If you treat igaming internal controls as a box-ticking task, your regulator will treat your business as a problem.

Regulators expect structured, living internal control documentation that matches how your platform really runs, not a generic PDF copied from someone else.

This guide walks you through what your internal controls template should contain, how to align it with current rules, and what regulators actually look for when they open your manual.

Why Regulators Care So Much About iGaming Internal Controls

iGaming sits at the crossroads of entertainment, finance, and consumer protection. That mix attracts money, risk, and attention from every regulator in sight.

By late 2025, most regulators will focus on a few common areas:

- Strong identity and age checks before a player can deposit

- Affordability and financial vulnerability checks for higher-risk players

- Real-time responsible gambling tools, like limits and self-exclusion

- Heavy anti-money laundering controls and monitoring

- Proven game fairness and technical standards

You can see this thinking in places like the Nevada Gaming Control Board’s internal control information or the U.S. federal minimum internal control standards for tribal gaming.

Your internal controls template is how you show that your platform, your people, and your systems line up with that rulebook.

Core Sections Your iGaming Internal Controls Template Must Cover

Think of your template as the operating manual for how your house stays clean, even when nobody is watching. These sections form the backbone.

1. Governance and the Control Environment

Regulators want to see who owns compliance, not just who writes reports.

Your template should spell out:

- Board or owner oversight of compliance

- Roles and responsibilities for compliance, risk, AML, and tech

- Escalation paths when something breaks or a risk is found

- A formal process for updating internal controls and getting approval

Many regulators publish minimum structure requirements. The Colorado Internal Control Minimum Procedures is a good example of how detailed they expect you to be.

2. KYC, AML, and Payments Controls

This is where your business looks very much like a fintech.

Your controls should cover:

- KYC checks before the first deposit, not later in the player’s life cycle

- Ongoing monitoring and enhanced checks for higher-risk players

- Source of funds and large transaction review rules

- Transaction monitoring scenarios and alert handling steps

- Clear separation of duties for payment approval and refunds

When you describe payment flows, link them to card data security as well. If you use third-party processors, your team should understand how platforms like Stripe handle PCI and card data. A good starting point is this Stripe PCI compliance overview, which shows how outsourced processing can reduce your own exposure.

3. Game Integrity and Technical Standards

If players or regulators suspect the games are rigged, everything else collapses.

Your template should explain:

- How your RNG and game engines are certified and by whom

- How do you control game configurations, payout tables, and odds

- How do you track software changes and releases into production

- How do you separate development, testing, and live environments

- How you handle incidents like game malfunctions or mispayments

The structure in the sample gaming internal control manual from North Dakota shows how to bring game operations, accounting, and tech into one control framework.

4. Responsible Gaming and Player Protection

This area has grown fast in 2024 and 2025. Many regulators now require:

- Deposit, loss, and time limits set by the player

- Mandatory breaks, session reminders, and reality checks

- Self-exclusion and cool-off tools, linked to any national database

- Real-time monitoring for risky behavior and outreach steps

- Blocked marketing to self-excluded or vulnerable players

Your template should describe the exact features you offer, how you flag risk, who reviews alerts, and what happens when a concern is raised. Think of it as a playbook for catching harm early, not a legal disclaimer.

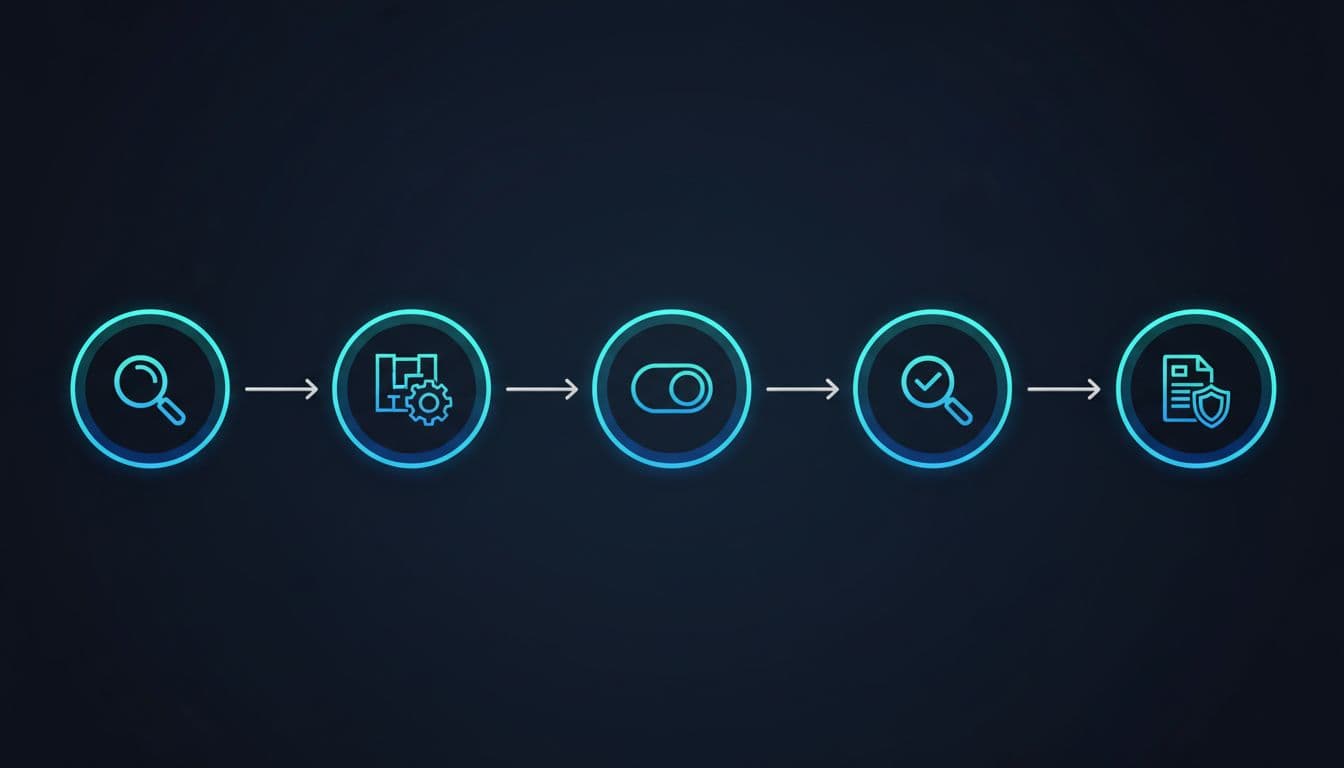

Turning Rules Into A Practical iGaming Internal Controls Template

Once you know what to cover, you need a clean, logical template structure. Many operators use a layout like this:

- Purpose and scope

- Definitions and abbreviations

- Governance and organization chart

- Licensing, key personnel, and vendor management

- Player lifecycle controls (onboarding, deposits, play, withdrawals)

- Game operations and technical controls

- AML and counter terror financing controls

- Responsible gaming and player protection

- Accounting, reconciliations, and reporting

- Incident management and change control

- Internal audit and testing

Using public models like the U.S. minimum internal control standards in 25 CFR Part 542 can help you benchmark your structure. Start with that framework, then adapt it to your tech stack, your markets, and your risk profile.

What Regulators Expect To See During Review

When a regulator picks up your manual, they look for a few things very fast.

1. Local rule alignment

They expect to see clear references to the specific laws, rules, and technical standards that apply in your markets.

2. Traceability to systems and reports

If you describe a control, they expect to find it in real screens, logs, or system configs, not just words on paper.

3. Evidence of testing

They want to see that you test your controls, fix gaps, and track follow-ups. The NIGC internal audit MICS compliance reporting guidelines show the kind of structured testing and reporting pattern they like.

4. Clear ownership

Every key control should have an owner by role, not “the company” or “the team”.

If your template tells this story clearly, the rest of the review goes a lot smoother.

Common Red Flags Inside Internal Control Manuals

Certain patterns raise questions right away:

- A manual that looks like a generic download with no local rules

- Controls that refer to reports or systems you no longer use

- No mention of affordability checks or modern responsible gaming tools

- No change log that shows when and why updates were made

- Vague statements like “staff will monitor activity” with no details

A good test: hand your template to a new manager. If they cannot explain your control flow after one read, your regulator will struggle too.

Keep Your Controls Alive With Testing And Monitoring

Your igaming internal controls template should describe not just what you do, but how you keep those controls working over time.

This usually includes:

- A risk assessment that you refresh at least yearly

- A simple internal audit plan focused on the highest risks

- Regular testing of KYC, AML, and game integrity controls

- Review of incident logs, complaints, and chargebacks

- Governance reviews where leaders sign off on changes

For startups and small operators, this does not need to be heavy. You can start with quarterly walk-throughs of a few core processes, document what you saw, note gaps, and track actions. Over time, this grows into a repeatable internal audit cycle that regulators trust.

Conclusion: Treat Your Template Like A Product, Not A PDF

Strong igaming internal controls are not a one-time license condition; they are an ongoing promise to your regulator and your players.

If your template maps to real systems, matches local rules, assigns clear owners, and includes a simple testing cycle, you are already ahead of many operators.

Treat the document like a product that you release, improve, and version, not a static file. Your future audits, your license, and your brand will all be safer for it.

Adeyemi Adetilewa leads the editorial direction at IdeasPlusBusiness.com. He has driven over 10M+ content views through strategic content marketing, with work trusted and published by platforms including HackerNoon, HuffPost, Addicted2Success, and others.