If your product is solid but revenue feels random, the issue usually isn’t effort, it’s direction. A B2B SaaS go-to-market plan turns “we should sell this” into a clear path from a defined buyer to repeatable pipeline and retention.

This guide is for startup founders, marketers, and small business owners who need a practical plan they can run weekly, not a strategy document that sits in a folder. You’ll learn what to decide first, what to measure, and how to build a motion that survives long sales cycles and picky buying committees.

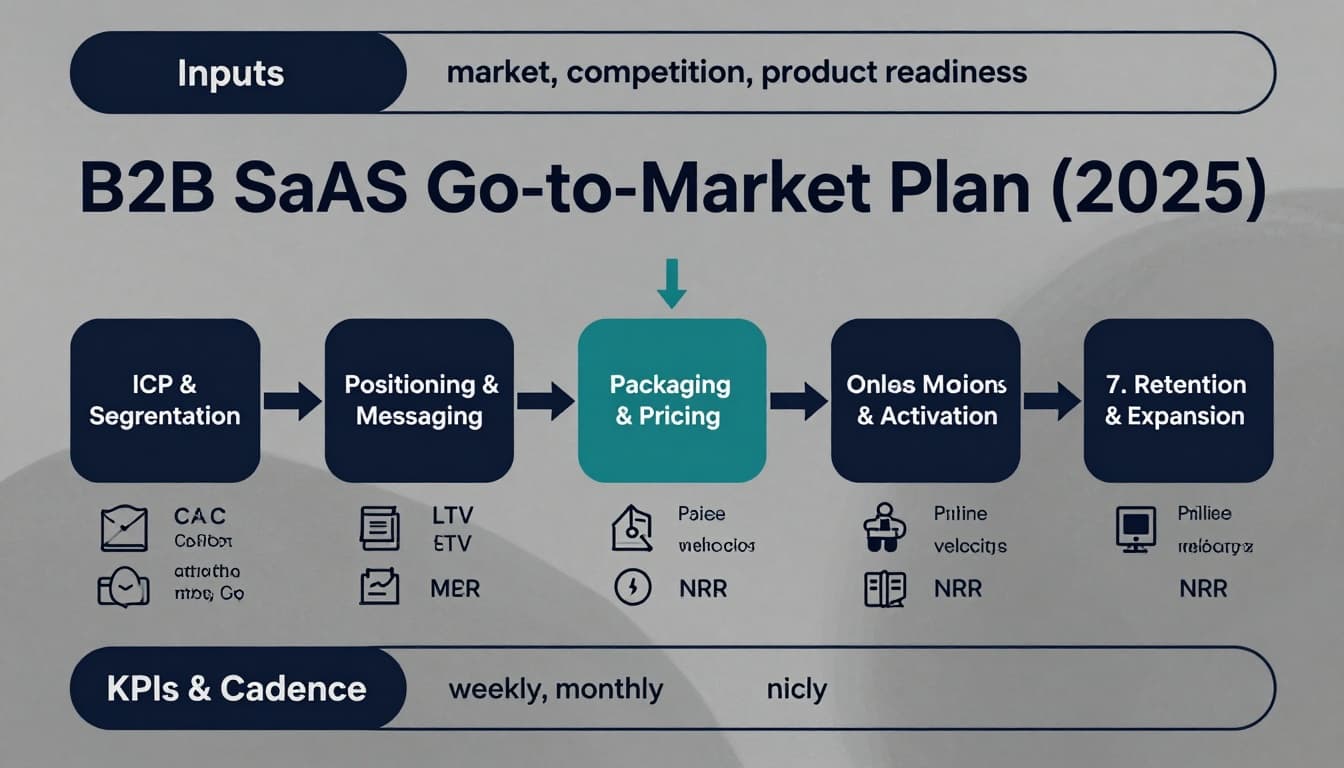

A simple 7-stage B2B SaaS go-to-market map

A go-to-market plan is basically your “how we win” system:

- Who you’re selling to (and who you’re not)

- Why they should switch now (not someday)

- How they discover you, evaluate you, and buy

- What makes them stick around long enough to expand

If you want a broader GTM checklist and template format, Zendesk has a helpful reference in its go-to-market strategy guide.

Step 1: Define your ICP and segmentation (the buyer you can serve best)

Your ideal customer profile (ICP) is not “companies with budgets.” It’s the slice of the market where your product feels like a key, not a spare part.

Aim for a short ICP statement you can repeat in one breath:

Industry + company size + trigger + job-to-be-done + constraint.

Example: “50 to 200-person logistics firms hiring SDRs fast, who need clean routing and response-time tracking, without changing their CRM.”

A few high-signal inputs:

- Trigger events: hiring, new compliance rules, new funding, new systems

- Existing tool stack: what you integrate with, replace, or sit beside

- Buying friction: security review, IT involvement, procurement rules

Keep your segments small enough to message clearly, then expand once you’ve earned the right.

Step 2: Positioning and messaging your sales team can actually use

Positioning is the frame, messaging is the copy. If either is vague, every channel gets expensive.

A practical way to tighten this fast:

- Problem: what’s broken in the buyer’s current process?

- Outcome: what “better” looks like in plain terms

- Proof: credible reasons you can deliver it (product, expertise, results)

- Trade-off: what you don’t do (this builds trust)

Write a short “talk track” version first. If a rep can’t explain it in 20 seconds, your homepage won’t save you.

For additional structure and examples, DevSquad’s B2B SaaS go-to-market strategy guide is a solid companion read.

Step 3: Packaging and pricing that matches the way customers buy

Pricing isn’t a finance task, it’s a go-to-market decision. It sets the tone for who buys, how fast, and how often they expand.

Common B2B SaaS packaging patterns (pick one that fits your value):

- Per seat: works when usage correlates with headcount

- Per usage: works when value scales with volume (events, calls, credits)

- Tiered bundles: works when buyers want clarity and procurement wants options

Practical rules:

- Keep tiers tied to outcomes, not a random feature list.

- Give sales a “why this tier” story for each package.

- Decide your entry point (self-serve trial, demo request, or paid pilot) based on deal size and complexity.

Step 4: Demand generation channels you can run every week

A channel isn’t a strategy, it’s a habit. If you can’t run it weekly, it won’t be predictable.

High-signal B2B SaaS channel mix in 2025:

- Search + content: build pages for pain, alternatives, and jobs-to-be-done (avoid the common traps in these SaaS SEO pitfalls to avoid)

- Outbound: targeted lists, tight personalization, and fast feedback loops

- Partners: agencies, integrators, and platforms that already have trust

- Webinars and workshops: teach the workflow, not the product

Channel reality check: buyers are doing more research before they talk to you. That shift shows up in how teams build systems, as discussed in this B2B SaaS GTM strategy for 2025.

Step 5: Choose your sales motion (PLG, SLG, or hybrid)

Pick your motion like you’re choosing a vehicle. A sports car is great, until you need to move furniture.

| Sales motion | Best fit | What to measure first |

|---|---|---|

| Product-led growth (PLG) | Low-to-mid ACV, fast time-to-value | Activation rate, trial-to-paid, product-qualified leads |

| Sales-led growth (SLG) | Higher ACV, complex workflows, security reviews | Pipeline velocity, win rate, sales cycle length |

| Hybrid (PLG + SLG) | Multiple segments, land-and-expand | PQL-to-opportunity, expansion rate, CAC payback |

Whatever you choose, align roles to it. Don’t ask marketing to drive trials if sales requires demos for every deal.

If outbound is part of your plan, make sure reps have the right stack and process. This list of sales prospecting tools for lead generation can help you tighten the basics without guesswork.

Step 6: Onboarding and activation, where churn is born

Most churn starts on day one, when the buyer can’t get to value fast enough.

Define your activation event. It’s the first moment the user feels the benefit (not “logged in”). Examples:

- “First report shared to a stakeholder”

- “First workflow automated”

- “First qualified lead routed correctly”

Then design onboarding to push users to that moment with fewer clicks, fewer choices, and clear guidance. If adoption is a challenge in complex accounts, use these ideas to accelerate product adoption with proven strategies.

Step 7: Retention and expansion, built into the plan (not bolted on later)

In B2B SaaS, retention is your profit engine. Expansion is your growth engine.

Set simple operating rhythms:

- A monthly value review tied to the buyer’s KPIs

- A “red flag” process for low usage, stalled seats, or missed milestones

- A clear upsell path that maps to bigger outcomes, not “more features”

Watch NRR (net revenue retention) as the scoreboard for whether your go-to-market plan is building durable growth.

A 90-day execution cadence (so the plan leaves the document)

A go-to-market plan works when it has cadence. Treat it like a flight checklist.

| Cadence | What you do | Outputs |

|---|---|---|

| Weekly | Review pipeline, activation, top channel experiments | 1 to 2 decisions, 1 experiment shipped |

| Monthly | Refresh ICP insights, pricing feedback, retention risks | Updated messaging, prioritized roadmap asks |

| Quarterly | Double down or cut channels, re-check segments | Next-quarter targets and resourcing |

Keep a single dashboard with a few metrics that match your motion (CAC, activation rate, pipeline velocity, churn, NRR). If the numbers don’t change, your activity isn’t connected to outcomes.

Conclusion: Build a B2B SaaS go-to-market plan that runs without heroics

A strong B2B SaaS go-to-market plan isn’t about doing more, it’s about doing the right few things on repeat: pick the ICP, nail the message, choose channels you can run weekly, then obsess over activation and retention. That’s how you turn a promising product into a system that keeps producing revenue.

If you’re refining business ideas or preparing for launch, start by writing your ICP in one sentence, then pressure-test it with ten real conversations this week. The market will tell you what to fix, if you’re listening.

Adeyemi Adetilewa leads the editorial direction at IdeasPlusBusiness.com. He has driven over 10M+ content views through strategic content marketing, with work trusted and published by platforms including HackerNoon, HuffPost, Addicted2Success, and others.