Image created with AI.

Running a small iGaming brand already feels like juggling fire. Add compliance, fraud checks, and responsible gambling rules, and it can get overwhelming fast.

Big operators hire data teams and buy expensive tools. You probably cannot. The good news is you can still build a player risk scoring model that is simple, explainable, and effective enough to satisfy regulators and protect your business.

This guide walks through a practical scoring model, with example matrices you can plug into Excel, a BI tool, or your existing platform.

Why Player Risk Scoring Matters For Small iGaming Operators

Without structure, risk decisions turn into gut calls. One analyst flags a player, another ignores the same pattern. That kind of inconsistency is dangerous when you deal with:

- Anti-money laundering (AML) rules

- Responsible gambling obligations

- Chargebacks and bonus abuse

A basic player risk scoring model helps you:

- Make consistent, documented decisions

- Prove to regulators that you have a method, not guesswork

- Prioritize attention on the few players who need real review

Think of it as a safety filter between raw behavior and high-stakes decisions like blocking, escalating, or contacting a player.

The Core Building Blocks Of A Simple Player Risk Scoring Model

Keep the first version small enough to manage on a spreadsheet. You can always upgrade later.

1. Three risk dimensions

Start with three dimensions that cover most iGaming risk:

- Financial risk (deposits, withdrawals, chargebacks)

- Behavioral risk (session length, chasing losses, late-night play)

- Integrity/compliance risk (KYC issues, multiple accounts, device or IP anomalies)

Each dimension will get its own sub-scores.

2. A short numeric scale

Use a 1 to 3 scale for each risk driver:

- 1 = Low risk

- 2 = Medium risk

- 3 = High risk

Small teams do not need 0.1 precision. You need something your ops staff can understand in a 5-minute handover.

3. Clear actions by risk band

For every final risk band, define what happens:

- Low: auto-approve, light monitoring

- Medium: soft checks, email or in-product nudge

- High: manual review, limits, or temporary blocks

If you treat this as a small project, a clear delivery plan helps. This guide on 5 stages of successful project delivery shows how to move from idea to working process without chaos.

Turning Behavior Into Numbers: Example Driver Scores

Start by converting raw behavior into scores. Here is a simple example.

Example driver scoring matrix

| Risk driver | Score 1 (low) | Score 2 (medium) | Score 3 (high) |

|---|---|---|---|

| Deposit frequency (7d) | 1 to 2 deposits | 3 to 7 deposits | 8 or more deposits |

| Average bet size | Under 1% of average balance | 1% to 5% of average balance | Over 5% of average balance |

| Session length (day) | Under 1 hour | 1 to 3 hours | Over 3 hours |

| Chargebacks (90d) | 0 | 1 | 2 or more |

| KYC status | Verified, no issues | Pending update | Failed, expired, or suspicious documents |

You can tune thresholds to your jurisdiction and risk appetite, but keep rules simple and transparent.

Example risk driver matrix. Image created with AI.

Once you have driver scores, you can roll them up into dimensions. For instance:

- Financial risk score = average of deposit frequency, average bet size, chargebacks

- Behavioral risk score = average of session length and time-of-day patterns

- Integrity risk score = KYC status plus account or device flags

Round to the nearest whole number so your team sees 1, 2, or 3, not decimals.

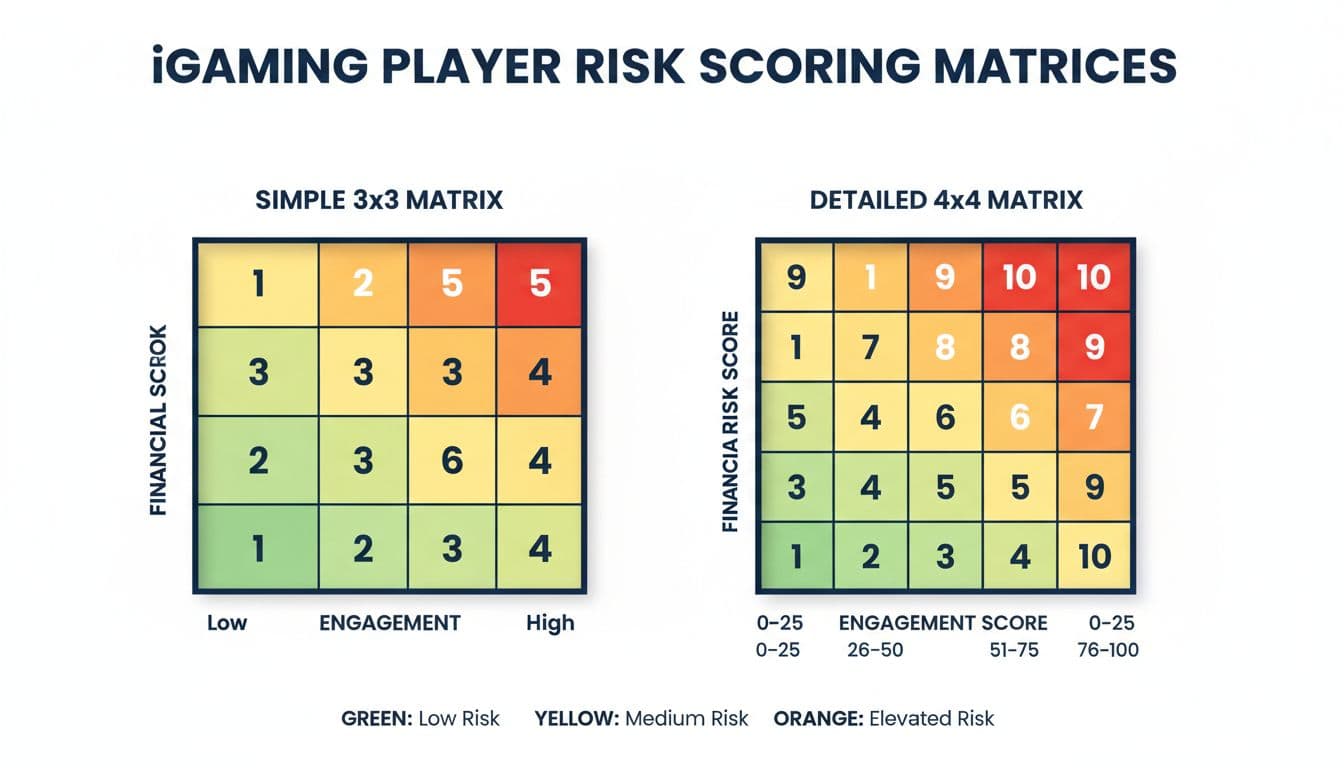

Example 3×3 Player Risk Scoring Matrix

Now use a matrix to combine two main dimensions into an overall band. For small teams, it is easiest to start with Financial risk and Behavioral risk.

3×3 and 4×4 player risk matrices. Image created with AI.

3×3 matrix: financial vs behavioral risk

Rows are Behavioral risk, columns are Financial risk:

| Behavioral Financial | 1 Low | 2 Medium | 3 High |

|---|---|---|---|

| 1 Low | Low | Low | Medium |

| 2 Medium | Low | Medium | High |

| 3 High | Medium | High | High |

Rules of thumb:

- Only the top-right corner is truly High

- The diagonal tends to be Medium

- Everything in the bottom-left stays Low

You can then pull Integrity risk into your final decision like a modifier:

- If Integrity risk = 3, upgrade any player to at least Medium, even if the matrix says Low

- If Integrity risk = 1 and others are Low, keep them Low but still track over time

This keeps your logic explainable in audits, and easy to document in your risk policy.

Worked Example: Scoring One Player

Let us walk through a quick case.

Player A in the last 7 days:

- 6 deposits

- Average bet size is 3% of balance

- 0 chargebacks

- Average session length is 2 hours

- KYC is verified and clean

Step by step:

- Driver scores

- Deposit frequency: 6 → Score 2

- Bet size: 3% → Score 2

- Chargebacks: 0 → Score 1

- Session length: 2 hours → Score 2

- KYC: verified → Score 1

- Dimension scores

- Financial risk = average of (2, 2, 1) = 1.67 → round to 2

- Behavioral risk = 2

- Integrity risk = 1

- Matrix lookup

- Financial = 2, Behavioral = 2 → Medium from the 3×3 table

- Modifier

- Integrity risk = 1, so no upgrade

Final band: Medium-risk player.

Actions could include:

- Soft affordability checks

- Limits on deposits until more history is available

- Friendly responsible-gambling message in-app

When To Move Beyond The Simple Model

The 3×3 model is a great starting point. Over time, you might outgrow it if:

- You add new markets with tighter regulations

- Your VIP base grows and exposure rises

- Fraud or bonus abuse becomes more creative

At that stage, you can:

- Switch to a 4×4 grid with extra bands like “Very High”

- Add more drivers, such as device fingerprinting, payment method risk, or affiliate source

- Feed the scores into a BI tool or a native integration in your platform

If your platform team wants to embed scoring logic into your SaaS product, this guide on native integration in SaaS covers trade-offs between bolt-on tools and built-in features.

From Scores To Actions: Simple Risk Workflow

Scoring is useless unless it drives action. A clear workflow keeps your team aligned.

High-level player risk workflow. Image created with AI.

A basic flow:

- Collect data

Daily export from your platform into Excel, a database, or a BI tool. - Calculate scores

Use formulas to assign driver scores and dimension averages. - Assign risk band

Apply your 3×3 matrix and integrity modifiers. - Trigger actions

- Low: passive monitoring

- Medium: soft checks, limit reviews

- High: manual review, contact, or blocking

- Review and tune

Once a month, review a sample of High and Medium players. Were they classified correctly? If not, adjust thresholds.

If you hook this model into other systems, strong integration practices matter. These SaaS integration best practices give a good checklist for stable, low-friction connections between tools.

Governance, Documentation, And Common Pitfalls

To keep your model safe and defensible:

- Write a 2 to 3 page policy. Define drivers, thresholds, and actions.

- Train your team. Everyone who touches risk should understand the matrix.

- Avoid model creep. Resist the urge to add 20 drivers in month one. Start small.

- Monitor bias and fairness. Do not use sensitive attributes like ethnicity, nationality, or other protected traits.

Common mistakes:

- Scores that are so complex no one trusts them

- Hard-coded thresholds that never get reviewed

- Relying only on automation and skipping human judgment for extreme cases

Conclusion

For small iGaming operators, a simple player risk scoring model beats an impressive but unused framework every time. A clear 1 to 3 scale, a compact 3×3 matrix, and predefined actions can give you structure, protect players, and reduce regulatory stress.

Start with a spreadsheet, test it on your current base, and refine it month by month. The point is not perfection. The point is a consistent, transparent method that your team can explain, run, and improve over time.

Adeyemi Adetilewa leads the editorial direction at IdeasPlusBusiness.com. He has driven over 10M+ content views through strategic content marketing, with work trusted and published by platforms including HackerNoon, HuffPost, Addicted2Success, and others.