming withdrawal risk checks into a growth asset

Fast payouts build trust, but only if they’re controlled. A clear SOP for approvals, holds, and releases protects your license, cuts avoidable support tickets, and makes training new hires easier.

If you’re looking for practical business ideas, one strong angle is building a managed “payout risk desk” service, or a lightweight workflow tool that standardizes evidence, maker-checker approvals, and audit logs for smaller operators.

Most of all, treat iGaming withdrawal risk checks like a product feature: defined, tested, measured, and improved every month.

Adeyemi Adetilewa leads the editorial direction at IdeasPlusBusiness.com. He has driven over 10M+ content views through strategic content marketing, with work trusted and published by platforms including HackerNoon, HuffPost, Addicted2Success, and others.