Selling iGaming compliance SaaS into casinos and sportsbooks isn’t like selling a marketing tool. It’s closer to selling a fire alarm system: nobody wants extra noise, but everyone cares when something goes wrong.

Your buyers are measured on what they prevent, not what they ship. Regulators, banking partners, and platform providers all sit behind them like referees with whistles.

This go-to-market plan is for founders and growth teams building RegTech or compliance SaaS for iGaming, especially if you need a clear ICP, strong proof points, and a deal process that survives security review and procurement.

Why RegTech GTM in iGaming is harder than it looks

iGaming companies don’t just “try” compliance tooling. They adopt it the way airlines adopt safety procedures, slowly, with receipts, and with a lot of stakeholders.

By late 2025, regulators in several markets have tightened expectations around instant age and ID checks, stronger AML monitoring, and more robust responsible gaming controls. That trend changes how operators buy software: they favor tools that show auditability, control, and predictable operations.

Here’s the catch: even when compliance leads the purchase, engineering and security can stop it. So your GTM has to win two fights at once: the business case and the risk case.

Your ICP: the buyer isn’t always the customer (and the blocker isn’t always the skeptic)

A useful ICP for iGaming isn’t “operators over X revenue.” It’s a set of conditions that predict urgency, budget, and implementability.

ICP segmentation that actually predicts deals

Operator type

- Tier-1 and Tier-2 operators (sportsbook, casino): biggest budgets, longest cycles, strictest security.

- Platform/PAM providers and aggregators: fewer accounts, but platform wins can pull multiple operators with them (big multiplier).

- Payments and risk teams (PSPs, payment orchestration): strong need for AML and fraud controls, but they’ll demand deep data and clear decisioning.

A good reality check is to scan what platforms treat as “approved partners.” For example, platform ecosystems like the Playtech SaaS partners directory show how seriously integration and vendor credibility are taken.

Regulatory footprint

- UK and EU-licensed: mature compliance teams, heavy focus on audit trails and responsible gaming.

- US state-by-state: complex rules, lots of vendor onboarding, higher legal involvement.

- Fast-growing markets (for example, Brazil’s newer regulated setup): urgent timelines and implementation pressure, but often less standardization.

Stack maturity

- Already using vendors for KYC, fraud, AML, and reporting.

- Has a data warehouse or event pipeline you can plug into.

- Has an internal compliance operations team that feels the manual workload.

A quick ICP scorecard (use it in targeting)

| ICP signal | What to look for | Why it matters |

|---|---|---|

| Recent regulatory action or policy change | New affordability checks, sign-up verification, marketing rules | Creates deadline pressure |

| Multi-jurisdiction licensing | UK plus EU, US, or LatAm | More complexity, more budget |

| Manual review backlog | “We can’t keep up” in AML or RG workflows | Clear time savings story |

| High-risk payments mix | Crypto exposure, high chargeback markets, VIP programs | Stronger risk controls needed |

Buying committee map (plan for this early)

Expect these roles to show up:

- Compliance lead, MLRO, risk, fraud

- Product and engineering

- InfoSec (security review)

- Legal and procurement

- CFO or finance partner (for pricing sign-off)

If your sales motion only speaks to compliance, the deal will stall the moment a security questionnaire lands.

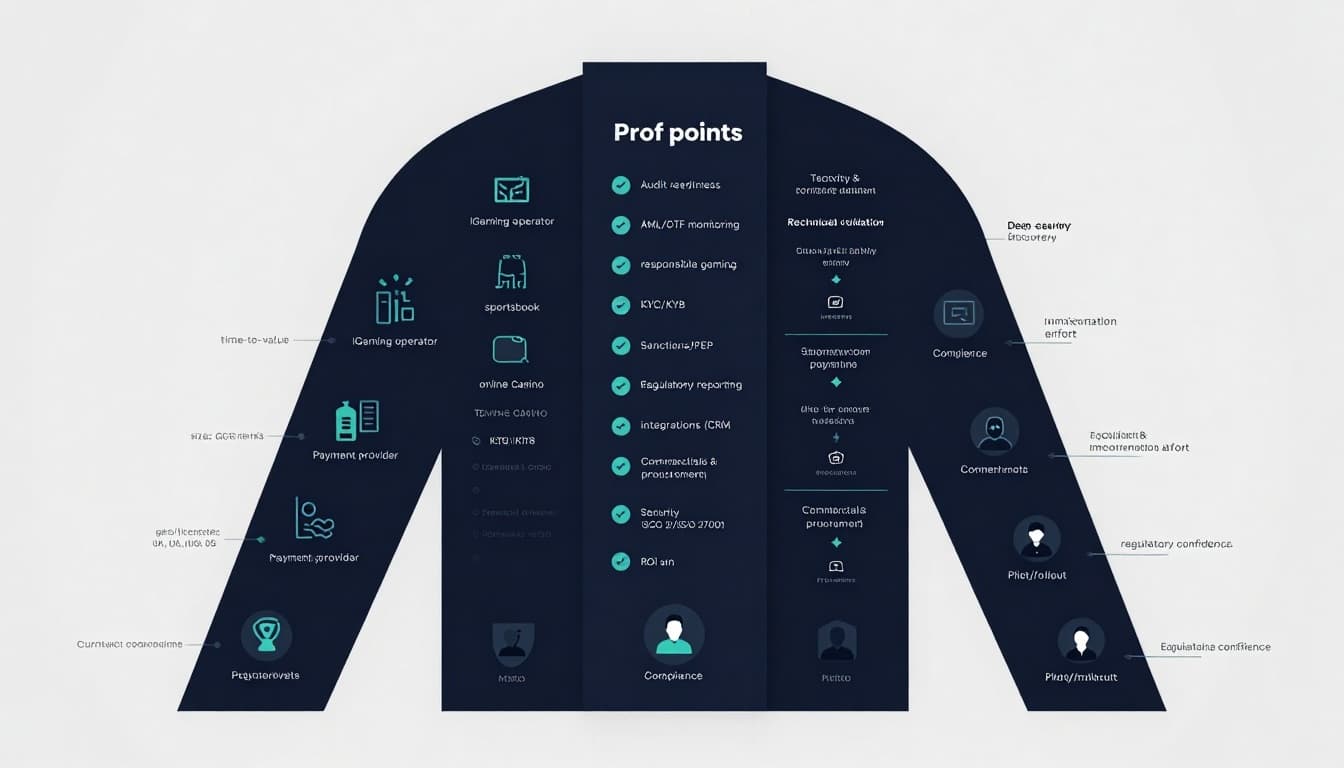

Proof points that close iGaming deals (and the ones that don’t)

In iGaming, “AI-driven compliance” isn’t a proof point. It’s a claim. Your job is to show evidence that survives scrutiny.

Proof points that move deals forward

Audit-ready outputs

- Clear decision logs (who, what, when, why).

- Exportable reports for regulators and banking partners.

- Explainable rules and thresholds (even if you use ML internally).

Coverage that matches iGaming reality

- KYC and age verification flows at sign-up (not “within 24 hours”).

- AML monitoring aligned to deposits, withdrawals, and bonus abuse patterns.

- Responsible gaming controls that fit player protection policies.

Integration proof

- A working integration path (API docs, webhooks, event schemas).

- References to common tooling patterns (CRM, data warehouse, payments).

- A sandbox or demo environment using realistic iGaming events.

Security and trust

- SOC 2 or ISO 27001 helps, but even without it you can show strong controls: encryption, access logging, retention policies, and clear sub-processor lists.

Operators already buy vendors focused on fraud and AML signals, such as SEON’s fraud prevention and AML tooling. Use that reality to your advantage: position your product as a system of record and control layer, not “another alert feed.”

Your “proof pack” (make this a single folder)

Keep it simple:

- 1-page security overview (hosting, encryption, access, logging)

- Sample audit trail and export

- Integration guide (30-day plan)

- Short case story (even if it’s a pilot), with outcomes framed as fewer manual reviews, faster escalations, cleaner reporting

Messaging that works: sell risk reduction like a seatbelt, not a rocket

Good iGaming messaging reads like a calm incident report, not a pitch deck.

A practical messaging formula:

- Problem: “Manual reviews and unclear logs create exposure during audits.”

- Impact: “Teams lose time, miss patterns, and can’t show consistent decisions.”

- Outcome: “A single control layer that records decisions, routes reviews, and produces audit-ready outputs.”

If your product touches marketing or affiliate compliance, show you understand that problem too. Tools like GiG Comply exist because operators get fined for what partners publish, not just for what the operator posts.

Deal stages for iGaming compliance SaaS (with exit criteria)

Treat your pipeline like a relay race. Each stage hands the baton to a new stakeholder group, and you need a clean handoff.

| Stage | Primary goal | Typical stakeholders | Exit criteria |

|---|---|---|---|

| Targeting | Identify accounts with urgency | Sales, compliance champion | Qualified trigger and clear use case |

| Discovery | Confirm pain, scope, success metrics | Compliance, MLRO, risk | Written success criteria and data needs |

| Technical validation | Prove integration and data fit | Engineering, product, data | Approved integration plan and timeline |

| Security and compliance review | Pass vendor risk checks | InfoSec, legal, privacy | Completed security review and DPA path |

| Commercials and procurement | Agree pricing and terms | Procurement, finance, legal | Order form/MSA ready for signature |

| Pilot and rollout | Deliver measurable outcomes | Compliance ops, engineering | Pilot results and rollout decision |

One common stall point is security review. Prepare for it before your first demo, not after. Another is “false positives” risk. If your tool creates extra manual work, you’ll lose political support fast.

Pricing and packaging: keep it tied to risk and workload

Compliance buyers hate pricing models that punish growth. They also hate models that feel open-ended.

Common packaging patterns that work:

- Base platform fee + usage tier (checks, events, or monitored accounts)

- Per brand, per jurisdiction (aligns to licensing reality)

- Operational module pricing (AML monitoring, RG controls, reporting)

Offer a pilot with a defined scope and an agreed measurement plan. Don’t sell “access.” Sell a clear result, like “reduce manual review time for these workflows” or “standardize audit exports across these jurisdictions.”

If you support advisory services or compliance program design, you can reference specialist firms like BetComply as an example of how operators often combine software with expertise, especially during new market launches.

Distribution: where pipeline comes from in iGaming RegTech

You don’t need ten channels. You need two that compound.

Strong options:

- Platform partnerships and marketplaces: integrations drive credibility and inbound.

- Account-based outreach: target by licensing footprint, market entry plans, and compliance hiring.

- Compliance-led content: short, practical guides on new verification expectations, audit prep checklists, and operational playbooks.

- Ecosystem referrals: KYC, fraud, and payments vendors often share customers. Build co-selling paths where it makes sense, including with vendors focused on gaming and gambling compliance such as Complytek’s gaming and gambling compliance solutions.

Conclusion: build a GTM motion that survives scrutiny

A go-to-market plan for iGaming compliance SaaS works when you treat trust as the product. Define an ICP that predicts urgency and implementability, build a proof pack that answers security and audit questions, and run a deal process with clear exit criteria at every stage.

If you want the simplest next step, write a one-page ICP scorecard and a one-page proof pack, then test them on 15 target accounts. The market will tell you fast what’s missing, and your pipeline will stop feeling like guesswork.

Adeyemi Adetilewa leads the editorial direction at IdeasPlusBusiness.com. He has driven over 10M+ content views through strategic content marketing, with work trusted and published by platforms including HackerNoon, HuffPost, Addicted2Success, and others.