A chargeback can feel like a surprise bill you didn’t agree to pay. The bank pulls the funds back, adds a fee, and asks you to prove you did everything right, fast.

That’s why chargeback reason codes matter. They aren’t just labels. They tell you what the cardholder’s bank believes went wrong, what evidence you’re allowed to send, and how tight your deadline is.

If you sell online, run subscriptions, or process card payments in person, this guide will help you read common codes, choose the right response, and avoid wasting time on the wrong documents.

What chargeback reason codes are (and why they change your response)

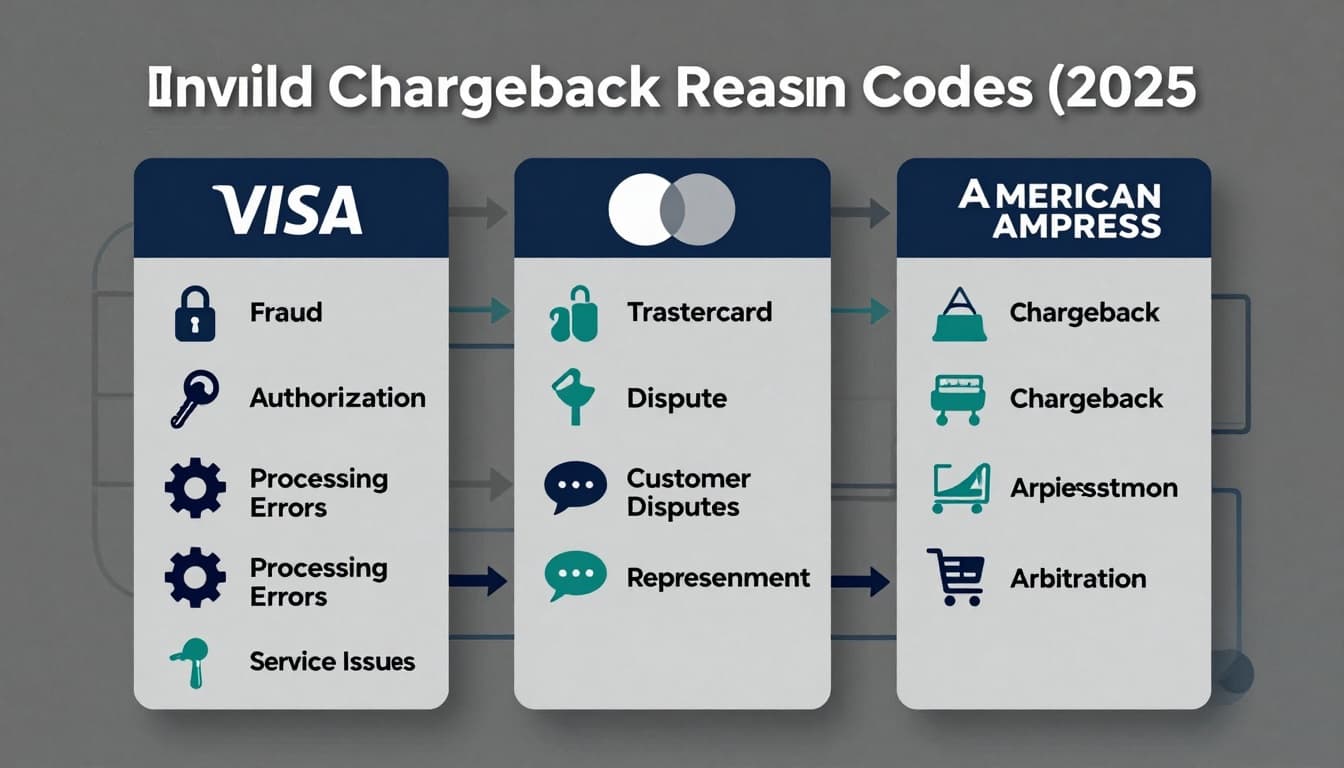

A chargeback reason code is the issuer’s shorthand for the dispute type. Each card network has its own set of codes and rules, so the same real-world complaint can look different on Visa vs Mastercard vs American Express.

The code impacts three practical things:

- Your odds of winning: Some codes are winnable with clean proof, others are uphill battles.

- What “compelling evidence” means: A “not received” dispute needs delivery proof, not a great-looking invoice.

- Your timeline: Miss the representment window and you lose by default, even if you’re right.

For a deeper directory-style reference, the definitions in Checkout.com’s explanation of chargeback reason codes can help you cross-check terminology.

How Visa, Mastercard, and American Express format reason codes (Dec 2025)

As of December 2025, the structures most merchants see are:

- Visa: Two digits, then a decimal (example: 10.4). The first part signals the category, such as fraud or disputes.

- Mastercard: Four digits often starting with 48 (example: 4837).

- American Express: A letter plus numbers (example: A02, C31), where the letter hints at the dispute family (authorization, card member dispute, processing, fraud).

Codes don’t tell the whole story, but they tell you where to start. For network-by-network listings, a well-organized option is the Chargeflow reason codes directory.

The 5 buckets most codes fall into (and what each bucket needs)

Think of reason codes like medical triage. Same patient, different treatment based on the first diagnosis.

- Fraud: The cardholder says they didn’t authorize the payment.

- Authorization: You didn’t get approval, or you settled outside the approval rules.

- Processing errors: Duplicate, wrong amount, wrong transaction details.

- Customer disputes (service/product): Not received, not as described, cancelled, returned, recurring issues.

- No-show/cancel scenarios: Common in travel, events, reservations, and some deposits.

When you match the code to the bucket, you stop guessing and start assembling the right proof.

10 common chargeback reason codes (what they mean and how to answer)

Below are high-frequency examples across the major networks. Use them as a response cheat sheet, then confirm the exact evidence rules for your processor and card brand.

Visa codes

Visa 10.4 (Other Fraud, card-absent environment)

Meaning: The issuer treats it as unauthorized online or keyed fraud.

How it affects your response: You typically need strong identity and usage proof (AVS match alone rarely wins).

Best evidence: Order details, device/IP data, account login history, proof of delivery or service use.

Visa 13.1 (Merchandise/Services Not Received)

Meaning: Cardholder claims the item never arrived or the service wasn’t delivered.

How it affects your response: Shipping proof is the center of the case, not your product description.

Best evidence: Carrier tracking showing delivered date and location, delivery signature (if available), customer communications.

Visa 13.3 (Not as Described or Defective)

Meaning: Cardholder says the product wasn’t what they bought, or it arrived defective.

How it affects your response: You must show you delivered what was promised and handled complaints fairly.

Best evidence: Product page at time of sale, photos, support tickets, return policy acceptance, replacement/refund offer.

Visa 12.2 (Incorrect Transaction Code)

Meaning: Transaction was processed with the wrong type or data (a processing classification issue).

How it affects your response: This is often fixable if you can prove correct processing or correct the records.

Best evidence: Authorization logs, transaction receipt, gateway/acquirer settlement details.

Mastercard codes

Mastercard 4837 (No Cardholder Authorization)

Meaning: Issuer believes the cardholder didn’t approve the purchase.

How it affects your response: Treat it like fraud and focus on authentication and consistent customer behavior.

Best evidence: 3DS results (if used), AVS/CVV results, device fingerprinting, proof of prior legitimate transactions.

Mastercard 4855 (Goods or Services Not Provided)

Meaning: Customer claims you didn’t deliver what they paid for.

How it affects your response: You need fulfillment proof and a timeline that matches your stated delivery terms.

Best evidence: Tracking, appointment logs, digital service access logs, customer updates about delays.

Mastercard 4863 (Cardholder Does Not Recognize, potential fraud)

Meaning: “I don’t recognize this charge” that can be true fraud or friendly fraud.

How it affects your response: Your billing descriptor and customer communication matter more than you think.

Best evidence: Descriptor match, invoice, email confirmation, customer account profile, delivery or usage proof.

American Express codes

Amex A02 (No Valid Authorization)

Meaning: Authorization wasn’t obtained, was invalid, or doesn’t support the charge.

How it affects your response: Amex will expect clean authorization records and correct timing.

Best evidence: Authorization approval code, AVS/CVV results (if applicable), transaction date and settle date.

Amex C08 (Goods/Services Not Received)

Meaning: Item or service wasn’t received.

How it affects your response: Similar to Visa 13.1, you win with delivery proof or service completion records.

Best evidence: Carrier delivery confirmation, service completion logs, customer messages acknowledging delivery.

Amex C31 (Goods/Services Not as Described)

Meaning: Customer says the product or service didn’t match the description.

How it affects your response: Your listing accuracy and your support trail decide the outcome.

Best evidence: Listing content at purchase time, proof of value delivered, return/refund attempt, written policy acceptance.

For broader explanations and prevention angles, Sift’s guide to chargeback reason codes is useful, especially if fraud pressure is rising.

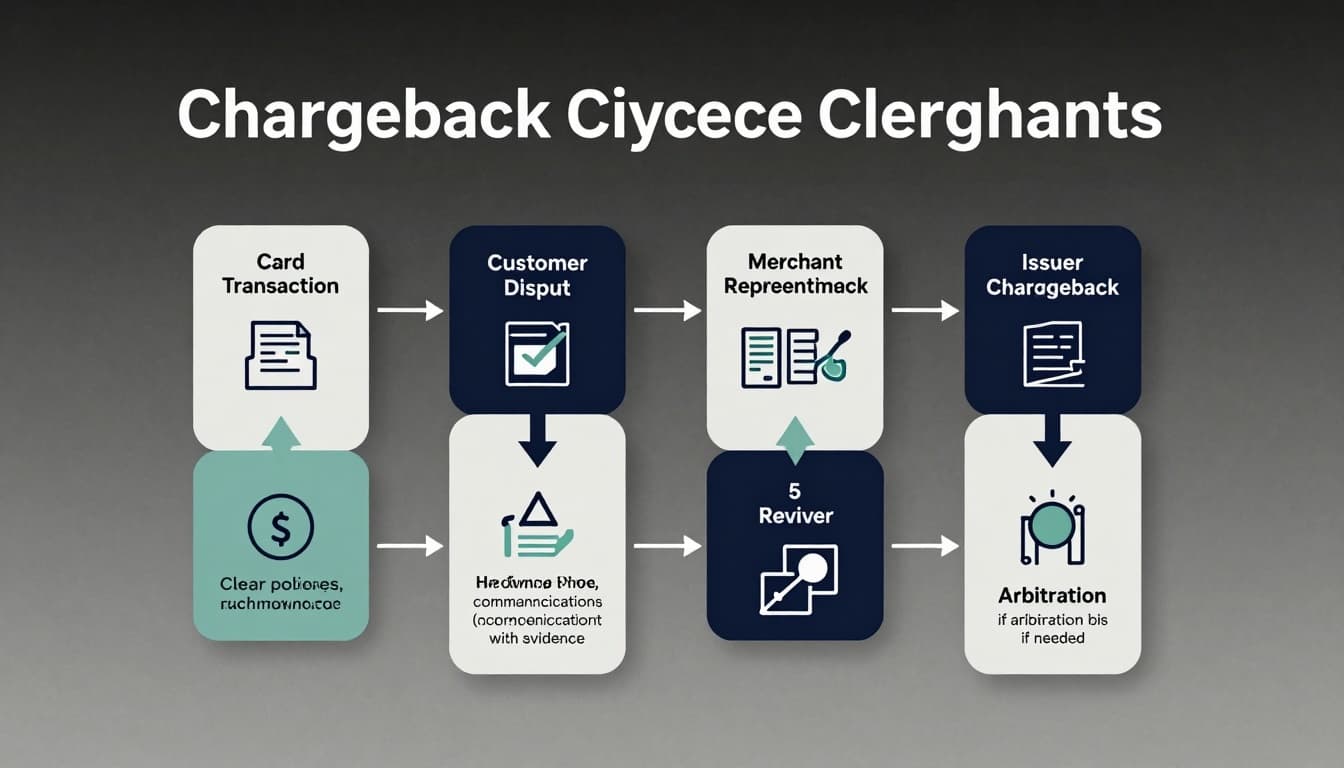

How the chargeback lifecycle works (and where reason codes fit)

A reason code shows up after the dispute is filed and escalates into a chargeback. Your job is to submit representment that matches the code, within the allowed window, through your acquirer or processor.

If you respond with the wrong evidence, it’s like bringing a birthday receipt to court when the judge asked for a passport.

A “compelling evidence” checklist by category (quick reference)

| Category | What the bank wants to see | Common mistake that loses cases |

|---|---|---|

| Fraud / no authorization | Proof the real cardholder authorized or benefited | Sending only an invoice or generic terms |

| Not received | Proof of delivery or service completion | Sending a tracking number with no delivery result |

| Not as described/defective | Proof item matched listing, plus fair resolution attempt | Ignoring support history and return policy |

| Processing error | Proof the transaction data is correct | Arguing feelings instead of fixing records |

| Cancel/recurring | Proof of clear billing terms and cancel outcome | No timestamped cancel logs or policy acceptance |

Prevent the next dispute while you fight this one

Winning representment is good. Reducing future disputes is better, because dispute ratios can threaten your processing terms.

Practical moves that work across most online business models:

- Tighten your checkout, descriptor, and receipts (make it obvious who charged the card).

- Put refunds and cancellations on rails, especially for subscriptions. If churn is rising, review common reasons customers cancel subscriptions so disputes don’t become their “exit plan.”

- Use the right processor support and tools for your model. Start with top ecommerce merchant accounts for online stores, then confirm what dispute tooling you get (alerts, evidence upload, fraud screening).

- Keep security and compliance in good shape. If you use Stripe, review this Stripe PCI compliance overview so you don’t create avoidable risk during payment capture.

Conclusion

Chargebacks don’t get easier because you’re busy. They get more expensive. When you understand chargeback reason codes, you stop sending random documents and start sending the evidence that fits the dispute.

Build a simple internal rule: identify the code, map it to the category, assemble proof that matches the bank’s question, then respond before the deadline. Do that consistently and you’ll protect margins, keep your processor relationship healthy, and keep your business ideas funded by real revenue, not hope.

Adeyemi Adetilewa leads the editorial direction at IdeasPlusBusiness.com. He has driven over 10M+ content views through strategic content marketing, with work trusted and published by platforms including HackerNoon, HuffPost, Addicted2Success, and others.