When iGaming age verification fails, it rarely fails in a clean, tidy way. A real customer gets blocked, support gets flooded, and a regulator might later ask, “Why did you let this account play at all?”

Think of age checks like the door staff at a venue. Most guests walk in with no fuss. But if the scanner glitches or the ID photo is worn, you need a calm, consistent backup plan that keeps the venue safe without turning away everyone.

This post breaks down why age checks fail, how to run a manual review fallback workflow, what “good evidence” looks like, and how to set safe account limits while you sort it out.

Why iGaming age verification fails (and why it’s not always fraud)

Most failures come from “messy reality,” not bad intent. Phones have cracked cameras, names don’t match perfectly across documents, and address formats vary by country.

Common failure causes include:

- Image quality issues: glare, blur, low light, cropped corners.

- Data mismatches: nicknames vs legal names, new addresses, missing middle names.

- Document problems: expired IDs, unsupported document types, damaged cards.

- Device and network risk signals: VPN use, emulator flags, unusual device fingerprints.

- Vendor gaps: coverage differences by geography or document type.

Here’s the catch: if your system treats every failure as “deny,” you lose good players. If it treats failures as “approve,” you risk underage access and compliance action. The middle path is a controlled manual review, with tight limits.

A practical way to think about it is this table:

| Failure type | What it usually means | Best next step |

|---|---|---|

| Poor photo or glare | Customer error, rushed upload | Prompt retry with guidance |

| Data mismatch (name/address) | Legit changes, formatting | Ask for supporting evidence |

| Vendor can’t verify | Coverage or doc type mismatch | Route to manual review |

| High-risk device signals | Higher fraud risk | Manual review plus stricter limits |

| Suspected underage | High regulatory risk | Block play pending decision |

For an overview of compliance best practices that tie KYC and age checks together, see this operator-focused guide from Fluid: https://fluidpayments.io/articles/kyc-and-age-verification-in-igaming-compliance-best-practices-for-operators

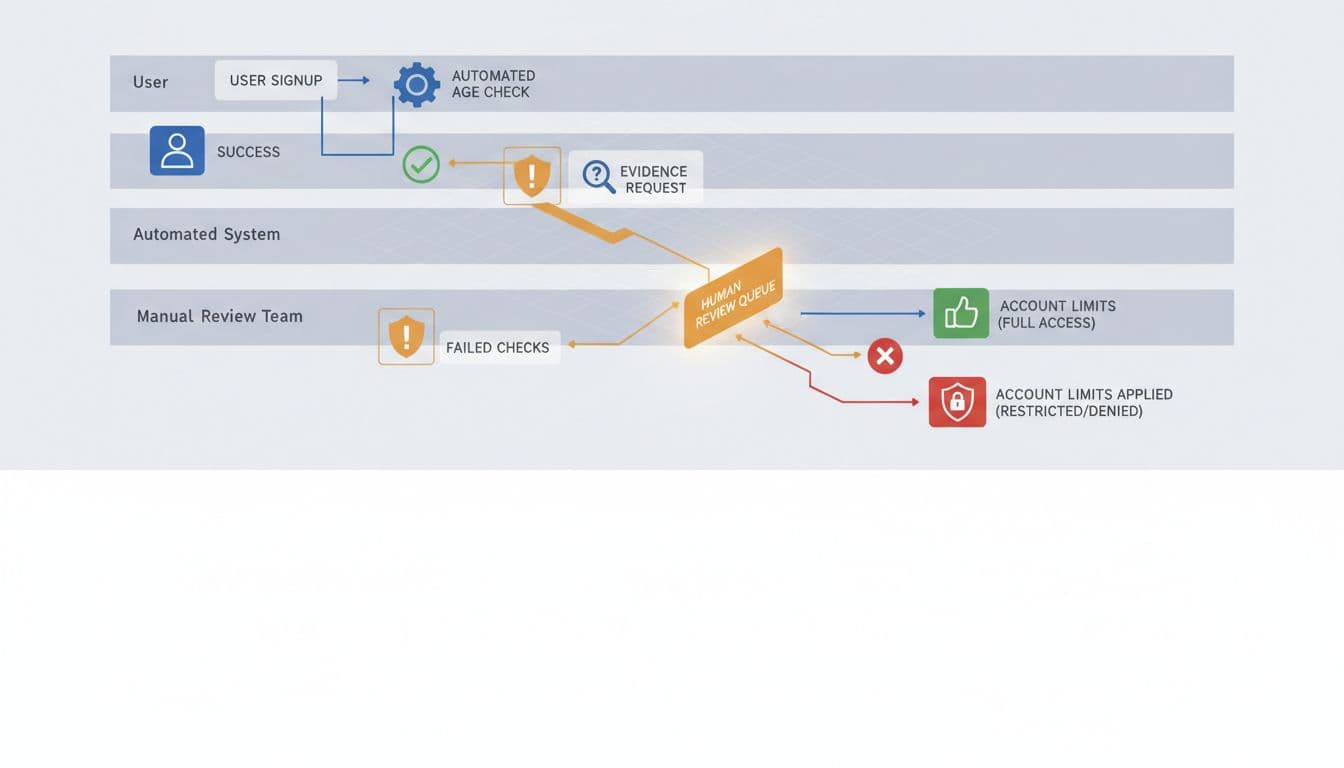

A fallback workflow for manual review that won’t break operations

A manual review process isn’t “support handling it.” It’s a defined workflow with owners, timers, evidence rules, and an audit trail. In January 2026, regulators and payment partners expect consistency, not heroics.

Step 1: Triage the failure (don’t send everything to humans)

Start with a quick decision split:

- Retry allowed: image quality issues, OCR read errors, minor formatting.

- Manual review required: vendor “inconclusive,” high-risk signals, mismatches.

- Hard stop: strong indicators of underage or fake document patterns.

Triage should happen in seconds, not minutes.

Step 2: Ask for evidence using a short, specific request

Long document lists create abandonment. Ask only for what resolves the specific failure reason.

Good patterns:

- If DOB is unreadable, request a clearer photo of the ID.

- If address mismatches, request a proof-of-address document (where allowed).

- If identity is unclear, request a selfie or liveness step (depending on your policy and market).

If you’re optimizing conversion while staying compliant, this discussion on reducing friction is useful: https://didit.me/blog/age-verification-gambling-online/

Step 3: Put the case in a review queue with SLAs

Your queue needs:

- Priority rules (for example, suspected underage at the top).

- Time targets (internal SLAs, not promises you can’t meet).

- Load balancing so one analyst doesn’t become the bottleneck.

Step 4: Make a decision, then lock it in

Every manual decision should produce:

- Outcome (approved, rejected, needs more info).

- Reason codes (standardized).

- Reviewer ID and timestamp.

- Evidence list (what was viewed and stored).

- Any account restrictions applied.

If you want a broader operator checklist for audits and regulator readiness, this internal resource helps frame the bigger picture: iGaming KYC workflow audit guide

Evidence and audit trail: what to store so you can prove your process

If a regulator asks, “How did you verify this customer’s age?” you need more than a screenshot. You need a retraceable story: what happened, when it happened, who decided, and what evidence supported it.

A solid evidence pack usually includes:

- User-provided inputs: documents submitted, dates, and submission method.

- System outputs: vendor responses, confidence levels (if provided), error codes.

- Case notes: reviewer rationale tied to a reason code.

- Communications log: what you asked the customer for, and what you told them.

- Change log: any overrides, limit changes, and who approved them.

Storage and retention rules differ by jurisdiction, so align with your licensing requirements and privacy obligations. For a regulatory lens on age controls and testing, the UK Gambling Commission’s guidance is a helpful reference point: https://gamblingcommission.gov.uk/guidance/guidance-to-licensing-authorities/part-36-test-purchasing-and-age-verification

One more practical point: evidence should be easy to retrieve. If it takes three hours to assemble a customer file, it’s too slow for real incidents and too fragile for inspections.

Safe account limits while verification is pending (make risk expensive, not impossible)

Manual review takes time. That doesn’t mean the account should have full access in the meantime.

A good approach is “limited access until proven.” It’s like letting someone into the lobby, not the VIP floor.

What “safe limits” can include

Choose controls that reduce harm and reduce regulatory exposure:

- Deposit caps: small initial cap until age is confirmed.

- Bet and loss caps: prevent high-speed spend.

- Withdrawal restrictions: pause withdrawals until verification completes (where allowed).

- Product restrictions: block higher-risk products or features.

- Promo restrictions: no bonuses or VIP treatment until verified.

- Time limits: session caps to slow down risky behavior.

To keep it clear for teams, define unlock rules up front.

| Control | Example “pending verification” setting | Unlock trigger |

|---|---|---|

| Deposits | Low daily cap | Age verified |

| Stakes | Low max stake | Age verified + risk review passed |

| Withdrawals | Held for review | Verification complete |

| Bonuses | Disabled | Verification complete |

Numbers should be set by your risk team based on market rules and your player base. The key is consistency.

Risk scoring can also help decide who gets the tightest limits. If you’re already using analytics in your betting stack, the ideas in Machine learning impact on sports betting odds can spark how you think about signals and models (even if the use case is different).

Make the workflow measurable (or it will drift)

A manual process without metrics turns into habit, and habit turns into exceptions.

Track a small set of operational signals:

- Failure rate by reason (image quality, mismatch, vendor outage).

- Time to decision (p50 and p95).

- Rework rate (cases that needed more evidence).

- Override rate (and which reviewers apply them).

- Underage attempts detected (trend, not bragging).

Then run a simple monthly review: what failed, what changed, and what you fixed.

Conclusion

Age checks will fail sometimes. What matters is what your team does next, and whether you can prove it later. A clear fallback workflow, tight evidence handling, and temporary safe limits protect your license and your players without burning conversion.

If you’re tightening controls this quarter, start by documenting your manual review steps and setting iGaming age verification limits that are easy to explain to a regulator and easy for your team to follow.

Adeyemi Adetilewa leads the editorial direction at IdeasPlusBusiness.com. He has driven over 10M+ content views through strategic content marketing, with work trusted and published by platforms including HackerNoon, HuffPost, Addicted2Success, and others.