Watching good users fail onboarding feels like a smoke alarm that won’t stop chirping. You know there’s real danger out there, but the noise is coming from the wrong place.

KYC false declines happen when legitimate customers get rejected by identity checks because something in the flow, data, or decision logic breaks down. The result is predictable: higher abandonment, more support tickets, lower activation, and a compliance team that still doesn’t feel safer.

This guide breaks down the KYC fail reasons that trigger false declines, then shares practical, low-regret fixes you can ship without opening the door to fraud.

What “false decline” really means in KYC (and why it’s expensive)

A false decline is not the same as “the customer didn’t finish.” It’s when your system actively blocks or fails a real person who could have passed with clearer instructions, better capture, smarter matching, or the right fallback.

It’s expensive because it hits growth twice: you lose the customer now, and you train marketing to bring in more people who will also bounce at the same broken step. Over time, teams respond by loosening checks blindly, which is how risk creeps in.

The better approach is to reduce false declines with precision, not softness.

KYC fail reasons that cause false declines (the usual suspects)

Most KYC failures cluster around a few patterns: capture problems, mismatches, over-strict rules, and weak fallback paths. Here’s a quick map you can use in triage.

| KYC fail reason | What it looks like in the funnel | Why does it cause false declines | What to fix first |

|---|---|---|---|

| Blurry or cropped ID images | Drop after document upload | OCR can’t extract fields, and authenticity checks fail | Guided capture, instant feedback, auto-crop |

| Glare, shadows, low light | High “doc unreadable” rate | Systems treat poor images like tampering | On-screen lighting tips, frame assist |

| Name variations (diacritics, middle names) | “Name mismatch” errors | Matching rules are too rigid | Fuzzy matching, alias support |

| Address formatting differences | The address fails even when real | Postal formats vary by country and user habits | Standardization, suggestions, and allow manual review |

| Outdated document templates | Legit IDs flagged | Vendor model not trained on new versions | Update templates, vendor refresh cadence |

| Device and network anomalies | Mobile users fail more | VPNs, roaming, and device signals trip rules | Risk-based handling, step-up, not hard fail |

| Selfie issues (pose, camera focus) | Liveness fails on good users | Poor UX guidance or hard thresholds | Better coaching, retake loops, accessibility modes |

| Sanctions/PEP “close match” noise | Spike in manual reviews | Overblocking on weak matches | Tune thresholds, add secondary identifiers |

| Manual review inconsistency | The same case gets different outcomes | Reviewer drift and unclear SOPs | Playbooks, QA sampling, decision logging |

| UX friction (too many fields) | Abandonment before upload | Users make errors, then fail verification | Shorter forms, progressive disclosure |

If you want the risk math behind this tradeoff, the false rejection vs false acceptance framing is explained well in this overview of false acceptance rate vs false rejection rate.

Practical business ideas to reduce KYC drop-off (without lowering standards)

These “business ideas” are really product and ops plays you can implement fast. Each one aims to keep your risk bar where it is, while removing failure points that trip real customers.

1. Ship a “retake loop” that doesn’t feel like punishment

Summary: Let users retry selfies and documents with calm guidance.

How to start: Add instant “why it failed” feedback, then a one-tap retake.

Tools: Identity vendor SDKs plus product analytics, like the approach discussed in reducing KYC abandonment.

Example: “Too much glare, tilt your ID away from the light,” beats “Upload failed.”

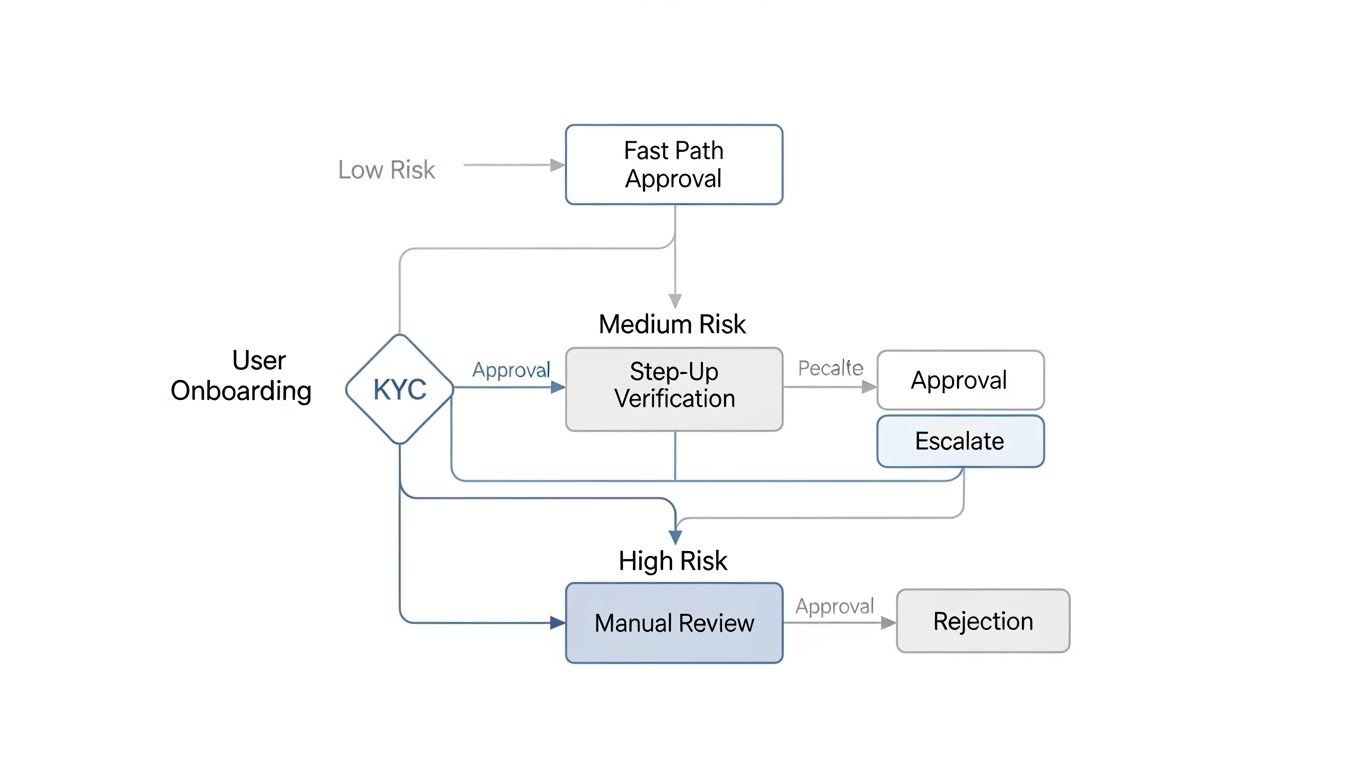

2. Use risk-based step-up instead of hard fails

Summary: When a signal looks odd, request one extra proof rather than declining.

Why it’s unique: You preserve fraud controls while saving good users with explainable edge cases.

Who it’s for: Fintech, marketplaces, and any app with global traffic.

Example: VPN detected, allow verification but require liveness plus a second doc on first withdrawal.

3. Replace exact-match rules with “human name logic.”

Summary: Real names are messy; systems shouldn’t be.

How to start: Support common variations (middle initials, hyphens, accents), and compare using multiple fields.

Example: “José A. García” should not fail “Jose Garcia” unless other risk flags exist.

4. Add address standardization before you compare

Summary: Standardize input, then match.

Steps: Auto-suggest addresses, normalize abbreviations, and store both raw and standardized values.

Who it’s for: Services that rely on proof-of-address, shipping, or regional compliance checks.

Example: “Apt” vs “Unit” becomes a non-issue.

5. Prefill what you already know, then ask for confirmation

Summary: Typing creates errors, confirmation removes them.

How to start: Prefill name, email, phone, and any trusted CRM data; ask users to confirm or edit.

Example: A returning user sees their legal name prefilled, fixes one letter, and passes.

6. Create a “document quality score” before submission

Summary: Don’t wait for the backend to reject a bad photo.

Steps: Check blur, glare, and edge detection on-device; block submission until the image is readable.

Tools: Many AI-KYC vendors support this, and trends in AI-driven verification are discussed in how AI KYC is changing identity verification.

Example: The capture screen says “Move closer” before the upload.

7. Tune sanctions screening to reduce close-match overblocking

Summary: Screening is necessary, but noisy matching burns good users.

How to start: Add second identifiers (DOB, country, document number), then route “possible matches” to review instead of declining.

Example: Common-name matches get reviewed, not blocked.

8. Standardize manual review with short, strict playbooks

Summary: Reviewers need rules they can follow at speed.

Steps: Define pass/fail reasons, add examples, and run weekly QA on a random sample.

Who it’s for: Teams seeing inconsistent decisions or long queues.

Example: Two reviewers reach the same outcome because they’re judging the same checklist.

9. Build a “save and resume” KYC flow across devices

Summary: Users often start on mobile and finish on desktop (or the reverse).

How to start: Persist progress, email a secure resume link, and keep the state for a defined window.

Example: A user starts selfie capture on a phone, and uploads a PDF utility bill later on a laptop.

10. Instrument the funnel like revenue depends on it (because it does)

Summary: If you can’t see where it fails, you can’t fix it.

Steps: Track attempt rate, fail reason codes, retry success, time-to-verify, and review queue time.

Reference: Conversion and false decline tradeoffs are a common theme in fraud programs, including Experian’s notes on reducing false declines while maintaining protection.

Example: If “doc glare” drives 40 percent of failures, your next sprint is obvious.

How to reduce KYC drop-off without raising risk (a simple decision checklist)

Use this quick filter before you change anything:

- Does this change reduce user error or reduce scrutiny? Aim for user error first.

- Can we step up instead of step down? Ask for extra proof only on the risky slice.

- Are we improving signal quality? Better images and cleaner data improve both conversion and detection.

- Do we have a safe fallback? If automation fails, route to review with clear context.

- Can we measure impact in a week? Pick changes with fast feedback loops.

Fewer false declines, stronger onboarding, same risk bar

KYC doesn’t have to feel like a locked door with a faulty key reader. When you focus on capture quality, matching logic, risk-based step-up, and clear fallbacks, KYC false declines drop fast, and your fraud posture stays intact.

Pick one failure cluster, fix it end-to-end, then measure retries and completion. The best onboarding teams don’t “make KYC easier,” they make it harder for bad actors and simpler for everyone else.

Adeyemi Adetilewa leads the editorial direction at IdeasPlusBusiness.com. He has driven over 10M+ content views through strategic content marketing, with work trusted and published by platforms including HackerNoon, HuffPost, Addicted2Success, and others.