A “quiet” player account can feel harmless. No bets, no deposits, no support tickets. But in AML work, silence can be cover. A dormant wallet is like an empty storefront with the lights still on, it might be nothing, or it might be staging.

That’s why iGaming dormancy monitoring matters. Not because regulators publish neat “inactive for 90 days = suspicious” rules (they usually don’t), but because operators still have to prove ongoing monitoring and a risk-based approach, even when players aren’t actively gambling.

This guide breaks down what “dormancy” should mean in practice, which inactive-player patterns deserve AML flags, and how to turn it into a monitoring workflow your team can defend in an audit.

What “dormant” should mean in an AML program (not just “not logging in”)

Dormancy isn’t one thing. In iGaming AML, it’s better to treat it as a state with multiple signals, not a single timer.

A player can be “inactive” but still risky if they:

- Keep a positive balance parked for long periods

- Log in but don’t bet (account testing)

- Return after months and immediately deposit big

- Change payment methods, devices, or location right before reactivation

So instead of asking, “How many days since last bet?”, ask, “What changed while they were quiet, and what happens when they return?”

What regulators actually expect in 2026 (and what they don’t spell out)

Across major iGaming jurisdictions, dormancy thresholds are typically operator-defined. Regulators focus on outcomes: ongoing monitoring, risk assessment, and evidence that controls work.

For example, the UK Gambling Commission guidance emphasizes continuous customer and transaction oversight rather than fixed dormancy day counts. See the UKGC sections on customer monitoring and ongoing monitoring.

That means your “dormancy monitoring rules” are often internal rules that must be:

- Risk-based (tighter for higher-risk segments)

- Consistent (applied the same way, with documented exceptions)

- Auditable (clear logs showing what triggered, when, and what you did)

If you can’t explain your dormancy logic to an auditor in plain English, it’s not ready.

Practical dormancy timelines most operators use (policy thresholds, not legal ones)

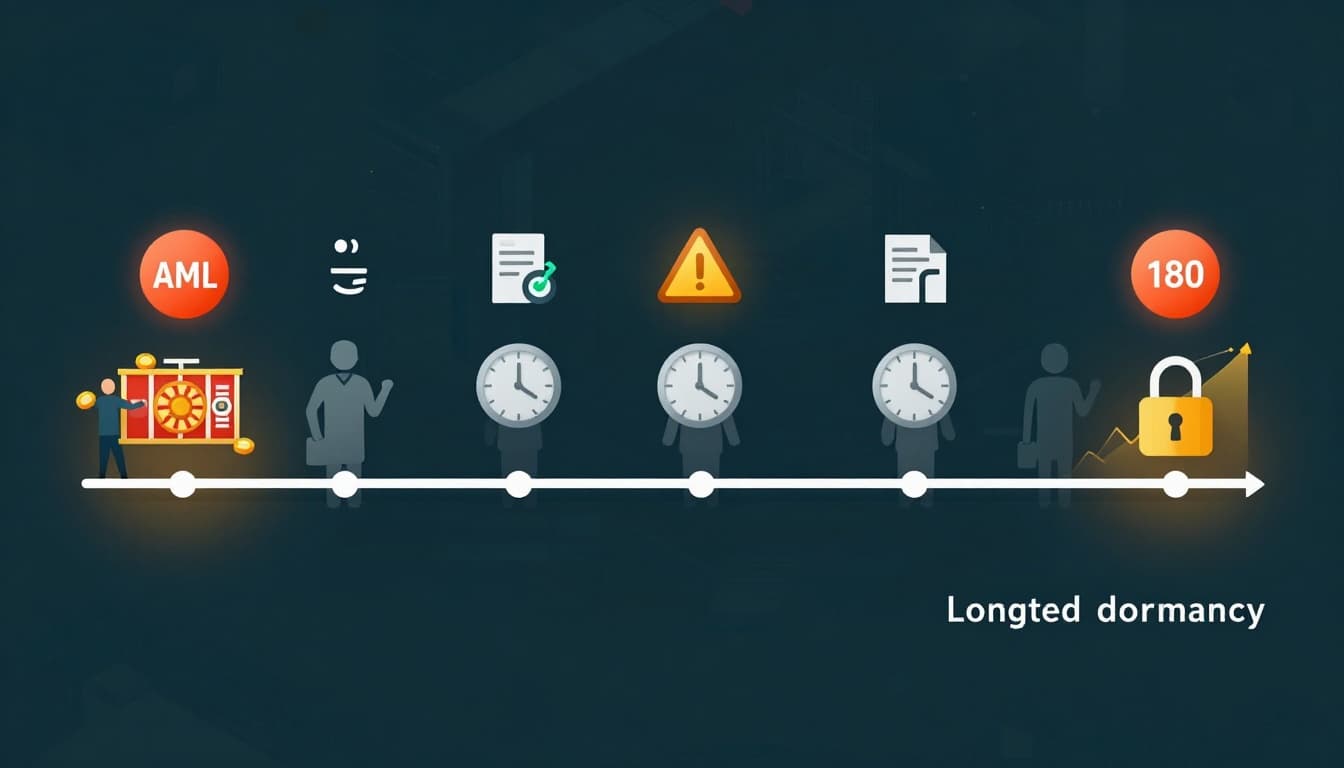

Most programs set time bands so alerts and actions don’t become random. A common approach is 30, 90, and 180-day stages (or similar), with different checks at each stage.

Here’s a sensible way to think about it:

- Short pause: normal life happens, travel, pay cycles, sports seasons end

- Medium dormancy: the account becomes “stale,” data and risk scoring may be outdated

- Long dormancy: reactivation starts to look like a “new customer” moment again

The key is what you do at each stage, not the number itself. For instance, long dormancy might trigger a light KYC refresh prompt, while reactivation after long dormancy might trigger an AML review if other risk signals stack up.

Dormancy becomes interesting when inactivity is paired with a behavior that’s common in laundering, fraud, or mule activity.

High-signal reactivation patterns

Reactivation spike after long inactivity: A player disappears, then returns and deposits large amounts quickly. This can indicate “placement” after funds have moved through other channels.

Rapid deposit then withdrawal with limited play: Minimal wagering and fast cash-out can be a wash pattern, especially if it repeats.

Identity, device, and location changes during “silence”

Dormancy can hide prep work:

- Payment method change right before first post-dormancy deposit

- New device fingerprint plus new IP range

- Geo jump that doesn’t match the customer profile

Fraud teams talk about dormancy as a setup phase for account takeover too. The pattern is well described in Unit21’s discussion of account dormancy and fraud detection.

Bonus, promo, and wallet behaviors

Dormant accounts can also be “stored inventory” for abuse:

- Dormant accounts reactivated in batches

- Same payment instrument used across multiple reactivations

- Bonus claim behavior that looks coordinated

Dormancy monitoring is where AML and fraud overlap. Treat those teams as allies, not separate lanes.

A simple “Dormancy Reactivation Risk Score” you can implement this quarter

To keep alerts from flooding your queue, score reactivations. Below is a lightweight scoring model you can tailor. It’s not a legal standard, it’s a practical filter.

| Risk factor (on reactivation) | Low (0) | Medium (1) | High (2) |

|---|---|---|---|

| Time dormant | Short | Medium | Long |

| Deposit size vs history | Normal | Elevated | Big jump |

| Payment method behavior | Same | New method | New method + mismatch signals |

| Geo/device change | None | One change | Multiple changes |

| Cash-out behavior | Normal play | Low play | Rapid withdrawal, minimal play |

Use it like a smoke alarm:

- 0 to 3: monitor as normal

- 4 to 6: queue for analyst review

- 7 to 10: consider EDD steps before allowing higher limits or withdrawals (based on your policies)

If you need inspiration for building rule logic and thresholds, SEON’s overview of AML transaction monitoring rules is a helpful reference point for structuring conditions, exceptions, and false-positive control.

The workflow regulators want to see: alert, triage, refresh, decide

A defensible dormancy program has a clear path from signal to action.

1) Alert creation

Log the trigger inputs (dormancy band, deposit delta, payment change, geo/device change). Preserve raw fields.

2) Triage and context

Analysts should see a compact story: “inactive 140 days, reactivated, 5x typical deposit, new card, new device.”

3) Proportionate response

Not every dormancy alert needs a full investigation. Common actions include:

- Light-touch KYC refresh for stale profiles

- Source of funds request when behavior materially shifts

- Temporary friction (limits or enhanced review) for high-risk reactivations

4) Decision and documentation

Either close the alert with rationale, escalate to EDD, or file where required (SAR/STR processes vary by jurisdiction). The point is consistency and a paper trail.

Where this creates real business ideas (without becoming a full RegTech company)

For founders and operators, dormancy monitoring isn’t just a cost center. It creates practical business ideas and product angles, especially for small teams who can’t build everything in-house.

A few examples that fit the market in 2026:

- A “reactivation risk” micro-service that scores dormant-to-active transitions and pushes cases into existing tools

- A rules tuning service that reduces false positives by segment (VIP, casual, high-risk countries)

- A compliance analytics dashboard focused on dormancy KPIs (alert-to-EDD rate, reactivation risk distribution, stale KYC counts)

These are narrow, shippable products that solve a clear pain point: too many alerts, too little context, and too much manual work.

Conclusion: make dormancy boring, measurable, and auditable

Dormant players aren’t automatically risky, but ignoring them is a mistake. A strong iGaming dormancy monitoring program uses simple time bands, smarter reactivation signals, and a documented workflow that ties every alert to an outcome.

Build rules you can explain, score alerts so the queue stays human-sized, and treat reactivation like a moment where risk can change fast. Quiet accounts shouldn’t scare you, but they should never be invisible.

Adeyemi Adetilewa leads the editorial direction at IdeasPlusBusiness.com. He has driven over 10M+ content views through strategic content marketing, with work trusted and published by platforms including HackerNoon, HuffPost, Addicted2Success, and others.