If you run a small iGaming brand, you probably feel squeezed between aggressive growth targets and strict AML rules. You know you need transaction monitoring rules that iGaming regulators will accept, but you do not have a big compliance team or an enterprise tool.

The good news: you do not need a massive system to get started. You need a focused ruleset that fits your risk, your product, and your resources. This guide walks you through a simple, practical rules framework you can set up and tune over time.

Why Simple Transaction Monitoring Rules Matter for Small iGaming Brands

Regulators expect you to know your customers and spot suspicious patterns. Fraudsters expect you not to.

Industry research shared by SEON on transaction monitoring in iGaming suggests that up to 5 percent of global digital transactions can be suspicious. For a small operator, even a fraction of that can hurt cash flow, chargebacks, and license prospects.

Strict rules help you:

- Flag obvious fraud and bonus abuse early.

- Detect possible money laundering patterns.

- Show regulators you use a risk-based, documented process.

Most importantly, simple rules keep your team focused on the alerts that really matter, instead of drowning in noise.

Start With A Clear Risk Picture

Before writing a single rule, get clear on what “risky” looks like for your product.

Think in three buckets:

- Player risk profile

- New vs returning players

- Jurisdictions you accept

- Payment methods you allow

- Transaction patterns

- Deposit and withdrawal frequency

- Average bet size by game type

- Typical session length for casual players

- Regulatory expectations

- AML requirements and SAR thresholds in your countries

- Responsible gambling triggers (loss limits, self-exclusion, etc.)

A good starting point is the risk-based view described in this AML compliance guide. You do not have to copy every control, but you should know which risks map to your own business.

Write this all down. Your “risk picture” becomes the backbone for your first set of rules.

Core Transaction Monitoring Rules iGaming Startups Should Use

Now you can translate that risk picture into a small, tight ruleset. Think of each rule as a smoke alarm. On its own, it does not prove a fire, but it tells you where to look.

1. High-velocity deposit rule

Goal: Catch rapid funding that does not match normal play.

Example rule:

- If a player makes 5 or more deposits within 30 minutes,

- And the total amount is above your “high” threshold,

- Then create a medium-risk alert.

Tune the number of deposits and the threshold to your product. A high-roller casino will differ from a casual sportsbook.

2. Deposit-to-withdrawal flip rule

Goal: Spot potential money laundering and chip dumping.

Example rule:

- If a player deposits more than X,

- Places minimal or no bets,

- Then withdraws 80 percent or more within 24 hours,

- Raise a high-risk alert.

This pattern often shows “funds in, funds out” behavior with no real gaming.

3. Sudden stake jump rule

Goal: Catch sharp changes in betting behavior.

Example rule:

- If the average bet size in the last 24 hours is more than 3 times the 7-day average,

- And the total wagered in 24 hours is above your risk cap,

- Create a medium-risk alert.

This can point to account takeover, collusion, or problem gambling.

4. Multi-account and device rule

Goal: Detect bonus abuse and fraud rings.

You do not need fancy device fingerprinting on day one, but you should track basic signals:

- Same device ID used for multiple accounts

- Same IP creating several accounts in a short time

- Same card or wallet funding different profiles

Trigger an alert when a combination crosses your comfort level.

5. Failed payment and KYC friction rule

Goal: Surface accounts trying to avoid checks.

Patterns to monitor:

- Several failed card attempts from one player

- Players who hit deposit thresholds that require KYC, then immediately stop using the account

- Players who refuse to upload documents but keep trying new payment methods

Set a rule that flags players with multiple KYC-related events plus financial activity.

6. Sanctions and high-risk country rule

Goal: Stay aligned with AML and sanctions rules.

Use a screening provider or a basic watchlist check. Then apply:

- Higher scrutiny on payments from high-risk countries

- Alerts for any match against sanctions or PEP lists

- Extra checks for cross-border gambling, where it may be restricted

The AML and sanctions compliance overview for iGaming is a useful reference when you map out these checks.

How To Implement And Tune Your Ruleset

You have the rules on paper. Now you need them running.

1. Start with your data

Confirm you can pull:

- Player ID and KYC status

- Transaction type, amount, payment method, and time

- Game activity (bets, wins, losses, session time)

If you use a cloud platform, the future of cloud security and compliance gives a broader view of how to keep these datasets safe while you centralize them.

2. Use a basic rules engine or vendor

On a tight budget, you can:

- Feed data into a database or warehouse

- Run scheduled queries that simulate rules

- Push alerts into a simple case queue or ticket tool

When you are ready for more, look at vendors that focus on transaction monitoring for iGaming firms. They let you configure thresholds, workflows, and alerts with less custom code.

3. Review, document, refine

For each alert:

- Tag it as true positive, false positive, or informational

- Note what you did and why

- Adjust thresholds where false positives are high

You will also need a clear process for when to file a Suspicious Activity Report. AML guides like this iGaming-focused overview can help you line up your triggers with regulatory expectations.

Common Pitfalls When Building Transaction Monitoring Rules

A small ruleset can still go wrong if you:

- Copy rules from big operators without scaling them to your risk and volume.

- Set thresholds too low, so your team spends all day clearing harmless alerts.

- Never retire rules, even when player behavior or regulation changes.

- Forget training, so frontline staff do not know how to read alerts or escalate.

Keep your ruleset lean. Add new rules only when they solve a clear problem.

Quick FAQ on Simple iGaming Transaction Monitoring

How many rules does a small iGaming operator really need?

Start with 5 to 10 well-defined rules that cover deposits, withdrawals, behavior spikes, multi-account activity, and sanctions risk. It is better to understand a small set deeply than to manage 50 rules nobody trusts.

How often should we review our rules?

Review at least quarterly, or after any big product change or regulatory update. Look at false-positive rates, new fraud patterns, and any feedback from regulators or banking partners.

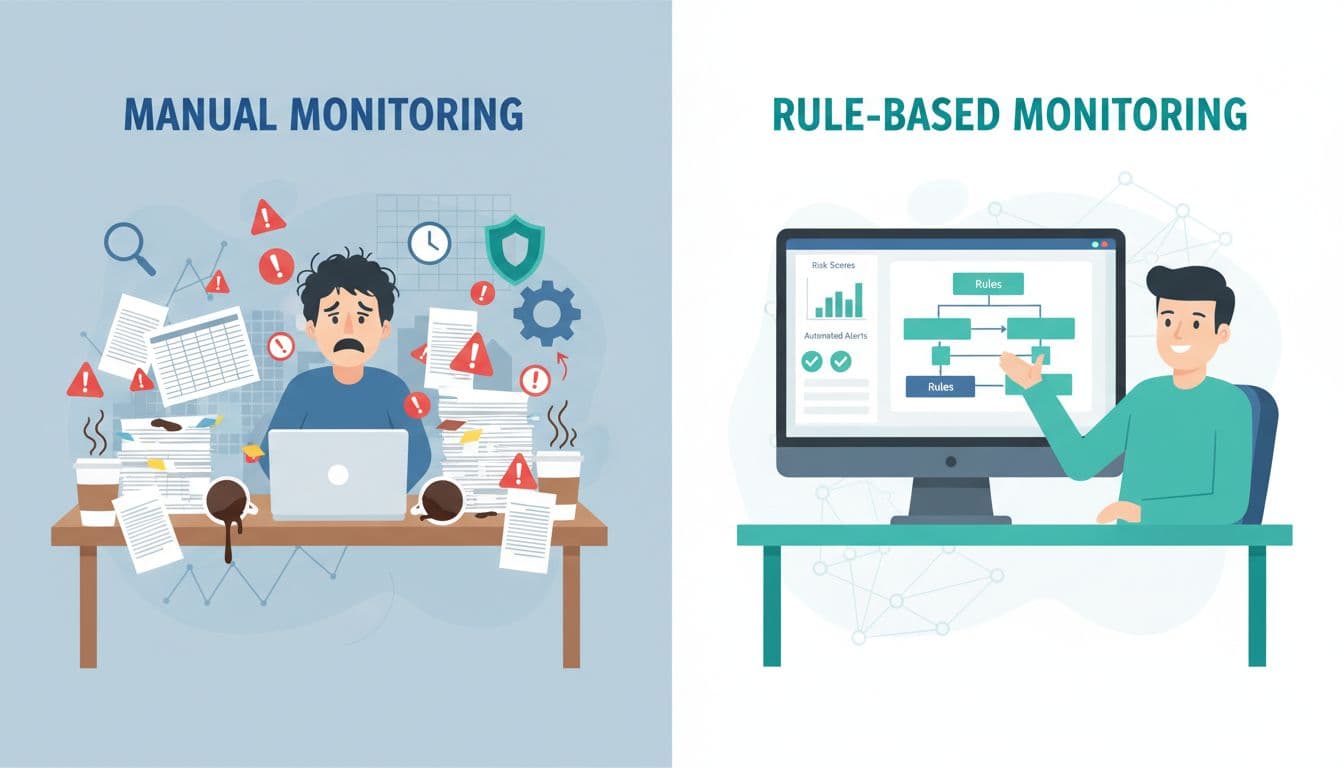

Can we rely only on manual reviews without rules?

Manual checks help, but they do not scale, and they miss subtle patterns. Even a simple rules engine gives you a consistent baseline and an audit trail of why alerts fired.

Bringing It All Together For Safer iGaming Growth

Strong transaction monitoring rules that iGaming teams use do not have to be complex or expensive. They have to be clear, tied to real risks, and reviewed often.

If you map your risks, start with a small core of smart rules, and keep tuning based on outcomes, you will protect your business, your players, and your license. The result is simple: fewer nasty surprises, more trust, and more room to grow.

Adeyemi Adetilewa leads the editorial direction at IdeasPlusBusiness.com. He has driven over 10M+ content views through strategic content marketing, with work trusted and published by platforms including HackerNoon, HuffPost, Addicted2Success, and others.