Regulator inspection on the horizon and feeling a bit exposed? You are not alone. For iGaming operators, KYC failures often hurt more than any marketing mistake.

A well-audited igaming KYC workflow protects your license, your brand, and your revenue. Done right, it also keeps genuine players happy while stopping bad actors early.

How To Audit Your iGaming KYC Workflow

This guide walks through a practical, step-by-step audit you can run before any inspection, even if you do not have a big compliance team or budget.

Start With Your Regulatory Risk Map

Before you review a single document, get clear on what your regulators expect from you in each market where you operate.

List every jurisdiction, the license type, and the key KYC and AML rules that apply. Tie this to your products, for example, sports betting, casino, live dealer, and payment methods, including cards, bank transfers, and crypto.

Use official sources whenever you can. For example, the UK Gambling Commission’s customer due diligence guidance shows how regulators expect operators to treat risk and customer checks.

Turn this into a simple risk map. For each market, score players by risk level, low, medium, and high, based on factors like bet size, geography, payment type, and product. Your whole KYC audit hangs on this picture.

Document Your End-to-End iGaming KYC Workflow

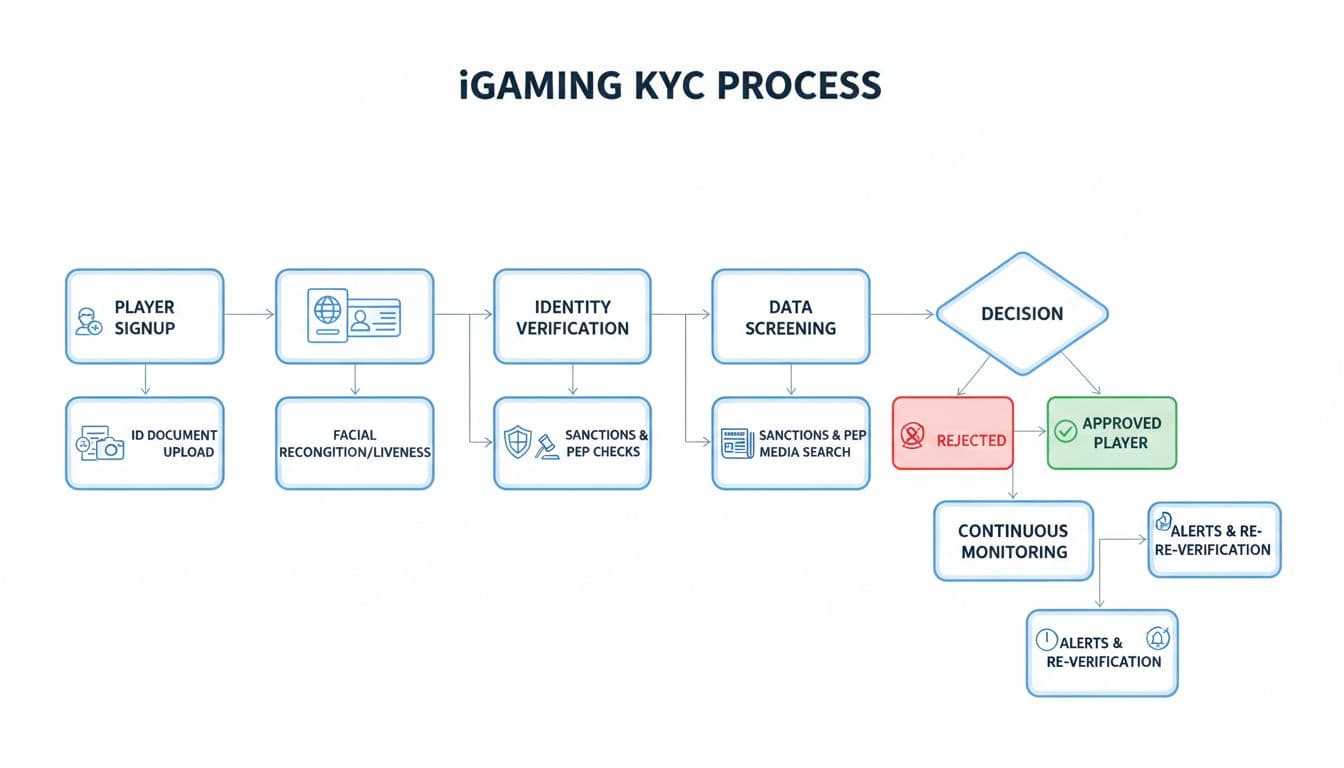

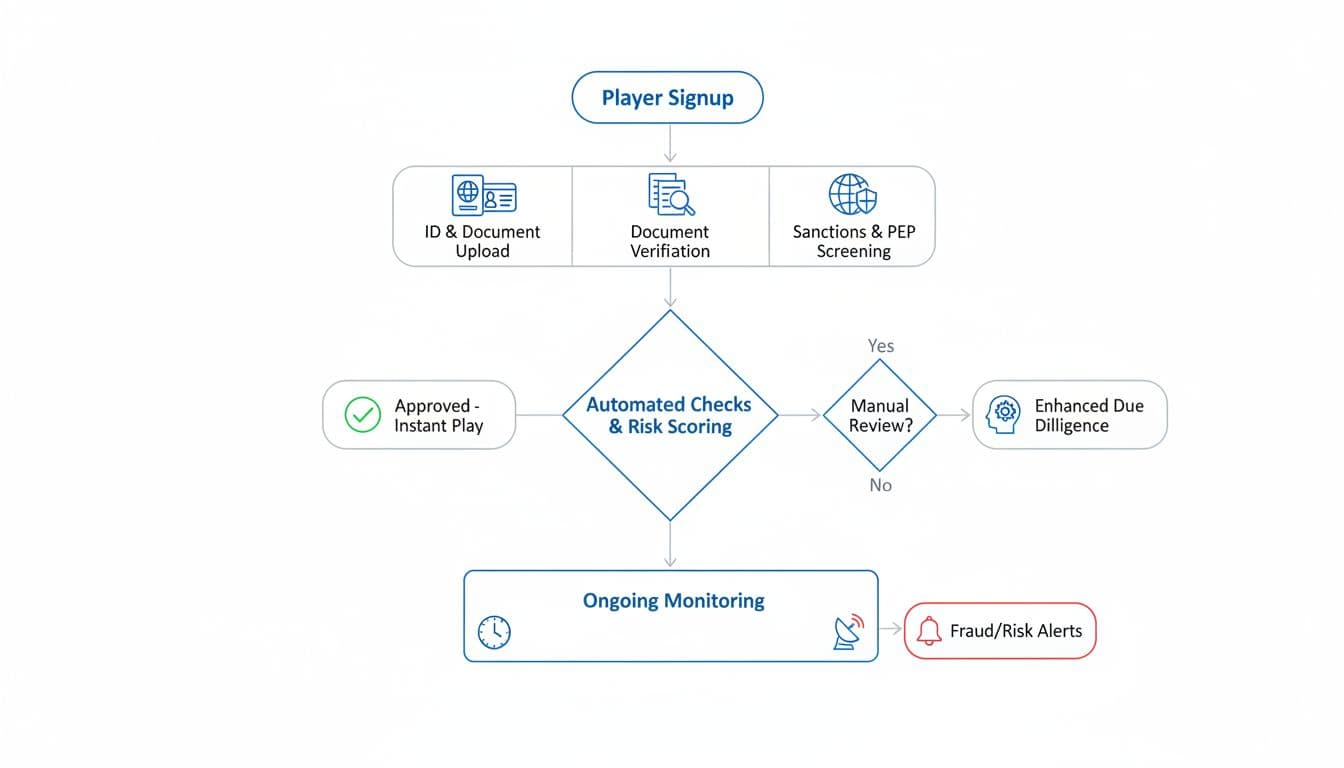

Next, document the journey a player takes and where KYC checks actually happen.

Start at registration and move step by step. Capture where you collect personal data, trigger ID verification, screen against sanctions, perform affordability or source-of-funds checks, and run enhanced checks for high-risk profiles.

Draw this as a simple flowchart or swim-lane diagram. Add who owns each step, product, risk, or operation, and what system does the work. This gives you a clear, shared view of your igaming KYC workflow, not just what lives in people’s heads.

Finally, mark where manual actions and exceptions exist. Those are prime spots for errors, delays, and regulatory findings.

Test KYC Controls With Realistic Scenarios

Once the map is clear, pressure-test it. Do not wait for a regulator to be the first one who really test your flow.

Pick a mix of realistic scenarios and run them like a penetration test for compliance. For example, try an underage user, a high-roller from a higher-risk country, or a player who rapidly increases deposits.

You can structure this testing with a simple table like this:

| Scenario | What to test | Evidence to save |

|---|---|---|

| Underage player | Age checks, document validation | Screenshots, logs, and failed registration |

| High-risk country with big deposits | Risk scoring, enhanced due diligence | Case notes, flags, transaction history |

| Rapid deposits across cards and wallets | Transaction monitoring, alerts, review | Alert trail, analyst decisions, outcomes |

Use scenario runs to check both automated and manual controls. Where did the system react too late, or not at all? Where did staff skip steps or misinterpret rules?

Compliance teams often pull ideas for scenarios from different resources. Adapt those lists to the specific products and markets in your operation.

Check Data Quality, Automation, and Vendor Performance

A clean igaming KYC workflow is only as strong as its data and tools.

Review a sample of recent customer files. Look for missing fields, expired identity documents, inconsistent addresses, and unlogged manual overrides. Bad data is a red flag for regulators, and it also weakens your fraud controls.

Then review every automated control. Document verification, sanctions screening, PEP checks, and transaction monitoring rules should match your current risk map, not old policies from two years ago.

If you use third-party KYC vendors, audit them too. Measure hit rates, false positives, average response times, and downtime. Different guides can help you benchmark what good looks like.

Record any gaps as formal issues, with owners, deadlines, and planned fixes. Regulators respond better when they see that you have a clear plan and can show progress.

Tighten Governance, Training, and Record-Keeping

Regulators inspect more than your workflow; they look at how you run compliance as a function.

Start with governance. Do you have a named compliance officer, clear reporting lines, and board-approved policies that are reviewed at least once a year? If not, treat that as a top priority.

Training is the next pressure point. Every staff group that touches customers or payments needs simple, role-based KYC training. That includes support agents, VIP hosts, payments teams, and marketing, not just compliance analysts.

Use short, focused sessions and real case studies from your own platform. The American Gaming Association AML best practices guide can help you design programs that connect day-to-day tasks with AML and KYC obligations.

Finally, tighten record-keeping. Keep a clear audit trail of every KYC decision, from initial verification to ongoing monitoring. Store evidence securely, index it by customer ID, and test how fast your team can retrieve it when a regulator asks.

Build a Regulator-Ready KYC Audit Pack

A smart move before any inspection is to prepare a standard KYC audit pack.

This does not have to be fancy. Start with a short overview of your business model and risk map, including products, markets, and key payment flows. Add your current KYC and AML policies, with version numbers and approval dates.

Include your igaming KYC workflow diagrams, covering onboarding, ongoing monitoring, and offboarding or account closure. Attach a set of anonymized customer case studies that show how you handle low, medium, and high-risk players.

Round it out with management information reports. Share KPIs like time to verify, the share of failed checks, number of alerts, SARs filed, and any remediation program you are running. This pack becomes your front page story for the inspection.

When regulators see structure, data, and honest self-assessment in one place, the conversation becomes far more manageable.

Conclusion: Turn Your iGaming KYC Workflow Into An Asset

A regulator inspection does not have to feel like a threat. With a clear risk map, a documented igaming KYC workflow, tested controls, and strong governance, your operation starts from a position of strength.

The best operators treat their KYC audit as a regular health check, not a last-minute scramble. That habit protects their license, reduces fraud, and cuts friction for genuine players.

Pick one section from this guide to act on this week, even if it is just mapping your current flow. Every small fix makes your next inspection easier and your business safer.

The Ideas Plus Business Editorial team is responsible for this post. For collaborations and partnership requests, kindly send an email to the Editorial Team at ideasplusbusiness[at]gmail[dot]com for the terms and conditions. You can also follow IdeasPlusBusiness.com on Twitter here and like our page on Facebook here.