A distributed iGaming team can ship product updates in hours, onboard players around the clock, and hire specialists anywhere. Then compliance taps you on the shoulder and asks a simple question: “Can you prove you did the right thing, in the right market, at the right time?”

That’s what an iGaming compliance playbook is for. It’s not a policy folder nobody opens. It’s your operating manual for how remote people make regulated decisions, handle risk, and keep evidence audit-ready.

If you’re a founder testing iGaming business ideas, or you’re scaling an existing operator with remote staff, this guide shows how to build a practical playbook that survives time zones, turnover, and regulator scrutiny.

Start with scope, owners, and the “one source of truth”

Before you write anything, set three anchors:

Scope: Which products (casino, sports, lottery, affiliate), which brands, which jurisdictions, which vendors, and which team functions (support, payments, risk, marketing, dev, BI).

Owners: Name a playbook owner (usually Head of Compliance) plus backups. Remote teams change fast, the playbook can’t become orphaned.

One source of truth: Pick one controlled space for policies, SOPs, and evidence links. The fastest way to fail an audit is to have “final_v7_reallyfinal.pdf” scattered across DMs.

Jurisdiction and policy mapping (where teams usually break)

Compliance for a single market is hard. Multi-market operations with remote staff are harder because people default to what they know. Your playbook must make “which rule applies” obvious.

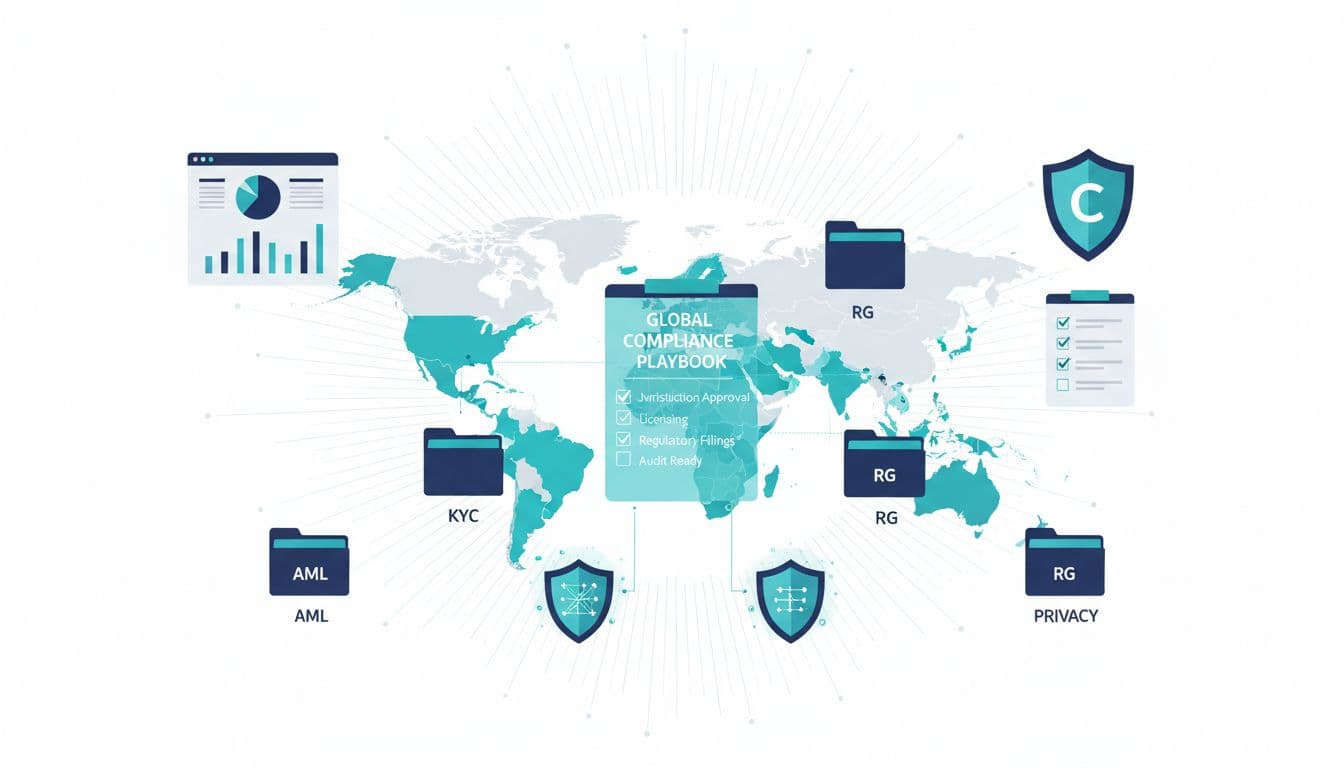

Jurisdiction & policy mapping for an iGaming compliance playbook

Build a simple jurisdiction matrix that answers, at minimum:

- What license covers the activity?

- Who the regulator is and what reporting is required

- AML and sanctions expectations

- KYC triggers (onboarding, deposit thresholds, source of funds)

- Responsible gambling (RG) rules, interventions, limits, self-exclusion

- Privacy and data residency requirements

Then tie each row to internal assets: the policy, the SOP, the form template, the ticket type, and the evidence location.

For KYC design, it helps to compare multiple approaches and risk points. This overview of KYC requirements and friction points in iGaming is a useful reference when you’re deciding what checks happen at signup versus later in the player journey.

Turn regulations into a control library people can follow

Remote teams don’t fail because they “don’t care.” They fail because decisions happen in Slack threads, calls, and quick fixes, and nobody knows what must be logged.

Create a control library with three fields anyone can understand:

Control: What must happen (example: “Sanctions screening runs at onboarding and before payouts”).

Trigger: When it must happen (example: “New account, change of address, payout request”).

Evidence: What proves it happened (example: “Screening result ID, timestamp, reviewer, case ticket link”).

Add a lightweight RACI so there’s no guessing.

| Playbook element | Responsible | Accountable | Evidence you keep |

|---|---|---|---|

| KYC decisioning rules | Compliance | MLRO/Head of Compliance | Versioned rules, approval ticket |

| RG interventions | Player Safety | Head of Operations | Intervention log, comms template used |

| Marketing approvals | Marketing | Compliance | Approved creatives, geo-target rules |

| Vendor onboarding | Procurement/Compliance | COO | Due diligence pack, contract, DPIA (if needed) |

When you publish controls, write them like checklists, not essays. If someone can’t follow it at 2:00 a.m. from another time zone, it’s not done yet.

For AML and KYC fundamentals in online gambling, this explainer on AML and KYC expectations for gambling operators can help validate your control coverage and common risk areas.

Design remote-first compliance workflows (tickets beat DMs)

If your compliance work happens in private messages, you don’t have a process. You have a memory test.

Your playbook should define a few standard workflows that every market uses, even if details differ by jurisdiction:

KYC and player risk workflow

- Intake (player action or automated trigger)

- Review steps (what checks, what data sources)

- Decision outcomes (approve, request info, restrict, close account)

- Escalation rules (EDD, PEP review, MLRO sign-off)

- Evidence captured automatically (IDs, screenshots, reason codes)

AML and sanctions workflow

Write down screening cadence, alert triage, and who can clear which alert types. For sanctions screening references and patterns, this guide on AML and sanctions compliance in iGaming is a helpful checklist companion when you’re documenting EDD and reporting triggers.

Responsible gambling workflow

Spell out how remote agents handle:

- Risk signals (spend spikes, time spent, repeated failed deposits)

- Interventions (messaging, limits, cool-off, self-exclusion support)

- Handoffs (support to player safety, player safety to compliance)

- Documentation (what to log, where, and within what time window)

Remote compliance operations (so approvals don’t bottleneck)

Remote teams move fast, but compliance can’t be a single person’s inbox. Add two safeguards:

Decision SLAs: Set response targets by risk tier (example: payouts flagged for sanctions screening get priority over low-risk document rechecks).

Coverage planning: Define “follow the sun” coverage for high-risk queues (KYC, payouts, fraud, RG escalations). If you can’t staff it, narrow markets or adjust product features until you can.

If you use time tracking for coverage and auditability of review work (not for surveillance), keep it transparent. A tool overview like this Time Doctor time tracking tool review can help you evaluate whether time logs fit your culture and privacy posture.

Choose a tool stack that preserves evidence (and integrates cleanly)

Most compliance gaps show up at the seams between tools: ID verification, payments, CRM, ticketing, analytics, and storage.

Pick tools with exportable logs and stable IDs, then connect them with clear integration rules. This SaaS integration best practices guide is a solid reference when you’re mapping what data flows where, and how to avoid messy duplicates and missing audit trails.

Here’s a practical way to think about your stack:

| Tool category | Primary job | What to verify |

|---|---|---|

| Ticketing/workflow | Case handling and approvals | Role-based access, immutable timestamps |

| IDV/KYC | Identity checks and document handling | Data retention options, regional coverage |

| Sanctions/PEP screening | Screening and alerting | List update frequency, evidence exports |

| GRC/wiki/docs | Policies, SOPs, versioning | Version control, access logs |

| Secure storage | Evidence retention | Encryption, retention policies, legal holds |

Keep privacy in view. Don’t store more personal data than you need, and don’t copy KYC files into random folders “for convenience.”

Build training that works across time zones and turnover

A playbook fails when it lives only in the compliance team’s head.

Make training part of the system:

- Role-based onboarding (support, payments, marketing, engineers)

- Short scenario drills (“Player requests payout after failed KYC,” “Affiliate campaign targets restricted geo”)

- Quarterly refreshers tied to real incidents and near misses

Keep sessions recorded and track completion. More important, track understanding. Quick quizzes and scenario reviews beat long slide decks.

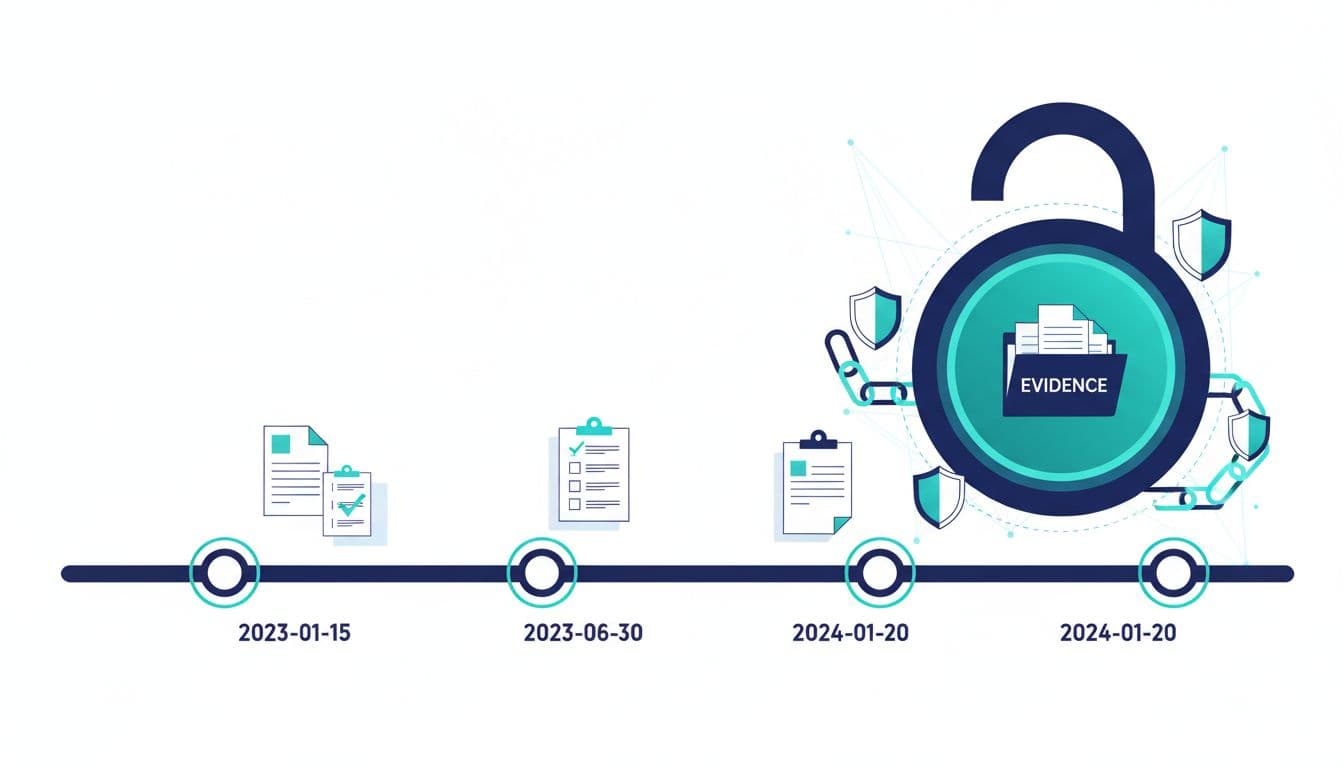

Make your evidence trail audit-ready (the quiet superpower)

Regulators rarely ask for your best intentions. They ask for proof.

Audit-ready evidence trail for an iGaming compliance playbook

Your playbook should specify:

- What evidence is captured automatically (system logs, timestamps, IDs)

- What evidence must be added manually (review notes, reason codes)

- Retention periods by evidence type and jurisdiction

- Who can export evidence, and how requests are tracked

When you document AML retention and reporting expectations, it can help to cross-check a reputable summary like Casino AML compliance guidance for 2025, then align it with your legal advice and license conditions.

Measure compliance operations like a business function

If you can’t measure it, you can’t staff it or improve it.

Track a small set of metrics:

- KYC queue aging by risk tier

- False-positive rate for screening alerts

- RG intervention outcomes (contact rate, limit adoption)

- Policy exception count, and time to close exceptions

- Audit request response time

If you already run dashboards for growth, mirror that discipline for compliance ops. A quick primer on key SaaS metrics for business growth can inspire how you set targets, define leading indicators, and keep reporting consistent.

Conclusion: a playbook is how remote teams stay consistent

Remote iGaming teams don’t need more documents. They need clear rules, clean workflows, and evidence that appears automatically when auditors ask. A strong iGaming compliance playbook turns regulation into daily habits, even when your team spans five time zones and ships weekly.

Start small: map jurisdictions, define controls, standardize tickets, and lock down evidence retention. Then review it monthly, like you would any system that protects revenue and keeps the business open.

Adeyemi Adetilewa leads the editorial direction at IdeasPlusBusiness.com. He has driven over 10M+ content views through strategic content marketing, with work trusted and published by platforms including HackerNoon, HuffPost, Addicted2Success, and others.