Are you interested in starting a credit repair business from the comfort of your home?

In today’s economic landscape, where credit plays a vital role in personal and financial opportunities, credit repair has emerged as a lucrative and in-demand industry. By helping individuals improve their credit scores and repair their financial reputation, you can not only make a positive impact on their lives but also build a successful business for yourself.

In this comprehensive guide, we will walk you through the essential steps to start a credit repair business from home. From understanding the credit repair industry to establishing your business and attracting clients, we’ve got you covered.

So, let’s dive in and explore the basics of starting a credit repair business from home.

What is Credit Repair?

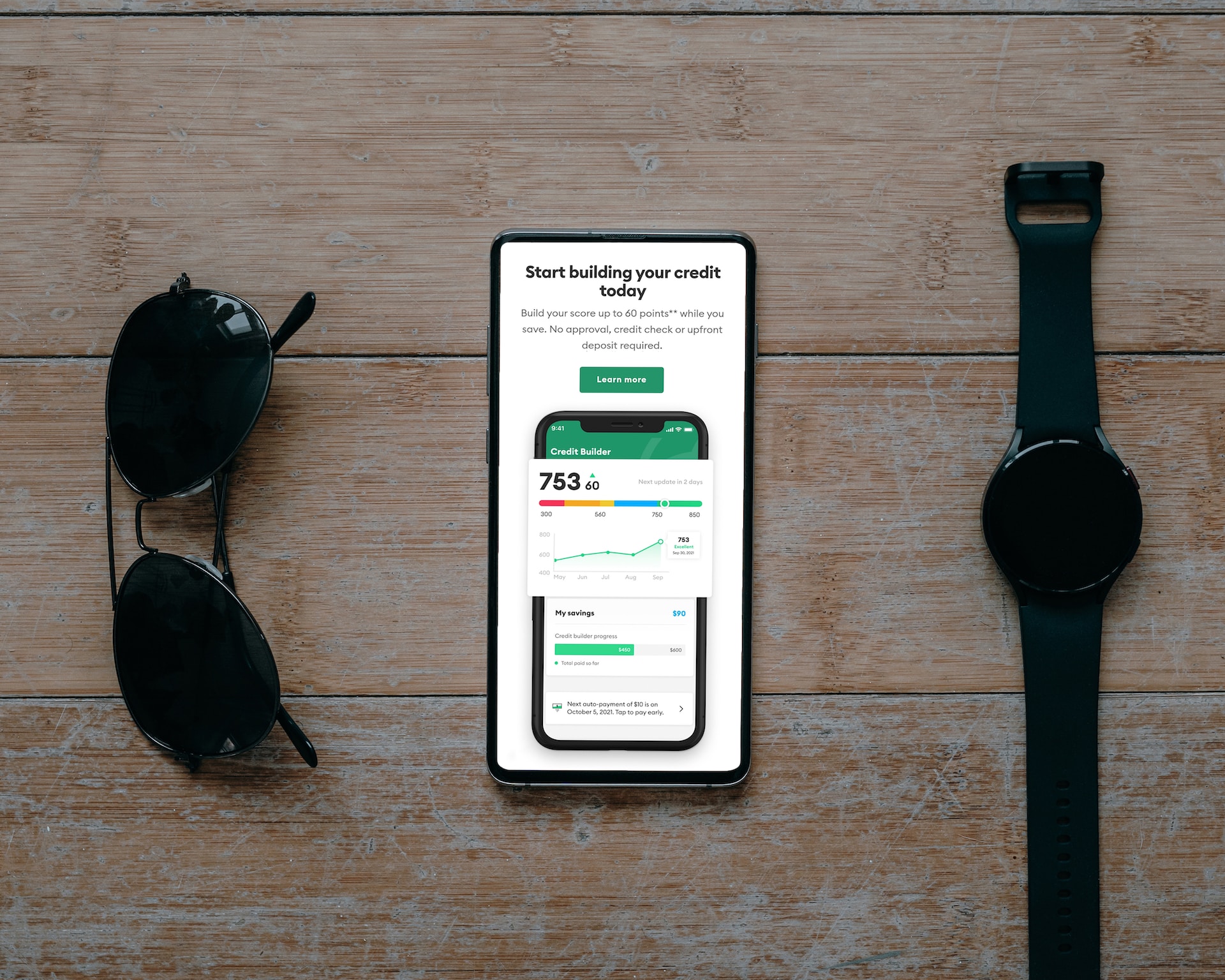

Credit repair refers to the process of identifying and correcting errors, inaccuracies, and outdated information on an individual’s credit report.

It involves working with credit bureaus and creditors to dispute negative items and improve the overall creditworthiness of a consumer. By removing or rectifying inaccurate information, credit repair helps individuals improve their credit scores and access better financial opportunities.

Why is Credit Repair Important?

Credit repair plays a crucial role in today’s society for several reasons:

Access to Better Financing: A good credit score opens doors to favorable interest rates on loans, mortgages, and credit cards, saving consumers thousands of dollars in the long run.

Employment Opportunities: Many employers consider credit history as part of their hiring process, especially for positions involving financial responsibility.

Lower Insurance Premiums: Insurance companies often utilize credit scores to determine premiums, with higher scores resulting in lower insurance costs.

Rental Applications: Landlords and property managers frequently assess creditworthiness when evaluating rental applications, making credit repair beneficial for securing desirable housing options.

Market Analysis: Is There a Demand For Credit Repair Business?

The credit repair industry continues to experience significant growth, driven by the increasing importance of credit scores in various aspects of life.

According to recent studies, more than one-third of Americans have at least one delinquent debt on their credit report, highlighting the vast potential market for credit repair services. As consumers become more aware of the impact credit scores have on their financial well-being, the demand for credit repair assistance is expected to rise.

Acquiring the Necessary Skills and Knowledge

Here is how to acquire the necessary skills and knowledge to start a credit repair business from home:

1. Study and Research

To succeed in the credit repair business, it is essential to have a solid foundation of knowledge. Invest time in studying credit repair techniques, credit laws, and industry best practices.

Explore reputable sources such as books, online courses, and industry forums to expand your knowledge and stay up-to-date with the latest trends and regulations.

2. Obtain Relevant Certifications

While certification is not mandatory to start a credit repair business, it adds credibility to your services and instills confidence in potential clients.

Consider obtaining certifications such as the Credit Repair Cloud’s Certified Credit Repair Specialist (CCRS) or the National Association of Credit Services Organizations (NACSO) Certified Credit Repair Specialist (CCRS) designation. These certifications demonstrate your commitment to professionalism and adherence to ethical standards.

3. Familiarize Yourself with Laws and Regulations

Understanding and complying with credit repair laws and regulations is crucial for maintaining a legitimate and ethical credit repair business.

Familiarize yourself with the Fair Credit Reporting Act (FCRA), the Credit Repair Organizations Act (CROA), and other relevant laws specific to your country or region. This knowledge will help you navigate the legal landscape and protect your client’s rights.

Starting A Credit Repair Business From Home

When starting a credit repair business from home, here are the steps to take:

1. Create a Business Plan

Before diving into the credit repair industry, develop a comprehensive business plan that outlines your goals, target market, services, marketing strategies, and financial projections.

A business plan provides a roadmap for your credit repair business and helps you stay focused and organized.

2. Choose a Catchy Credit Repair Business Name and Register It

Selecting a memorable and relevant credit repair business name is an important step in establishing your brand identity.

Ensure the chosen name is not already in use and register it with the appropriate authorities in your jurisdiction. Additionally, consider securing a domain name that aligns with your credit repair business name for your website.

3. Set Up a Dedicated Workspace

Designate a dedicated workspace in your home where you can focus on your credit repair business. This area should be free from distractions and equipped with essential tools, including a computer, phone line, printer, and other office supplies.

A separate workspace helps maintain a professional atmosphere and enhances productivity.

Essential Tools and Software For Credit Repair Business

Here are some of the essential software and tools for a credit repair business:

1. Credit Reporting Software

Credit reporting software is an indispensable tool for credit repair professionals. It allows you to access and analyze credit reports, track client progress, and generate dispute letters efficiently.

Choose a reputable credit reporting software that complies with industry standards and offers robust features to streamline your credit repair processes.

2. Customer Relationship Management (CRM) Software

CRM software helps you manage and organize client information, track communication history, and schedule follow-ups.

It streamlines client onboarding, allows you to automate routine tasks, and provides a centralized database for easy access to client data.

3. Secure Document Management System

A secure document management system is essential for storing and managing sensitive client information securely.

Look for a system that offers encryption, access controls, and data backup to ensure client confidentiality and comply with data protection regulations.

Credit Repair Marketing Ideas For Business

Use these credit repair marketing ideas for your business:

1. Define Your Target Market

Identify your target market within the credit repair industry. Determine the demographics, financial goals, and pain points of your ideal clients.

This information will help you tailor your marketing messages and strategies to resonate with your target audience.

2. Build an Online Presence

Establishing an online presence is vital in today’s digital age. Create a professional website that showcases your services, expertise, and success stories.

Optimize your website for search engines by incorporating relevant keywords, including “How to Start a Credit Repair Business From Home,” in your content. Utilize search engine optimization (SEO) techniques to improve your website’s visibility and attract organic traffic.

3. Utilize Social Media Marketing

Harness the power of social media platforms to reach a wider audience and engage with potential clients.

Create business profiles on popular platforms such as Facebook, Instagram, and LinkedIn. Share informative content, success stories, and industry updates to position yourself as a credible expert in the credit repair field.

4. Network and Collaborate with Industry Professionals

Networking with other professionals in the finance and real estate industries can be valuable for your credit repair business.

Attend industry conferences, join relevant associations, and engage in online communities to establish connections and explore collaborative opportunities. Building relationships with professionals like mortgage brokers, real estate agents, and financial advisors can lead to referrals and partnerships.

How to Build Trust and Credibility When Starting A Credit Repair Business From Home

Use these tips to build trust and credibility when you start a credit repair business from home:

1. Establish a Professional Website

A well-designed and professional website is crucial for establishing trust and credibility with potential clients.

Ensure your website is visually appealing, easy to navigate, and mobile-friendly. Include informative content, testimonials, and contact information to reassure visitors of your expertise and reliability.

2. Develop Compelling Content

Content marketing is an effective strategy for building trust and attracting potential clients. Create blog posts, articles, and guides that address common credit repair challenges and provide actionable tips.

Use a conversational tone and include the keyword “How to Start a Credit Repair Business From Home” naturally within your content to enhance SEO.

3. Leverage Testimonials and Case Studies

Positive testimonials and case studies from satisfied clients serve as powerful social proof. Request feedback from your clients and feature their success stories on your website and marketing materials.

Ensure you have their consent to use their testimonials and consider including before-and-after credit scores to showcase the effectiveness of your services.

How to do Credit Repair Business For Clients

Here are some steps to take when working with clients and repairing credit:

1. Client Onboarding and Assessment

Develop a streamlined client onboarding process to gather necessary information and assess their credit repair needs.

Create intake forms or questionnaires that capture essential details about their financial history, credit goals, and any specific concerns they may have.

2. Analyzing Credit Reports

Thoroughly analyze clients’ credit reports to identify errors, discrepancies, or negative items affecting their credit scores.

Look for inaccuracies, outdated information, and potential areas for improvement. This analysis will serve as the foundation for developing personalized credit repair strategies.

3. Disputing Inaccurate Information

Craft well-crafted dispute letters to challenge inaccurate information on clients’ credit reports.

Tailor each letter to address specific issues and provide supporting evidence. Follow up with credit bureaus and creditors to ensure the timely resolution of disputes.

4. Creating Actionable Credit Improvement Plans

Work collaboratively with clients to create actionable credit improvement plans. Set realistic goals and milestones, and provide guidance on managing finances, paying off debts, and establishing positive credit habits.

Regularly monitor progress and adjust strategies as needed to achieve optimal results.

Credit Repair Business Compliance and Ethical Practices

Here is how to ensure compliance and ethical practices when you start a credit repair business:

1. Familiarize Yourself with Credit Repair Laws

Maintaining compliance with credit repair laws is crucial for the success and longevity of your business.

Stay updated on the FCRA, CROA, and other relevant laws and regulations governing credit repair. Adhere to ethical practices and ensure transparency with your clients throughout the credit repair process.

2. Maintain Client Data Security and Privacy

Protecting client data is of utmost importance. Implement robust data security measures, such as encrypted file storage, secure communication channels, and regularly updated antivirus software.

Obtain written consent from clients to store and use their personal information, and clearly communicate your privacy policy.

3. Practice Ethical Standards

Operate your credit repair business with integrity and professionalism. Avoid making false promises or misleading claims to clients.

Maintain open and honest communication, and provide realistic expectations regarding the credit repair process. Uphold ethical standards to build a reputable and trusted brand.

How to Scale Your Credit Repair Business

Use these tips to scale your credit repair business:

1. Hiring and Outsourcing

As your credit repair business grows, consider hiring additional staff or outsourcing certain tasks to manage increasing client volumes effectively.

Delegate administrative tasks, such as document management or customer support, to free up your time to focus on core business activities.

2. Streamlining Processes

Continuously evaluate and refine your credit repair processes to improve efficiency and productivity. Leverage technology to automate routine tasks, such as client communication or progress tracking.

Streamlining your processes will enable you to handle more clients and scale your business effectively.

3. Expanding Your Services

Diversify your service offerings to cater to a broader range of client needs. Consider providing credit education workshops, financial coaching, or credit monitoring services.

Expanding your services can attract new clients and create additional revenue streams for your credit repair business.

Frequently Asked Questions (FAQs)

How profitable is a credit repair business?

Earnings in the credit repair industry vary based on factors such as the number of clients, services offered, and market demand. Successful credit repair professionals can earn a substantial income, but it requires dedication, expertise, and effective marketing strategies.

Can I start a credit repair business from home with no prior experience?

While prior experience in finance or credit-related fields can be beneficial, it is possible to start a credit repair business without previous experience. However, acquiring knowledge and certifications in credit repair, as well as staying updated on industry trends and regulations, is essential for success.

Is credit repair legal?

Yes, credit repair is legal as long as it is conducted within the framework of applicable laws and regulations. It is important to comply with the FCRA, CROA, and any other laws specific to your region.

How long does credit repair take?

The duration of credit repair varies depending on the complexity of each client’s credit history and the effectiveness of the strategies implemented. Some clients may see improvements within a few months, while others may require longer-term efforts.

Can I repair my own credit without a credit repair business?

It is possible to repair your own credit without the assistance of a credit repair business. However, credit repair can be a complex process, and professional expertise can help navigate challenges and achieve optimal results.

Conclusion

Starting a credit repair business from home can be a rewarding and profitable venture. By following the steps outlined in this guide, you can establish a successful credit repair business while helping individuals improve their financial well-being.

Remember to continuously educate yourself, prioritize compliance and ethics, and provide exceptional service to your clients.

With determination, hard work, and the right strategies, you can embark on a fulfilling journey in the credit repair industry. So, take the first step and begin your path to financial freedom today!

I am Adeyemi Adetilewa, an SEO Specialist helping online businesses grow through content creation and proven SEO strategies. Proficient in WordPress CMS, Technical Site Audits, Search Engine Optimization, Keyword Research, and Technical Writing (Portfolio).

I help brands share unique and impactful stories through the use of public relations, advertising, and online marketing. My work has been featured in the Huffington Post, Thrive Global, Addicted2Success, Hackernoon, The Good Men Project, and other publications.