If you’re running a lean sportsbook or casino brand, iGaming affordability checks can feel like a problem built for big operators with big teams. Players expect fast deposits and instant play, but regulators and payment partners expect you to spot harm and financial risk early.

The good news is you don’t need a massive compliance department to run affordability checks well. You need a clear tier model, consistent triggers, a short list of acceptable proof, and player messaging that’s polite and firm.

What “affordability” means in practice (and why small operators struggle)

Affordability checks are about deciding whether a player’s gambling activity fits their likely financial situation, then acting when it doesn’t. For small operators, the challenge is balancing three pressures:

Risk: You can’t ignore fast-rising deposits, loss spikes, or failed payments.

Friction: Asking for documents too early can push good customers away.

Capacity: Manual review time is limited, so your rules must be easy to run.

If you’re in the UK or serving UK players, follow the ongoing debate and expectations around financial checks via industry coverage like iGB’s explainer on financial risk checks and what’s still uncertain. Even outside the UK, the operational pattern is similar: tiered monitoring, documented decisioning, and clear player communications.

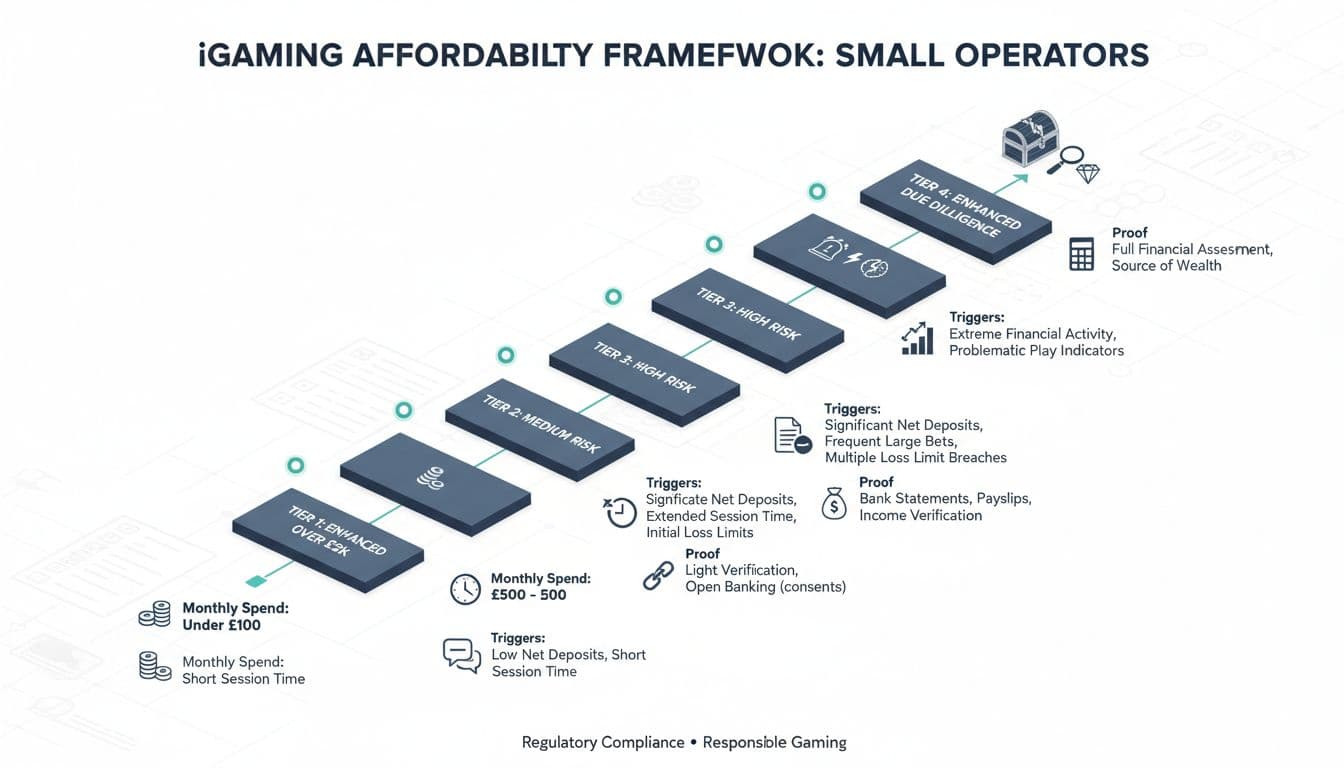

Build a tiered affordability framework you can actually operate

A tier system is like airport security. Most people pass through with minimal friction, but a smaller group triggers extra checks. Your tiers should do the same.

A simple 4-tier model (example thresholds)

Use your own risk appetite, market, and product mix to set figures. The key is consistency and documented rationale. Here’s an example structure you can adapt:

| Tier | Player profile | Typical triggers | What you do | Acceptable proof (examples) |

|---|---|---|---|---|

| Tier 1: Low | Stable, low spend | Low net deposits, no risk flags | Monitor, offer limits tools | Usually none, self-declaration if needed |

| Tier 2: Medium | Spend rising | Deposit frequency increases, longer sessions | Light-touch outreach, set limits | Self-declaration, basic explanation of funds |

| Tier 3: High | Fast growth or volatility | Loss velocity spikes, repeated deposits | Require affordability info before higher activity | Payslip, bank statement excerpt, benefits letter |

| Tier 4: Enhanced | Strong risk indicators | Multiple red flags, failed payments, chargebacks | Pause increases, EDD review | Stronger evidence, source-of-funds detail |

Two practical rules that help small teams:

- Make Tier 2 “human-friendly.” It’s the point where you can prevent Tier 3 workload.

- Treat Tier 4 as a decision point. If you can’t get comfortable, you reduce risk (limits, cooling-off, or restrictions depending on your rules).

For teams designing roles and accountability, this pairs well with a clear compliance ownership model (see this internal guide on an iGaming compliance officer job description guide).

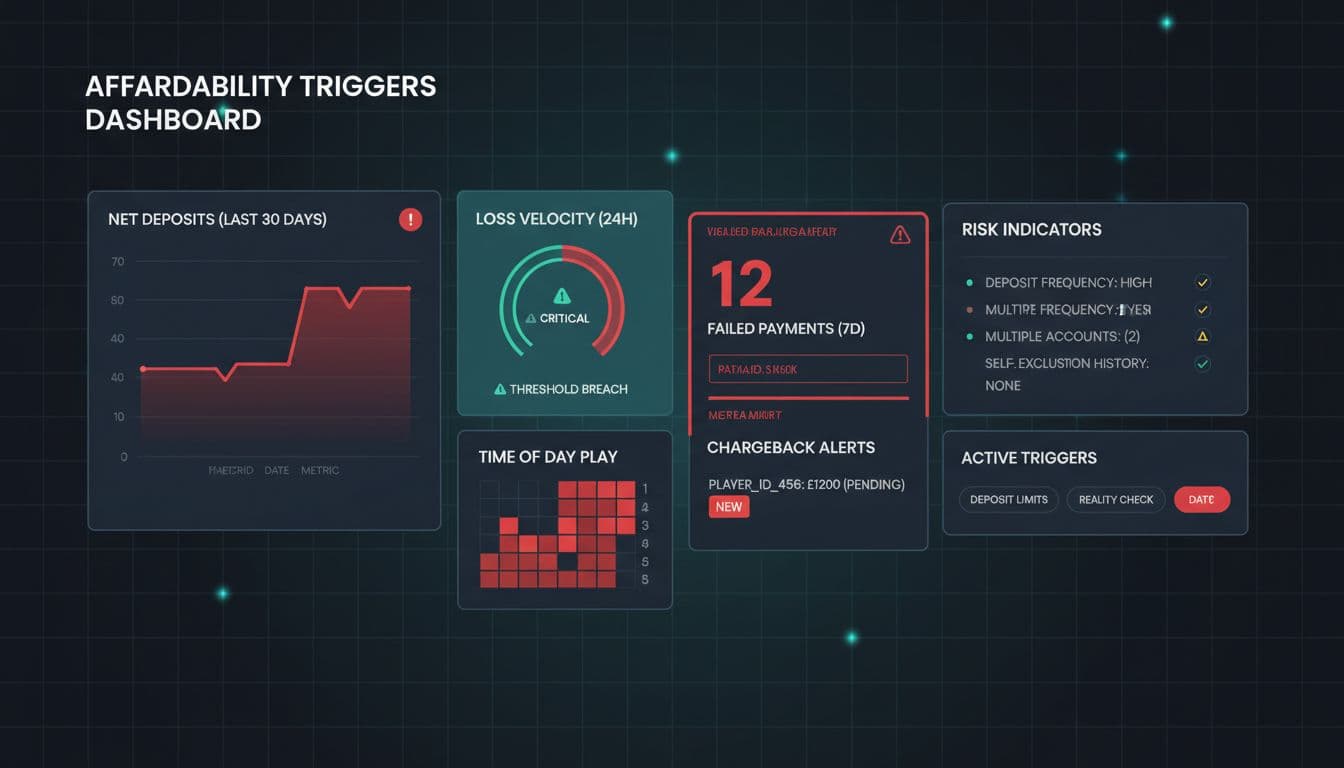

Set triggers that are measurable, auditable, and hard to argue with

“Player looked risky” isn’t a trigger. A trigger is a number, a pattern, or an event you can show in a report.

Strong trigger categories for small operators

Net deposits over a short window: One of the cleanest signals because it’s measurable and comparable.

Loss velocity: Rapid losses in hours or days (not just total loss).

Deposit stacking: Many deposits close together, especially after losses.

Payment distress: Failed deposits, reversed payments, chargebacks, or unusual card behavior.

Time and intensity: Very long sessions, repeated late-night play, or sudden increases in active days.

How to convert triggers into escalation rules

Keep it predictable. A workable pattern looks like this:

Tier trigger: When the player crosses Threshold A, they move from Tier 1 to Tier 2.

Tier timer: If activity stays high for X days, escalate even if there’s no single spike.

Stacking rule: Any 2 red flags within 30 days triggers a review.

Payment override: Certain payment events force escalation regardless of spend.

Document your “why” for each trigger, and review monthly. If Tier 3 is overloaded, Tier 2 outreach and limits are probably too weak.

Acceptable proof: what to request (and what to avoid)

Think of affordability proof like verifying a refund claim. You don’t need their entire life story, but you do need enough to make a fair decision.

A useful distinction is source of funds (where the gambling money comes from) versus source of wealth (how the person became wealthy). For context, ACGCS provides a solid overview of source of funds vs source of wealth in iGaming.

Commonly accepted evidence (keep the list short)

Payslip or salary statement: Best for employed players.

Bank statement excerpts (redacted): Show income and major outgoings without oversharing.

Benefits or pension letter: Useful for fixed-income players.

Tax documents: Helpful for self-employed players (request only what you need).

Open banking consent (where permitted): Can reduce manual checks, but be clear on scope.

What to avoid requesting (or request only in edge cases)

Full bank statements for long periods, unrelated documents, or vague “send anything” requests. Those create privacy concerns, complaints, and inconsistent decisions.

Also, align affordability workflows with your payment security posture. If you’re processing card payments, tighten your broader compliance stack as well (internal reference: PCI compliance requirements for Stripe payments).

Sample player messages you can copy (polite, clear, and action-focused)

Your messages should sound like customer support, not an interrogation. Short. Specific. Respectful. Always explain what happens next.

1) Tier 2 light-touch nudge (no documents yet)

Hi [Name], quick check in. We’ve noticed your recent deposits have increased.

To help you stay in control, we can help you set deposit or loss limits in your account.

If you’d like, reply with a rough monthly budget you’re comfortable with for play, and we’ll help you set it up.

2) Tier 3 affordability request (document options + deadline)

Hi [Name], thanks for playing with us. Your recent activity has reached a level where we need to complete an affordability check before allowing further increases.

Please send one of the following within 72 hours:

- A recent payslip, or

- A bank statement excerpt showing income (you may redact unrelated transactions), or

- A benefits or pension letter

If we don’t receive this in time, we may apply temporary limits to your account until the review is complete.

3) Tier 4 enhanced review (pause, explain, give path forward)

Hi [Name]. We need to complete an enhanced affordability review due to recent payment and spend risk indicators on your account.

To continue, please provide:

- Proof of income (payslip, tax document, or benefits letter), and

- A bank statement excerpt showing the source of recent gambling funds (redactions are ok)

While we review this, we’ve applied a temporary restriction to prevent further deposits. We’ll update you within 2 business days once we’ve assessed the information.

4) Player refuses to provide proof (calm, no debate)

Hi [Name]. We understand you may not want to share documents.

Because we can’t complete the required check, we’ll keep your account on restricted limits for now.

You can still withdraw available funds. If you change your mind, reply to this message and we’ll restart the review.

Keep it workable: a small-operator checklist

A tight affordability program is mostly process, not headcount:

One owner: Assign a named person (or role) for final tier decisions.

One playbook: Same triggers, same proof list, same outcomes.

One audit trail: Log trigger fired, message sent, evidence received, and decision made.

One review rhythm: Monthly tuning, quarterly deeper review.

Conclusion

Small operators don’t win by doing more checks, they win by doing consistent checks. A tiered model, clear triggers, and a short list of acceptable proof makes iGaming affordability checks easier to run, easier to defend, and less frustrating for players.

If you had to improve just one thing this month, would it be better triggers, better messaging, or faster reviews? Pick one, document it, and ship the change.

Adeyemi Adetilewa leads the editorial direction at IdeasPlusBusiness.com. He has driven over 10M+ content views through strategic content marketing, with work trusted and published by platforms including HackerNoon, HuffPost, Addicted2Success, and others.