A sanctions miss in iGaming can feel like letting the wrong person into a VIP room, then realizing the bouncer never checked the guest list. It’s not just a compliance problem, it’s a payout, payment, and licensing problem.

This guide lays out a practical igaming sanctions screening workflow you can run in production: real-time checks at key moments, batch rescreens when lists and customer data change, and a clean hit triage process that cuts false positives without cutting corners.

If you’re a founder or operator building internal controls (or even a compliance-focused service business), this is the “how it works” blueprint you can implement and improve over time.

Why sanctions screening is harder in iGaming than most industries

iGaming combines high velocity with high scrutiny. Players sign up fast, deposit fast, and expect instant play. Meanwhile, sanctions lists and enforcement priorities can shift with little notice.

A few factors raise the stakes:

- Always-on transactions: deposits, withdrawals, and bonuses happen 24/7.

- Global player bases: multiple jurisdictions, languages, and name formats.

- Friction sensitivity: every extra second in onboarding can reduce conversion.

- Audit pressure: regulators expect proof, not promises.

For a useful overview of expectations and common screening capabilities in gaming, see AML and sanctions screening for gaming and gambling platforms.

The end-to-end workflow you can run today (from signup to audit)

A workable sanctions workflow isn’t “screen at signup and hope.” It’s a loop with clear triggers, consistent decision rules, and evidence you can replay months later.

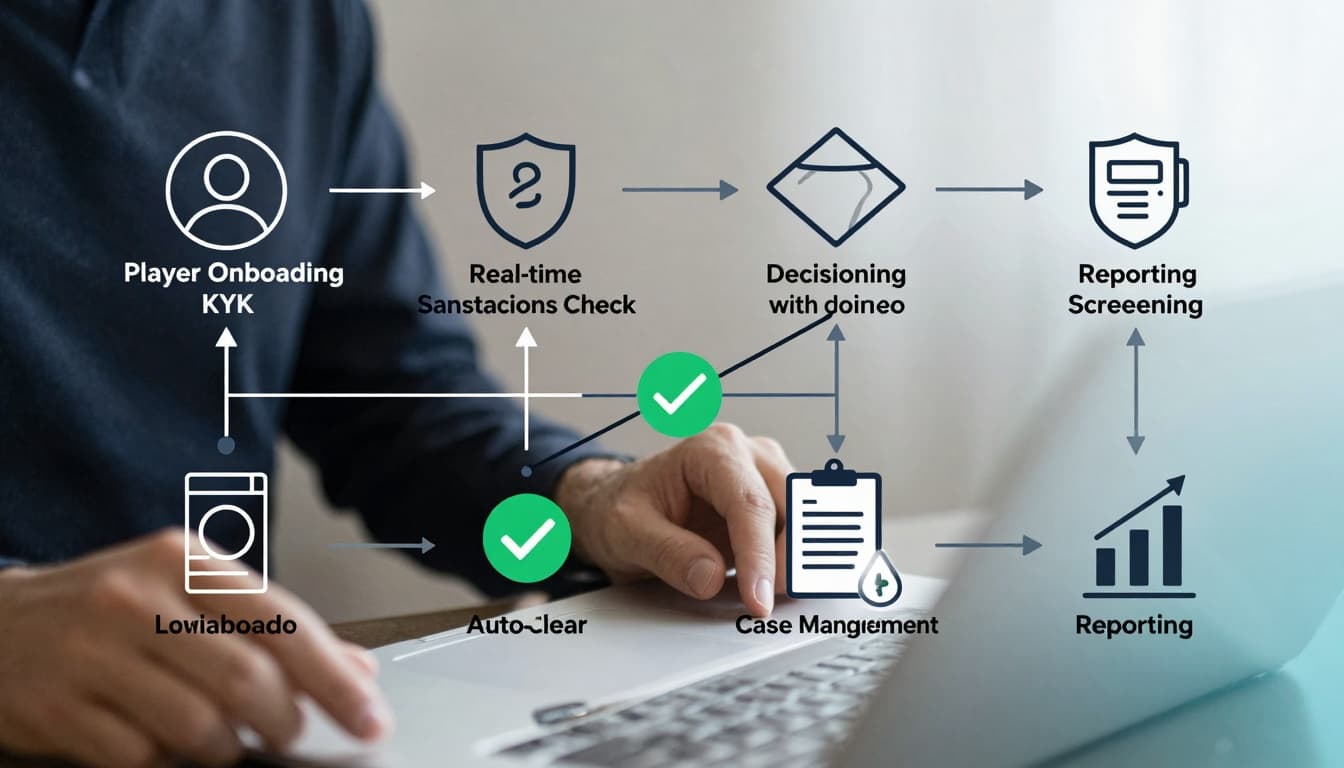

Here’s the practical sequence:

- Player onboarding and KYC data capture: collect names (including aliases if available), date of birth, address, and country.

- Real-time sanctions check: screen the identity profile before allowing meaningful access (especially deposits and withdrawals).

- Decisioning: auto-clear low-risk no-match results, queue potential matches for review, block confirmed matches.

- Case management: document what was reviewed, what evidence was used, who approved, and what action was taken.

- Reporting and audit trail: produce logs you can export by player, date range, or regulator request.

If you’re mapping this into your wider compliance stack, pair it with an iGaming KYC workflow audit guide that helps you validate where checks happen and what proof you’ll need later: https://ideasplusbusiness.com/igaming-kyc-workflow-audit/

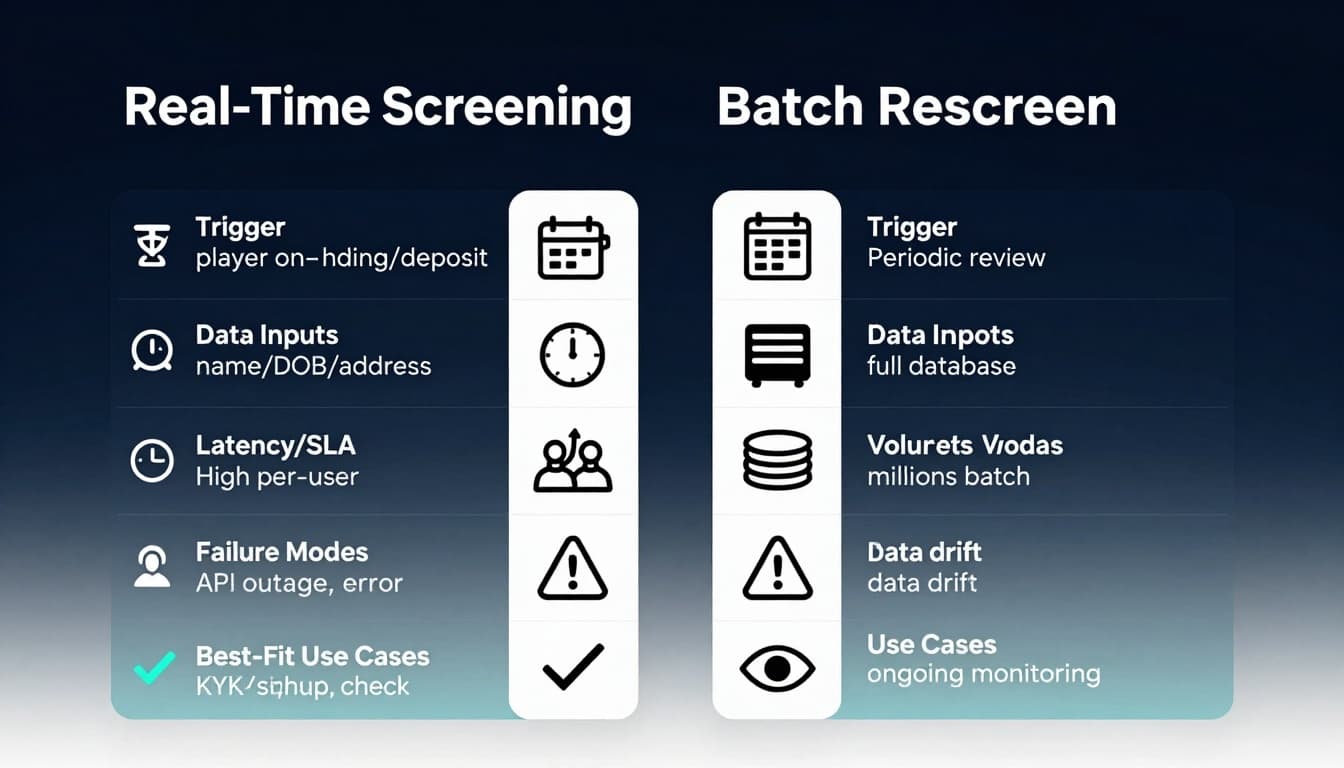

Real-time sanctions checks: where to place them so they actually work

Real-time screening is about two things: stopping prohibited activity and not punishing legitimate players. The trick is picking the right triggers and enforcing consistent outcomes.

Real-time triggers that matter in iGaming

Most operators start at signup, but real-time should also fire at “money moments.” Common triggers include:

- Account registration (before account activation)

- First deposit (before funds are accepted, if your flow supports it)

- Withdrawal request (before payout)

- Material profile changes (name, address, country, email, phone)

- VIP or limit increases (when risk appetite changes)

What “good” real-time screening looks like in practice

Real-time checks should have:

- Normalization: handle spacing, diacritics, and name order (critical for multilingual players).

- Fuzzy matching controls: tuned thresholds so you don’t queue half your player base.

- Deterministic rules: “if X, then Y,” so staff don’t improvise.

- Fail behavior: define what happens if the screening API times out (pause deposit, allow gameplay but block cashout, etc., based on your risk policy).

Many teams look at established sanctions screening approaches to understand matching, tuning, and alert handling expectations, even if they don’t use those tools directly. Example reference: NICE Actimize sanctions screening overview.

Batch rescreens: how to catch list updates and silent risk changes

Real-time checks protect key moments. Batch rescreens protect your entire book of business.

Rescreening matters because risk changes without the player doing anything. A new sanctions designation can land overnight, or new identifiers can be added that strengthen a match.

A simple, defensible batch rescreen schedule

Most operators can start with:

- Daily rescreen for higher-risk segments (VIPs, high-volume withdrawers, higher-risk geos).

- Weekly rescreen for the broader active player base.

- Event-based rescreen when your data vendor updates sanctions lists, or when your internal risk model changes.

Batch rescreen hygiene (where teams usually slip)

Batch jobs fail quietly unless you design for it. Build in:

- Run logs: start time, end time, records screened, alerts created.

- Exception handling: how many records failed due to missing DOB, bad addresses, or encoding issues.

- Re-run controls: a safe way to resubmit the failed slice without duplicating alerts.

If you want to connect batch rescreens to “always-on” AML monitoring, it helps to align sanctions alerts with your transaction monitoring playbook. This GBG resource is a solid reference point for how iGaming monitoring workflows are commonly structured: https://www.gbg.com/en/fraud-compliance-management/transaction-monitoring-for-igaming-firms/

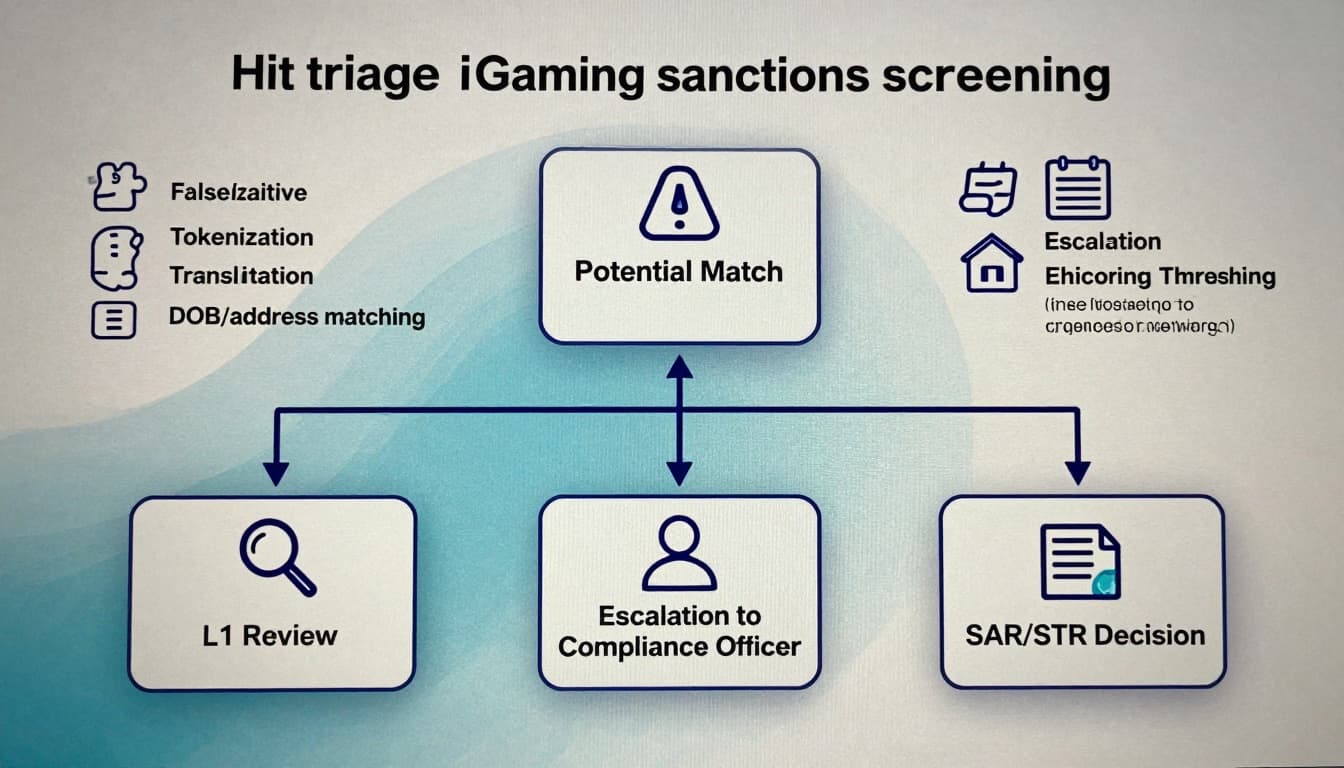

Hit triage: how to clear faster without clearing wrong

Sanctions screening creates “noise” because names collide. Hit triage is how you turn noise into decisions.

A three-tier triage model that scales

Level 0 (auto-clear rules): clear obvious non-matches automatically, based on strong negative signals (country mismatch plus DOB mismatch, for example), if your policy allows it.

Level 1 (ops review): quick review using consistent fields, with a target SLA (for example, 15 minutes for withdrawals).

Level 2 (EDD and compliance escalation): deeper checks when the match is plausible, with documented rationale and approvals.

False positives drop when you standardize what reviewers check

Train reviewers to verify the same “match package” every time:

- Name variants and transliteration

- Date of birth (exact or partial)

- Address and country signals

- Source list details (what list, what program, what identifiers)

- Internal activity context (deposit behavior, withdrawal urgency, account age)

For small teams, it’s smart to tie sanctions triage into your broader alert queue so one case view shows: sanctions hits, payment risk flags, and gameplay anomalies. This related guide helps with the monitoring side: https://ideasplusbusiness.com/igaming-transaction-monitoring-rules/

For background on combining onboarding with automated AML screening and ongoing monitoring, Jumio’s product overview is a useful explainer-style reference: https://www.jumio.com/products/screening/

Metrics and audit trail: what to log so you can prove control

When a regulator asks, “Show me your sanctions controls,” they’re asking for evidence that the process runs consistently.

Track a small set of metrics that reveal control health:

| Metric | Why it matters | Good operational use |

|---|---|---|

| Real-time screening latency | Prevents hidden friction and drop-offs | Alert when latency spikes |

| Alert rate (hits per 1,000 screens) | Shows tuning quality | Investigate sudden jumps |

| False positive rate | Reduces analyst load | Tune thresholds and data quality |

| Time to decision (by trigger) | Protects payouts and player experience | Set SLAs for withdrawals |

| Override rate | Catches risky “rubber stamping” | Require reason codes |

Conclusion: turn igaming sanctions screening into a repeatable system

The goal isn’t more alerts, it’s better decisions at the right moments. Real-time checks protect money moments, batch rescreens protect your whole player base, and hit triage keeps the queue sane.

Treat igaming sanctions screening like a production workflow, not a one-time setup. Document triggers, tune matching, log everything, and review metrics monthly. Your future self (and your license) will thank you.

Adeyemi Adetilewa leads the editorial direction at IdeasPlusBusiness.com. He has driven over 10M+ content views through strategic content marketing, with work trusted and published by platforms including HackerNoon, HuffPost, Addicted2Success, and others.