Good accountants are important for any business. They are responsible for maintaining the financial records of a company, which includes recording and reporting all transactions, as well as preparing financial statements and tax returns.

The accountant is an important part of any business because they keep track of the money coming in and going out. They also work with bankers to make sure that the business has access to funds when needed.

A good accountant can help you run your business more smoothly by making sure that you have enough money in the bank to cover expenses, helping you plan for future expenses, and making sure that your company complies with IRS regulations.

Having a good accountant is important

If you want to save money, then having a good accountant is important. A good accountant can save you money by helping you reduce your business tax liability and by finding ways to help you be more efficient with your financial resources.

Mike Savage New Canaan identified this need for small businesses. It is worth reading more about Mike Savage from New Canaan, CT especially if you are also interested in muscle cars. Here are nine ways that a good accountant can help save the small business owner money.

1. Reduce Your Business Tax Liability

A good accountant will help you reduce your tax liability by finding deductions that will lower the amount of taxes that your company has to pay.

If you have a business, you may need a business tax ID number. This number is necessary for all companies that pay taxes in the US. If your company does not have this number, then you will need to apply for one from the IRS. The IRS has a special website where small businesses can apply for their numbers.

To save money on taxes paid, it is a good idea to familiarize yourself with the tax laws so that you know which deductions will help lower your tax liability.

For example, if your company has some type of advertising expense, such as signage throughout the building or stationery, then these costs can be deducted from your taxable income and help lower your federal tax liability. This can save you money especially if your taxes are high.

2. Help You Manage Your Money Better

A good accountant will help you manage your funds better. This will reduce the amount of money that you lose as a result of making financial mistakes.

For example, if your account is overdrawn and your bank charges penalty fees, then you will pay more money in overdraft fees than the total amount of what you were trying to withdraw in the first place. If this occurs frequently, then it can be quite costly for your company and should be avoided by keeping track of spending properly.

A good accountant will increase the amount of money that your company has in the bank by helping you manage your funds properly.

For example, if your company is about to spend more money than it has available in the bank, then a good accountant will alert you to this before any payments are made. In this way, you can avoid overdraft fees and still ensure that all payments are made on time.

3. Help You Schedule Business Expenses

A good accountant can help you schedule your business expenses better. If you have a large number of bills for monthly payments or for one specific item, then it is important to have your bills ready in advance to avoid the mounting costs that these amounts can cause.

For example, if you have a $50 monthly water bill and it is scheduled each month, then you will spend $600 each year to pay your water bill and not realize that you could be paying more than this amount each month if there were other expenses such as utility charges and interest on the loan.

4. Help You Avoid Bad Business Partners

A good accountant will help you avoid bad business partners. This is extremely important if you choose to hire an associate to help run your business.

If the person you hire has a history of not paying bills and not completing projects, then it can be devastating for your company’s long-term viability. A good accountant will help you screen potential employees so that you do not get involved with those who have bad money management skills or those who are not reliable.

Going into business with the wrong person can spell disaster for a small business, especially if the wrong person is not earning money in a timely fashion for your business. If you are aware of these problems before they occur, then you can avoid getting involved with a bad associate and save yourself from the financial problems that can arise in such situations.

5. Help You Get the Financing You Need

A good accountant will help you get the financing that you need for your business. This will save you money by getting a business loan from a bank at an interest rate that is less than the interest rate you would pay if you went to a personal loan company.

Personal loans usually have higher rates than business loans and are not as cost-effective for your company’s budget.

Failure to get financing can mean missing out on a business opportunity that is profitable for your company. If your business does not get the loan that it needs to conduct its operations, then it will never be able to develop a presence in the marketplace and may miss out on a great opportunity to increase its profits.

6. Save You Money on Taxes

A good accountant can help you save money on taxes. This is because a professional accountant knows which tax deductions and credits are available for use by small businesses which will lower your tax liability.

For example, if your company does not own its own buildings, the real estate property taxes that are paid will be deductible on your federal tax return. This can lower the amount of taxes that you owe and save you money.

Failure to submit your return to the IRS on time could result in a fine. This can be costly and could leave you owing more than the amount of taxes that you originally owed.

For example, if the due date for your tax return is April 15th and it is not submitted to the IRS by that deadline then you will be hit with penalty fees that will raise the original tax liability even higher than before.

7. Be Confident in Doing Business with Others

When you have a good accountant working with you, it will make it easier for you to be confident in doing business with others because you can trust that your financial documents are accurate and consistent with IRS regulations.

This shows that you are not trying to keep any money hidden from the IRS and will help build your reputation and increase the amount of business that you get.

An example of this is having a company that contracts with another company to paint the interior of their building. If there is any additional money paid, such as for materials or supplies, then this amount must be included on the contract and will be reported as income on the painting company’s federal tax return.

The expense of all other items must be accounted for through receipts or invoices so that all of your income will be reported correctly on your return and any excess tax liability can be avoided.

8. Help You Locate Business Information

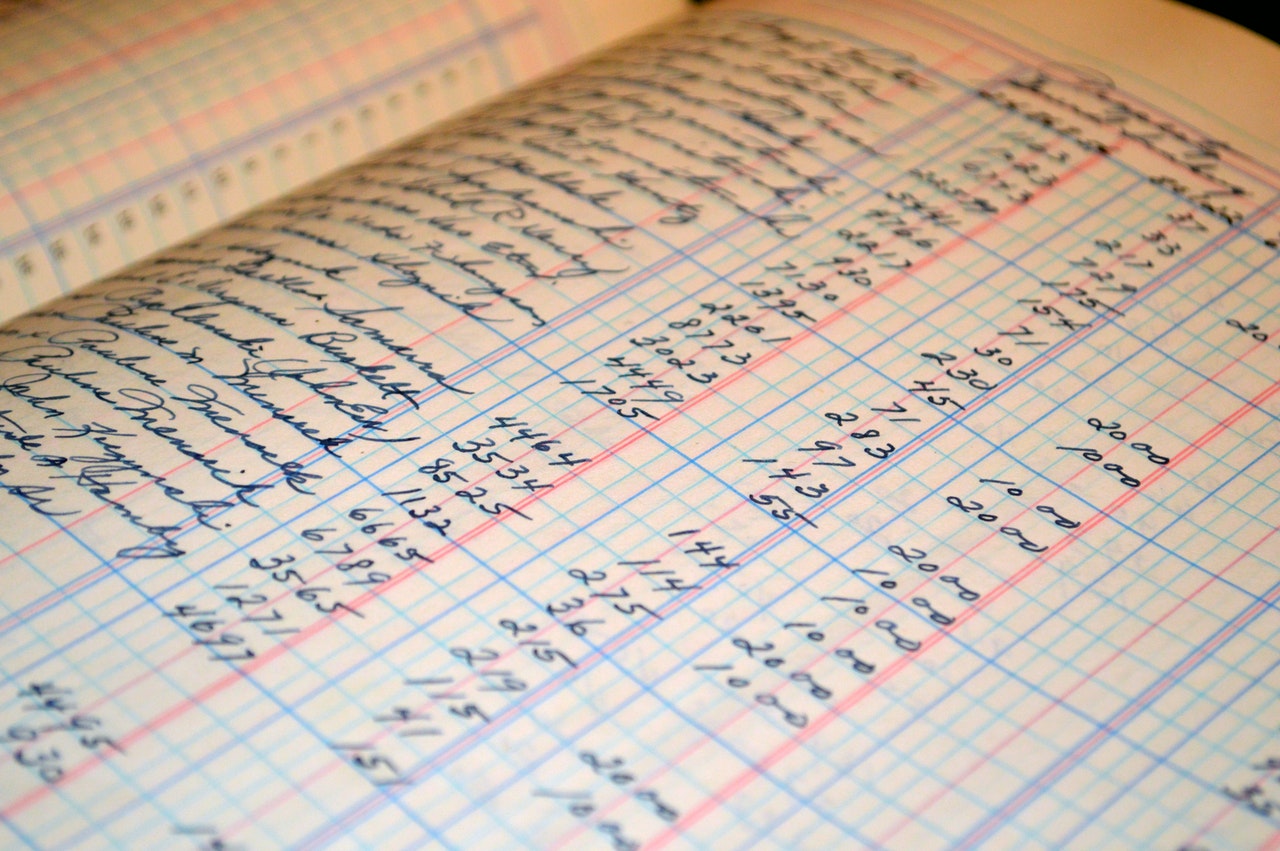

A good accountant will help you locate vital information about your company so that it is easy for you to be aware of all of your financial accounts and the transactions that are occurring within those accounts.

For example, if you own a business that sells products to other companies and then receive payments for these products, it is important to know exactly how much money you have in your accounts so that you can avoid overdraft fees.

Otherwise, if your business is not monitoring its cash flow properly and has a large amount of money in its accounts, then you may be hit with overdraft fees that will eat away at the profit margin of your business. Knowing how much money you have available in your accounts will help you to avoid these excessive fees and keep more money in your pockets.

9. Keep Track of Your Assets

A good accountant will help keep track of your assets with a financial tracking system that assists in identifying trends in your financial situation so that you can take preventative measures where necessary and be prepared for a decrease in future income or unexpected expenses.

This will help keep your company running smoothly and ensure that you have avoided making bad financial decisions such as failing to pay bills on time and missing out on valuable deductions.

What qualities make a good accountant?

A good accountant can help you keep your company up to date with any necessary IRS requirements and will help you get your business off the ground so that you can start making money. Failure to have a good accountant working for your company could seriously affect the growth of your business and the amount of money that it brings in.

You should take the time to educate yourself on what a good accountant should do before you make the decision to hire one. This will keep your company out of financial trouble and ensure that you have a business that is being operated correctly rather than one that will struggle after only a few months.

Here are some ways a good accountant can help you save money as a business owner:

- Reduce your business tax liability.

- Help you manage your money better.

- Help you schedule business expenses.

- Help you avoid bad business partners.

- Help you get the financing you need.

- Save you money on taxes.

- Be confident in doing business with others.

- Help you locate business information.

- Keep track of your assets.

I am Adeyemi Adetilewa, an SEO Specialist helping online businesses grow through content creation and proven SEO strategies. Proficient in WordPress CMS, Technical Site Audits, Search Engine Optimization, Keyword Research, and Technical Writing (Portfolio).

I help brands share unique and impactful stories through the use of public relations, advertising, and online marketing. My work has been featured in the Huffington Post, Thrive Global, Addicted2Success, Hackernoon, The Good Men Project, and other publications.