If money laundering is “dirty money” going through a wash cycle, banks are the quality inspectors standing next to the machine. They’re watching what goes in, how it moves, and what comes out.

That’s why understanding AML stages banking isn’t just a compliance exercise. It helps founders, fintech operators, and small business owners spot risk earlier, set smarter controls, and avoid becoming the easiest weak link in a criminal money trail.

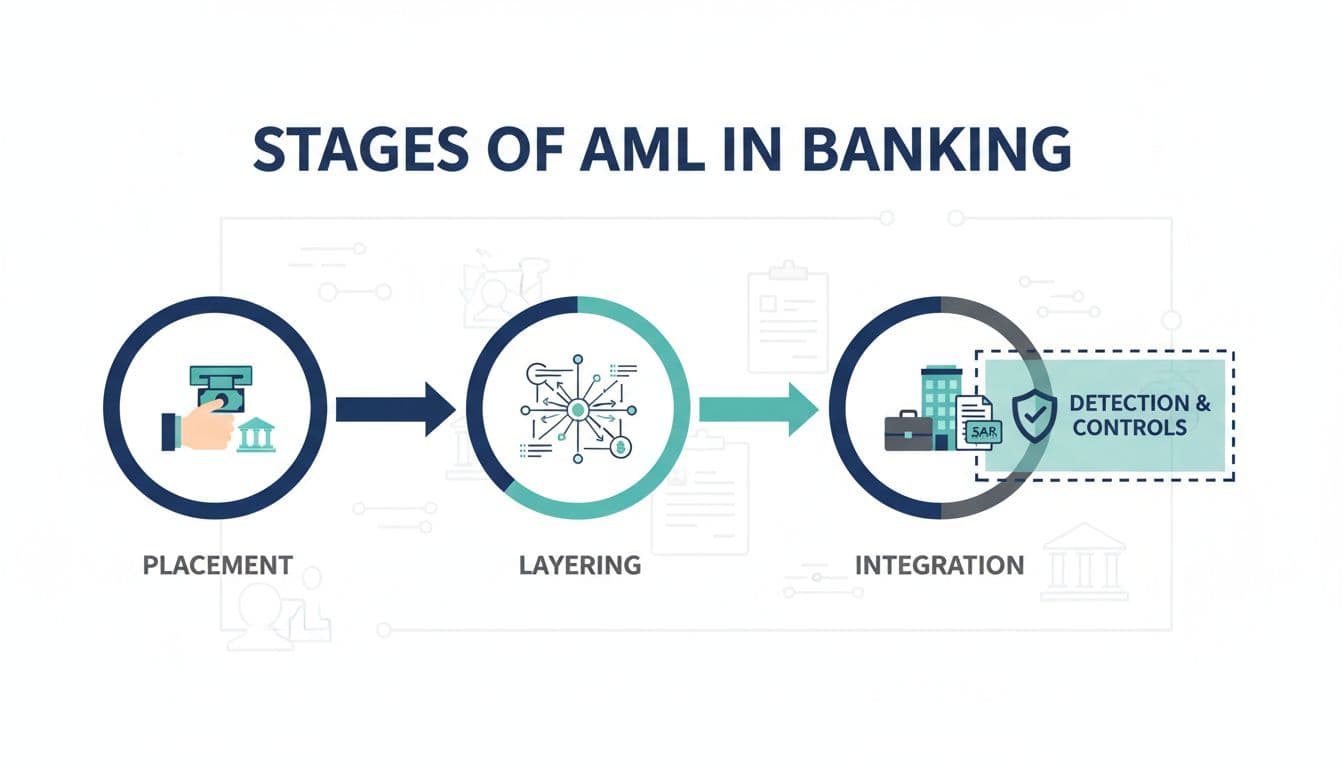

This guide breaks down the three classic laundering stages, then maps them to what banks actually do day to day to detect, investigate, and report suspicious activity.

The three money laundering stages (and why banks care)

Most laundering follows a simple pattern: get illegal cash into the system, scramble the trail, then spend it like it’s clean.

Banks care because each stage leaves different fingerprints. The best AML programs don’t treat every transaction like a crime, they focus attention where the risk is highest and the signals are strongest.

For a growing fintech, marketplace, or payments business, this matters for another reason: partners and sponsor banks often expect you to prove you can manage AML risk, not just promise you will.

AML stages banking explained: placement, layering, and integration

Stage 1: Placement (getting the money into the system)

Placement is the point where illegal funds first enter the financial system. Think cash deposits, money orders, prepaid instruments, or third-party payments designed to look routine.

For criminals, placement is risky because cash is bulky and suspicious. For banks, placement is often the best moment to catch odd activity because the money is closest to its source.

Common placement tactics include:

- Breaking cash into smaller deposits (often called structuring)

- Using cash-heavy businesses as a “front”

- Depositing via ATMs or branches far from where the customer lives or operates

If you want a deeper overview of the three-stage model, Financial Crime Academy’s breakdown of the three stages of money laundering is a helpful reference.

Stage 2: Layering (hiding the trail)

Layering is where the laundering starts to look like ordinary finance. Funds move through multiple accounts, entities, and jurisdictions to make the trail hard to follow.

This stage often uses:

- Rapid transfers between accounts (sometimes across many banks)

- Shell companies with unclear business purpose

- Trade-based payments that are tough to price-check

- Crypto or payment intermediaries (depending on controls and access)

Banks typically spot layering through patterns, not single transactions. One transfer might look fine. Ten transfers in two hours, split across unrelated beneficiaries, looks different.

Fenergo outlines practical mitigation approaches alongside the three money laundering stages, which is useful if you’re thinking about controls, not just definitions.

Stage 3: Integration (spending the money like it’s legitimate)

Integration is the end goal: money that “looks clean” returns to the criminal as usable wealth.

At this stage, funds may show up as:

- Real estate purchases

- Business investments or shareholder loans

- Luxury assets (cars, jewelry, art)

- “Consulting” invoices and vendor payments that mimic real commerce

Integration is hard to detect if the earlier stages weren’t flagged. By the time money is mixed with real income streams, the signals can be subtle.

Quick comparison: what each AML stage looks like inside a bank

| Money laundering stage | What it looks like in banking | What banks focus on |

|---|---|---|

| Placement | Cash deposits, unusual funding sources, first-time large inflows | Customer profile fit, cash patterns, source-of-funds questions |

| Layering | Fast movement across accounts, complex transfers, many counterparties | Network patterns, velocity, unusual beneficiaries, cross-border flows |

| Integration | Purchases, investments, “legit” revenue, asset-backed activity | Purpose checks, documentation quality, beneficial ownership clarity |

How banks detect each stage (the AML workflow behind the scenes)

Most people imagine AML as a single “fraud system” that catches bad guys automatically. In reality, it’s a chain of controls that should line up with the three laundering stages.

Here’s how it usually works in practice.

1) Customer due diligence (CDD) and KYC at onboarding

Strong onboarding is like checking ID at the door before a crowded event. It won’t catch everything, but it reduces the odds you’re letting obvious risk walk right in.

Banks use KYC and CDD to understand:

- Who the customer is (and who really owns the business)

- Expected activity (typical payment size, counterparties, geographies)

- Risk level (industry, products used, exposure to high-risk regions)

Higher-risk profiles may trigger enhanced due diligence (EDD), such as extra documents or deeper checks.

2) Transaction monitoring to spot placement and layering patterns

Monitoring is where banks look for “does this behavior match what we know about this customer?”

Good monitoring mixes:

- Rules (clear thresholds and pattern triggers)

- Behavior analytics (what’s normal for this customer segment)

- Review workflows (alerts that get investigated, not ignored)

If you operate in regulated, high-velocity payments (like gaming or wallets), the mechanics are similar even outside traditional banking. The approach in these iGaming transaction monitoring rules shows how pattern-based alerts can be designed without a massive team.

3) Alert investigation and case management

An alert isn’t proof. It’s a signal. Investigators look for context: customer history, counterparties, location, and whether documents support the story.

This is where banks decide whether activity is:

- Explainable (close the alert with notes)

- Concerning (keep watching, request info)

- Suspicious (file a report where required)

4) Reporting suspicious activity (and improving controls)

When suspicion remains, banks may file a Suspicious Activity Report (SAR) with the relevant authority (in the US, this is FinCEN). The key point is that reporting isn’t the finish line. It should feed back into better monitoring and tighter onboarding questions.

Technology is changing this part fast, especially around faster triage and better narrative drafting for investigators. If you’re tracking where AI fits into financial compliance work, this overview of generative AI applications in finance offers practical examples of what automation can support (and what still needs human review).

For another perspective on detection and controls across the three stages, Unit21’s guide to the 3 stages of money laundering connects the stages to how teams typically build detection programs.

Common red flags by stage (plain-English examples)

Red flags aren’t a checklist to accuse customers. They’re prompts to ask, “Does this make sense?”

A few stage-based examples:

- Placement red flags: sudden cash deposits that don’t fit the customer’s profile, repeated deposits just under reporting thresholds, third-party funding with no clear reason.

- Layering red flags: rapid in-and-out transfers, many new beneficiaries, frequent cross-border wires without a business story, funds moving through multiple related accounts quickly.

- Integration red flags: property purchases that don’t fit income, vague “consulting” payments, circular payments between linked entities that create fake revenue.

Context matters. A busy retailer may have lots of deposits. A global SaaS firm may pay cross-border vendors. The question is whether the activity matches the customer’s real-world business.

Conclusion: building clarity around AML stages in banking

Once you understand the three stages, you stop seeing AML as random alerts and start seeing a story: entry, disguise, and payoff. That perspective helps you design controls that catch risk earlier, when signals are stronger and losses are smaller.

If you’re building products or processes in finance, keep AML stages banking in mind when you set onboarding questions, monitoring rules, and investigation workflows. The goal isn’t to treat everyone like a suspect, it’s to make it harder for bad money to look normal.

Adeyemi Adetilewa leads the editorial direction at IdeasPlusBusiness.com. He has driven over 10M+ content views through strategic content marketing, with work trusted and published by platforms including HackerNoon, HuffPost, Addicted2Success, and others.