If your AML policy is 30 pages long, your team won’t read it. If they don’t read it, they won’t follow it, and you’re left with a compliance document that looks good in a folder and fails in real life.

This guide shows how to write a clear AML policy template that staff can use under pressure, during onboarding rush, while handling refunds, or when a customer’s story doesn’t add up.

You’ll get a practical structure (with sample wording) that works well for compliance-heavy business ideas like payment apps, remittance services, marketplaces with wallets, crypto products, and any business handling higher-risk fund flows.

Write AML policies like you’re writing for a tired teammate

A policy shouldn’t read like a law textbook. It should read like a set of agreed house rules. Think of it like a fire exit plan, not a history of fire.

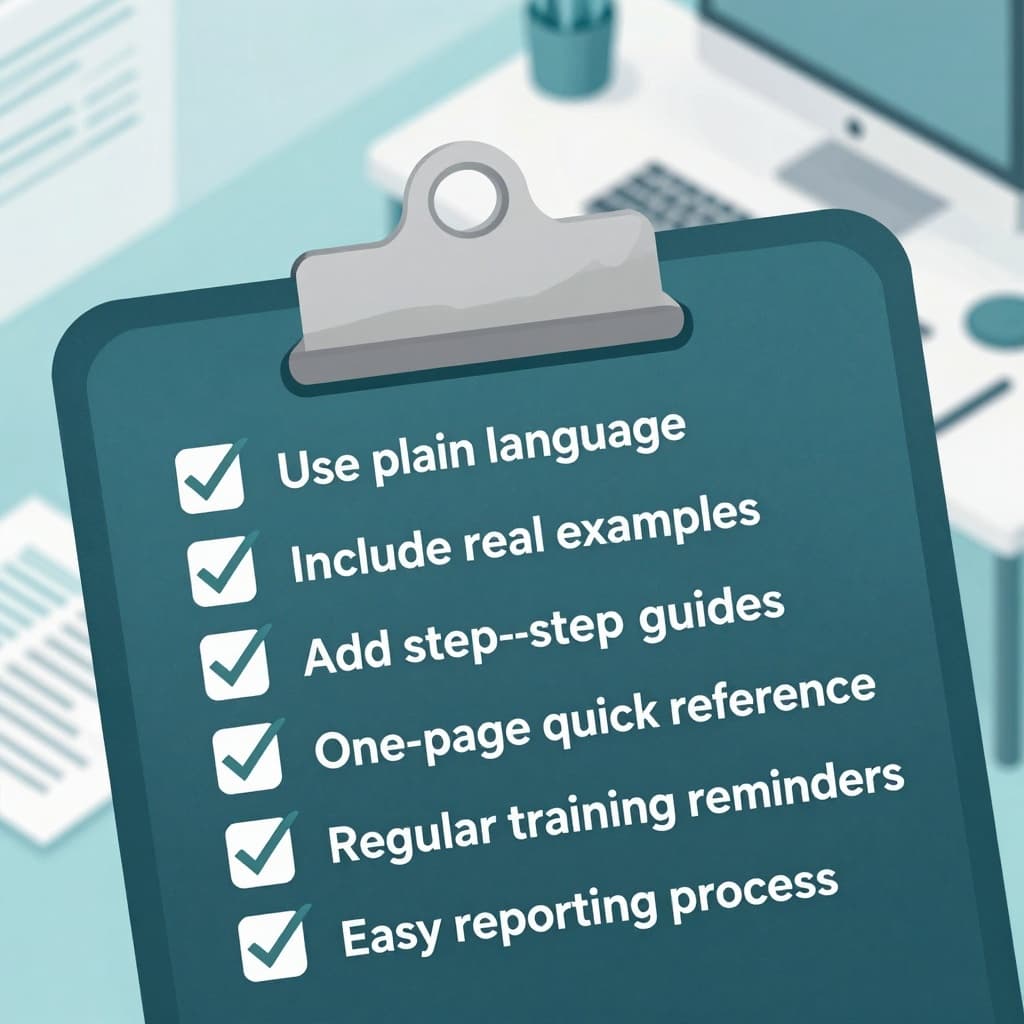

To get follow-through, build your policy around these habits:

- Plain words over legal terms: If a frontline teammate can’t explain it back, rewrite it.

- Decisions, not definitions: Staff need “when X happens, do Y,” not a glossary.

- Role-based instructions: A sales rep and an ops lead shouldn’t hunt through the same paragraph.

- One-page quick reference: Put the “what to do now” summary up front, then details after.

Keep the policy tight, then link your internal SOPs separately (screens, steps, owners). The policy is the rulebook; the SOP is the play.

Policy vs procedure vs job aid (use all three)

Most teams fail because they try to cram everything into “the policy.” Split it so each document has a job.

| Document | What it’s for | Best length | Example content |

|---|---|---|---|

| AML Policy | Rules, ownership, and minimum standards | 3 to 10 pages | Risk approach, CDD/EDD rules, SAR/STR reporting responsibility |

| AML Procedures (SOPs) | Step-by-step “how” for tasks | 1 to 3 pages each | “How to verify ID,” “How to clear a sanctions match.” |

| Job Aids | Fast prompts for busy staff | 1 page | Red-flag list, escalation flow, “Do not process” triggers |

If you’re looking for a baseline policy structure, FINRA’s Anti-Money Laundering (AML) Template for Small Firms is a useful reference for covered firms (adapt it to your business and legal scope).

A practical AML policy template that staff will actually follow

Below is an 8-part structure that works across many small businesses. Each section includes sample wording you can copy, then edit.

1. Purpose and scope (say what you do, and what you don’t)

Make the scope specific to your product, customer types, and geographies.

Sample wording:

“Our goal is to prevent our services from being used for money laundering, fraud, or terrorist financing. This policy applies to all employees and contractors who onboard customers, approve transactions, handle refunds, or review alerts for [Company Name]. This policy covers [products/services], including [wallets, payouts, subscriptions, escrow], and applies to customers in [countries/states served].”

2. Roles and responsibilities (name owners by role, not person)

Avoid “Compliance will…” without naming who does what.

Sample wording:

“The Board and CEO are responsible for approving this AML program and providing resources to operate it. The AML Compliance Officer (MLRO) owns day-to-day oversight, escalation decisions, and regulatory reporting. Frontline teams (Sales, Support, Ops) must follow CDD steps, document customer interactions, and escalate red flags within required timeframes.”

3. Risk assessment (keep it simple, document the logic)

Most small teams need a basic, repeatable risk method.

Sample wording:

“We use a risk-based approach. Each customer is assigned Low, Medium, or High risk based on customer type, location, product usage, expected transaction size, funding source, and adverse media indicators. High-risk customers require EDD and more frequent monitoring.”

4. Customer due diligence (CDD) and enhanced due diligence (EDD)

Spell out what you collect, when you verify, and what triggers EDD.

Sample wording:

“We collect and verify customer identity information where required. Minimum CDD includes full legal name, date of birth (for individuals), address, and a verified contact method. EDD is required when risk is High or when red flags are present (for example, unusual ownership structures, high-value activity inconsistent with stated purpose, or customers in higher-risk geographies).”

5. Ongoing monitoring (tell staff what gets reviewed, and when)

Monitoring fails when it’s vague. Define review triggers.

Sample wording:

“We monitor transactions for patterns inconsistent with a customer’s stated activity. Alerts are generated for defined scenarios (including rapid in-out movement of funds, unusual volume spikes, repeated failed payments followed by large successes, and frequent third-party funding). Alerts must be reviewed within [X] business days and documented.”

6. Sanctions and PEP screening (what happens on a match)

This section should be blunt. Staff should know when to stop.

Sample wording:

“We screen customers and, where applicable, counterparties against sanctions lists and PEP sources. If a potential match is identified, staff must pause onboarding or transaction processing and escalate to the MLRO. Only the MLRO (or delegate) can clear a match or approve a decline.”

7. Reporting and recordkeeping (who reports, what to retain)

In the US, reporting duties vary by business type and registration status. Don’t guess. Write your internal rule for escalation, then your MLRO confirms whether a filing is required.

Sample wording:

“All staff must escalate suspicious activity immediately using [channel]. The MLRO determines whether a report is required and files it within the required timelines. We retain CDD files, alert case notes, transaction records, and investigation outcomes for at least [X] years (or longer if required).”

8. Training, testing, and review (make it routine)

Training shouldn’t be a once-a-year slide deck.

Sample wording:

“Relevant staff receive AML training at onboarding and at least annually. Training includes red flags tied to our products, how to escalate, and documentation standards. The AML program is tested at least annually by an independent reviewer (internal audit or qualified third party). Policy updates are version-controlled and communicated to staff.”

For additional examples of how firms frame these sections, you can compare formats with guides like Writing an AML Policy and vendor templates such as Anti-Money Laundering (AML) Policy (use them as references, then rewrite to match your real workflow).

Make the AML policy “doable” with triggers and micro-scripts

Staff follow policies when the policy answers: “What do I do next?”

Add short, reusable lines people can paste into tickets and customer emails:

- Escalation trigger: “Stop processing and escalate if the customer refuses to provide source-of-funds info after two requests.”

- CDD mismatch: “If the customer’s stated business purpose conflicts with observed activity, escalate within 24 hours.”

- Documentation rule: “If it isn’t written in the case notes, it didn’t happen.”

Real-world example: A marketplace seller asks for payouts to a new bank account, then immediately requests refunds to a different card. Your policy shouldn’t say “monitor for suspicious activity.” It should say “place a hold, open a case, request explanation and supporting documents, escalate if inconsistent.”

Roll it out so it sticks (a simple 30-day adoption plan)

A good AML policy still fails if it’s launched like a PDF announcement.

Week 1: Publish the policy plus a one-page quick reference (red flags, escalation path, response times).

Week 2: Train by role (Support, Ops, Sales). Use 3 short scenarios, not long lectures.

Week 3: Add QA checks (spot-check 5 cases a week, give feedback fast).

Week 4: Fix what’s unclear, then lock version control (owner, approval date, next review date).

A usable AML policy beats a perfect one

A clear AML policy is like a seatbelt. It only works if people actually wear it. When you write your AML policy template around roles, triggers, and real actions, staff stop guessing and start escalating the right issues early.

If you’re launching or scaling compliance-heavy business ideas, don’t aim for the longest document. Aim for the one your team can follow on a busy Tuesday, without asking for permission every time.

Adeyemi Adetilewa leads the editorial direction at IdeasPlusBusiness.com. He has driven over 10M+ content views through strategic content marketing, with work trusted and published by platforms including HackerNoon, HuffPost, Addicted2Success, and others.