If you run an iGaming brand, you’re balancing two forces that don’t always get along: frictionless player growth and serious AML obligations. iGaming PEP screening sits right at that crossroads.

A politically exposed person (PEP) match doesn’t mean “bad player.” It means “higher risk, handle with care.” The trouble is the day-to-day reality: false positives, repeat checks, VIP pressure, and the one thing regulators always ask for, your decision trail.

This guide lays out a simple, practical workflow for when to screen, when to re-screen, and how to document decisions so you can move fast without getting sloppy.

What “PEP” really means in iGaming (and why it changes your workflow)

A PEP is someone with a prominent public role (and often their close associates or family) who may be at higher risk for bribery, corruption, or misuse of funds. That risk doesn’t come from the games. It comes from how money might enter, move through, and exit your platform.

The key point: PEPs aren’t automatically prohibited. Most compliance programs treat them as higher-risk customers who may require Enhanced Due Diligence (EDD), closer monitoring, and stronger record-keeping. If you want a plain-English refresher on definitions and best practices, Ondato’s overview of PEP screening in KYC is a helpful starting reference.

The simple iGaming PEP screening workflow (one page view)

Think of your workflow like airport security. Most passengers pass through quickly. A few get flagged, not because they’ve done something wrong, but because the system saw a risk signal. Your job is to respond consistently.

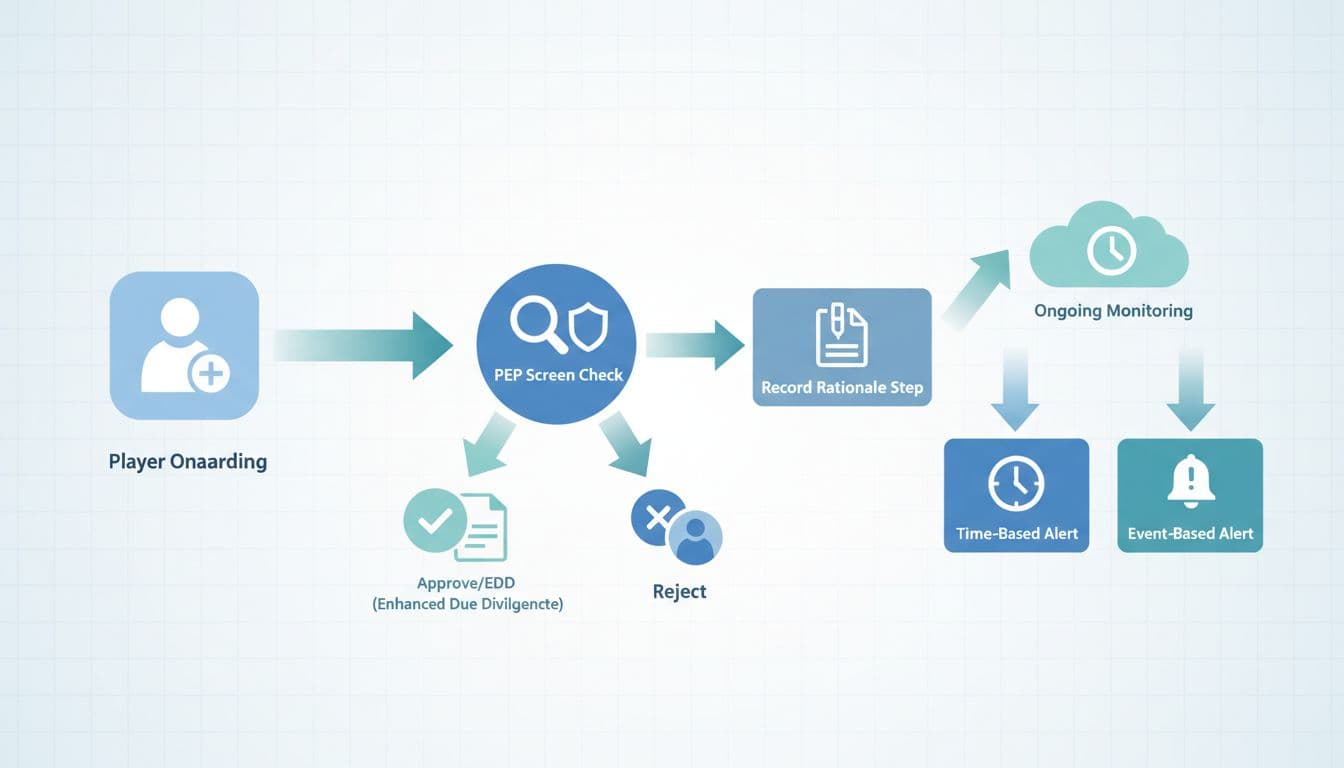

A workable end-to-end flow looks like this:

- Onboarding and identity collection (enough data to screen properly)

- PEP screen (plus sanctions, if your process combines them)

- Triage the result (no match, possible match, likely match)

- Decision (approve, approve with EDD, restrict/reject as your policy allows)

- Record the rationale (what you saw, what you did, who approved)

- Ongoing monitoring and re-screen triggers (time-based and event-based)

You don’t need a huge team to do this well. You need a repeatable routine.

When to screen players: the checkpoints that actually matter

Screening too early with weak data creates noise. Screening too late creates risk. The sweet spot is to screen when the player relationship becomes financially meaningful, and when the risk profile changes.

Here are the checkpoints most operators build around:

1) At account creation (or first meaningful verification step)

If you collect enough identifiers (full name, DOB, country, address), run the first PEP screen here. If your sign-up form is minimal, wait until ID verification so the screen is based on reliable data.

2) Before enabling withdrawals (a common control point)

Withdrawals are where AML exposure often becomes most sensitive. A pre-withdrawal “confirm status” check helps catch missed matches and recent list updates.

3) When a deposit, loss, or wagering threshold is reached

Many programs use thresholds to trigger stronger due diligence. The exact thresholds depend on your market and risk appetite, but the idea is consistent: as value increases, controls increase.

4) When the player becomes VIP (or requests higher limits)

VIP handling without stronger checks is like giving a bigger credit line without re-checking income. If the relationship is escalating, your screening should too.

5) When the player adds or changes key details

New payment method, address change, nationality update, name change, or an email/phone swap after long inactivity can all justify a re-check.

If you’re tightening your broader controls alongside PEP checks, pair this with your monitoring rules. This guide on simple transaction monitoring rules for small iGaming operators fits well with the same “do the basics consistently” approach.

When to re-screen: periodic cadence plus event-based triggers

Re-screening is where many teams get stuck. Do it too often and you drown in alerts. Don’t do it often enough and you miss changes (new appointments, new adverse media, list updates).

A practical approach is two layers:

- Periodic re-screening: run it on a schedule based on risk (high-risk more often, low-risk less often).

- Event-based re-screening: run it when something meaningful happens.

Here’s a simple trigger table you can adopt and tune:

| Trigger | Why it matters | What to do | What to record |

|---|---|---|---|

| Time-based review (by risk tier) | Lists and roles change | Re-screen and confirm status | Date, result, reviewer |

| Big deposit or withdrawal spike | Higher exposure | Re-screen, consider EDD | Linked transactions, notes |

| VIP upgrade or limit increase | Relationship is escalating | Re-screen, refresh risk rating | Risk tier change, approver |

| Key profile change (name, address, country) | Matching accuracy changes | Re-screen using updated data | Old vs new data, evidence |

| New payment method (especially higher-risk) | Adds laundering pathways | Re-screen and review source of funds | Payment details, rationale |

| Adverse media alert | Signals reputational or criminal risk | Review, decide EDD or restrict | Sources checked, outcome |

If you need a deeper explanation of how the screening process works in practice (including false positives and match logic), SmartSearch’s breakdown of how the PEP screening process works is a solid reference.

Triage and decisions: a simple way to handle matches without panic

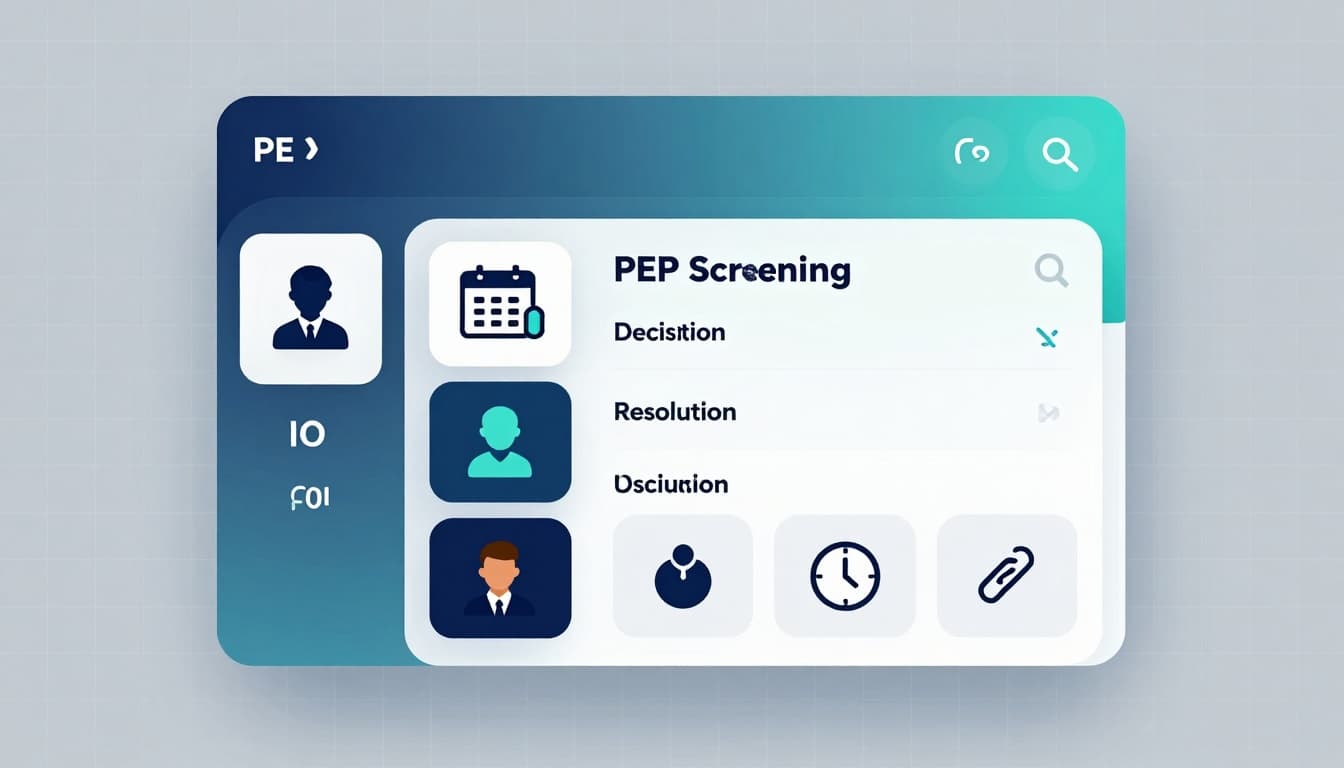

A PEP “hit” is usually one of three things:

Clear non-match: different DOB, different country, different person.

Possible match: partial overlap, needs manual review.

Likely match: strong identifiers align, or the provider confidence is high.

Your decision options should be written down in policy, then used consistently:

- Approve (document why it’s low risk, or clearly not a match)

- Approve with EDD (collect source of funds, check occupation, verify wealth claims if relevant)

- Restrict, pause, or reject (only if your policy and local rules allow it, and the rationale is clear)

A quick real-world scenario: a player registers as “M. Khan,” triggers a PEP match, and wants a fast withdrawal. Your analyst requests DOB confirmation and address proof, confirms it’s a different individual, clears as non-match, then re-screens at first large withdrawal anyway. The goal isn’t to block. The goal is to show your work.

Record-keeping: what regulators expect you to reproduce later

If screening is the lock, record-keeping is the security camera. Months later, nobody cares what you “remember.” They care what you can prove.

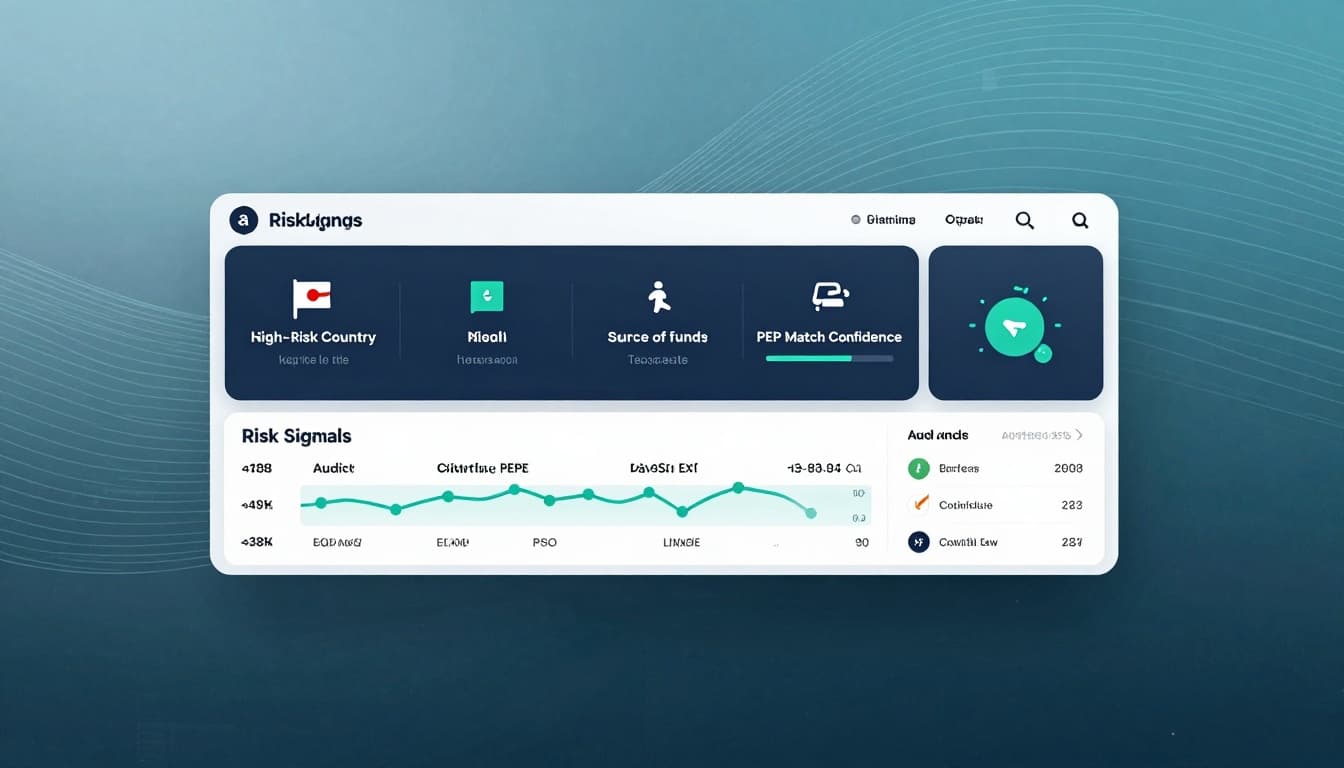

At minimum, each PEP screening alert should produce an audit-ready record with:

- Player identifiers used (name, DOB, country, address where available)

- Screening date/time, provider name, and lists checked (as applicable)

- Match details (matched profile, confidence score if provided, key overlaps)

- Triage outcome (non-match, possible match, confirmed PEP)

- Actions taken (EDD requested, limits applied, withdrawal held, account closed)

- Evidence reviewed (documents, source-of-funds notes, open-source checks)

- Decision maker and approver (with timestamps)

- Rationale in plain language (one tight paragraph beats five vague lines)

For broader context on AML controls and the importance of retaining compliance evidence, Dilisense provides a useful overview of AML and sanctions compliance in iGaming.

If you want to pressure-test your overall process (not just PEP checks), this guide on auditing iGaming KYC workflow for regulator readiness pairs well with the documentation standards above.

Keeping it simple with tools (without overbuying)

Most iGaming teams don’t fail because they lack software. They fail because the workflow isn’t consistent.

If you’re building a lean stack, prioritize:

Screening provider that supports PEP + sanctions + adverse media (where required), plus ongoing monitoring alerts.

Case management with an immutable audit log (who did what, and when).

A clear handoff to transaction monitoring so PEP status influences thresholds and alert severity.

Treat your tooling like a seatbelt. It helps, but it won’t fix reckless driving.

Conclusion: a workflow you can defend is a workflow you can scale

Good iGaming PEP screening isn’t about catching “bad” people. It’s about running a consistent, risk-based process you can explain under pressure. Screen at the right checkpoints, re-screen on schedule and on real triggers, and write down decisions like someone will read them a year from now.

If you’re building iGaming business ideas that rely on trust, payments, and long-term licenses, compliance isn’t a side task. It’s part of the product. Keep the workflow simple, keep the records clean, and your growth won’t come with ugly surprises later.

Adeyemi Adetilewa leads the editorial direction at IdeasPlusBusiness.com. He has driven over 10M+ content views through strategic content marketing, with work trusted and published by platforms including HackerNoon, HuffPost, Addicted2Success, and others.