A 529 plan is a simple idea with big tax perks, it’s a savings account for education costs that rewards you for planning ahead. If you’re a busy founder or small business owner, a 529 helps you build a college fund without extra income tax hits on growth.

That is the power of 529 plan income tax rules used the right way.

Here is the quick win. Your money grows tax-free, and qualified withdrawals are not taxed at the federal level. Many states also offer deductions or credits on contributions, which can lower your state tax bill.

A real example. Maya, a SaaS founder, sets an automatic $8,000 yearly contribution for her son’s future tuition.

She stays under the 2025 gift tax exclusion (up to $19,000 per giver), claims her state’s available tax break, and lets the account grow without federal income tax on earnings as long as the money is used for qualified education.

Why this matters to owners. You can sync contributions with cash flow, keep funds outside your operating risk, and still optimize taxes.

You get flexibility, too, since beneficiaries can be changed within the family if plans shift.

Find out more about the tax by reading 529 Plan Tax Deferred: Rules, Limits, and Smart Moves.

In this post, you’ll learn:

-

How 529 plan income tax rules work in 2025, in plain English

-

What counts as qualified expenses, and what triggers taxes and penalties

-

Smart contribution tactics founders use, including gift tax basics

-

State deduction and credit tips, plus common pitfalls to avoid

-

A quick setup checklist you can execute in under an hour

How 529 Plans Cut Your Income Tax Bill Through Smart Savings

A smart 529 plan income tax strategy lets your money work harder while you run your business. You get growth without annual tax drag and tax-free withdrawals for qualified education costs.

That combo protects returns the way a shield protects your margin.

Tax-Free Growth

With a 529, your contributions grow tax-deferred, so you do not pay income taxes on dividends or gains each year.

That is the direct opposite of a taxable account, where annual taxes shave off growth and compound over time.

Here is a simple 2025 example using a 24% federal bracket. A $10,000 investment in a taxable account grows to about $14,093 after taxes, while the same $10,000 in a 529 can reach about $18,543 when used for qualified education.

That gap is the silent tax drag you avoid.

The key is how you spend it. Use the money for qualified education expenses and those gains stay tax-free. Use it for something else and taxes apply to earnings.

-

Actionable tip:

-

Check plan fees and investment options carefully.

-

Lower fees help keep more of your growth compounding over time.

-

Key takeaway:

-

Start small now and let compounding handle the heavy lifting for long-term growth.

Qualified Withdrawals

Withdrawals for qualified expenses come out tax-free, which is the heart of 529 plan income tax benefits. The IRS Q&A makes this clear, and it is your best guide for what qualifies.

What counts as qualified:

-

How 529 plan income tax rules work in 2025, in plain English

-

What counts as qualified expenses, and what triggers taxes and penalties

-

Smart contribution tactics founders use, including gift tax basics

-

State deduction and credit tips, plus common pitfalls to avoid

-

A quick setup checklist you can execute in under an hour

What does not qualify:

-

Travel, sports fees, and health insurance

-

Test prep, application fees, or optional equipment

-

Rent or meals if the student is less than half-time

-

Non-education purchases of any kind

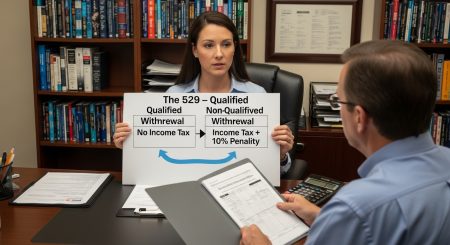

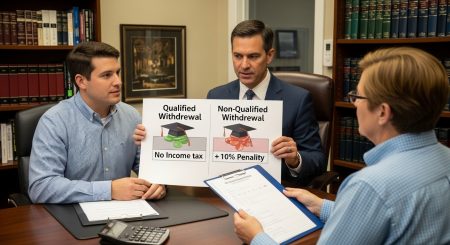

If you spend on non-qualified items, the earnings portion of the withdrawal is subject to income tax plus a 10% penalty. Your original contributions are not taxed on withdrawal.

Founder planning tip: map expected education costs next to your business cash flow calendar. Set automatic monthly contributions that match slower months, then top up after strong quarters.

This keeps your plan funded without straining operations while protecting more of your returns from taxes. Explore our article on 2 Types Kiddie Tax Calculator: What Parents and Founders Need to Know about tax.

Understanding gift tax rules helps you make smarter 529 plan income tax moves without surprises. In 2025, you can fund education goals confidently, stay compliant, and still keep cash flow predictable as a founder.

Annual Limits

The 2025 annual gift tax exclusion lets you contribute up to $19,000 per beneficiary without IRS reporting. If you file jointly, you and your spouse can give $38,000 per child, per year.

Contributions to a 529 are not deductible at the federal level, but they avoid gift tax within these limits. Many states offer deductions or credits, which can stack with your federal 529 plan income tax advantages on growth and withdrawals.

Example: a founder channels a $19,000 year-end bonus into a child’s 529 every year. No gift tax issues, no Form 709 needed, and earnings grow tax-free for qualified education.

Build this into your family plan by timing contributions with cash inflows, like distributions or quarterly profit spikes.

Quick guardrails:

-

Keep total gifts per beneficiary under the annual exclusion to skip gift tax reporting

-

Coordinate gifts from grandparents to avoid accidental overage

-

Track state tax rules for extra savings on top of federal benefits

Superfunding Strategy

Superfunding lets you contribute five years’ worth of gifts at once. In 2025, that is $95,000 per beneficiary, or $190,000 for couples, and you elect to spread it evenly over five years on your tax return.

Here is how it works. You make the lump sum, then on Form 709 you elect five-year averaging so it does not use your lifetime exemption.

Treat the account as hands-off for five years, no withdrawals, to keep the election clean and focused on growth.

Why founders like it:

-

Faster compounding inside the 529’s tax-free wrapper

-

One big move during a strong liquidity event or exit

-

Clear estate planning benefits while keeping funds earmarked for education

Consider an Invest529 example. A founder puts $95,000 into Invest529 in January 2025, elects the five-year spread, and lets it ride.

Assuming steady markets, earlier dollars work longer, which can materially increase the college fund by freshman year.

Important notes:

-

The five-year election is irrevocable once filed

-

Additional gifts to the same beneficiary during the five-year window may eat into your lifetime exemption

-

If your plan might change, talk to a tax pro before superfunding. A brief consult can prevent a costly mismatch with your 529 plan income tax strategy

Action checklist before superfunding:

-

Confirm cash needs and runway for the next 12 to 24 months

-

Verify state 529 rules and any contribution caps

-

Align beneficiary plans and consider backups in the family

-

File Form 709 correctly with the five-year election

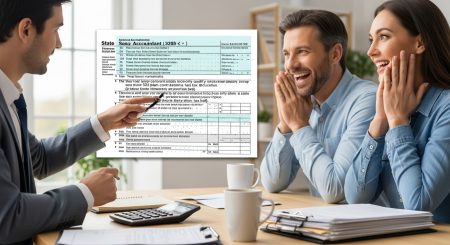

State Tax Deductions

State tax breaks stack on top of your federal 529 plan income tax advantages. That means you can reduce taxable income today, then use tax-free growth for qualified education later.

If you are already contributing, a small tweak could put real money back in your pocket.

Popular State Breaks

Several states sweeten your 529 plan income tax results with 2025 deductions. Here is a quick snapshot founders can use during year-end planning.

-

Colorado: up to $22,700 for single filers and $34,000 for joint filers in 2025. Contributions are deductible against state income, subject to the annual cap

-

Wisconsin: a moderate deduction, generally around $3,000 to $3,500 per beneficiary for single filers, and double for joint filers

-

New York: up to $5,000 for single filers, and $10,000 for joint filers, when you contribute to the New York 529 plan

How to claim in most states:

-

Contribute to your state’s plan by December 31. Many states require in-state contributions to qualify

-

Save contribution confirmations. You will reference them on your state return

-

Use your state’s 529 deduction line or schedule. Your plan provider often lists the exact line in tax documents

Helpful nuance:

-

Some states offer tax parity, you can contribute to an out-of-state plan and still get a deduction. Check your state’s rule before moving money

-

A few states have income tax but no deduction. The 529 still helps with tax-free growth and withdrawals

Simple example:

- A $5,000 deduction at a 24% marginal rate can save about $1,200 in taxes. That cash can fund next quarter’s contribution or cover books and fees.

Founder playbook:

-

Front-load contributions in strong cash months to max state breaks

-

If you moved states, confirm which plan qualifies before contributing

-

Keep a running tally per beneficiary to avoid missing caps or paperwork

Avoiding 529 Plan Tax Traps

Smart founders use 529 plan income tax rules to grow savings, then trip over avoidable penalties. The fix is simple, understand what triggers taxes and how to stay in bounds.

Use the account as intended, track your numbers, and keep records tight.

What Happens with Non-Qualified Withdrawals?

Withdrawals used for non-qualified expenses do not wipe out your 529 plan income tax benefits completely, but they do sting.

Only the earnings portion is taxed at the beneficiary’s ordinary income rate, plus a 10% penalty on that earnings slice. Your original contributions, the basis, come out tax and penalty free.

Here is the simple math. You withdraw $5,000 and $2,000 of that is earnings, the penalty is $200, then the beneficiary owes income tax on the $2,000.

State taxes may also apply to the earnings, and some states may claw back prior deductions.

Key exceptions to the 10% penalty:

-

Death or disability of the beneficiary

-

Scholarships, up to the amount of the scholarship

-

Attendance at a U.S. military academy, limited to allowed costs

Avoid headaches by tracking basis and earnings before you withdraw. Most plans show the split on statements, but verify it before payment.

If you need cash for a non-qualified cost, consider withdrawing only basis or waiting until an exception applies.

Pro tips to stay clean:

-

Align withdrawals to qualified expenses in the same calendar year

-

Pay the school or qualified vendor directly when possible

-

Document everything, invoices, receipts, and 529 distribution confirmations

Impact on Financial Aid and Other Tax Considerations

A 529 owned by a parent is treated as a parental asset on the FAFSA, generally assessed at up to about 5.6%. That is far gentler than student-owned assets, which face a much higher assessment.

For founders, this means college aid formulas penalize you less while you still get 529 plan income tax advantages.

Your 529 does not affect your business deductions or your company’s tax position. It is a personal savings tool, so it lives outside your P&L. Keep it separate from business accounts so audits and bookkeeping stay clean.

Estate planning gets a quiet win here. Large 529 contributions remove assets from your taxable estate while you retain control as the account owner.

That can support a broader gifting strategy, especially when paired with annual exclusion gifts or five-year superfunding elected on your personal return.

Balance your savings mix so college funding does not starve other goals:

-

Keep an emergency fund at 3 to 6 months of expenses

-

Max retirement accounts first, then layer on 529 contributions

-

If cash flow varies, automate small monthly 529 deposits, then add lump sums after strong quarters

Use the 529 for education, time withdrawals with qualified costs, and keep records sharp. That is how you lock in the 529 plan income tax benefits with fewer surprises.

Conclusion

529 plan income tax rules reward early, steady action. You get tax-free growth, tax-free qualified withdrawals, and the ability to use annual gift exclusions or superfunding to front-load savings when cash flow is strong.

State deductions or credits can stack on top, which puts real dollars back into your plan. Avoid common pitfalls by matching withdrawals to qualified expenses in the same calendar year and tracking the basis versus earnings before you pull funds.

For founders and business families, the win is clarity and control. You can keep education money outside business risk, time contributions around profit spikes, and still cut taxes along the way.

One immediate takeaway: run a two-minute savings check. Multiply your planned 2025 contribution by your state marginal rate to estimate deduction savings, then compare that with the tax drag you’d face in a taxable account to see the 529 gap you’ll keep.

Next steps are simple. Open a 529, set an automatic monthly amount, check your state’s perks, and talk with a tax pro about gift exclusions or a five-year election.

You’ll secure a stronger education future without the tax stress. Find out more about tax by exploring Kiddie Tax : Smart Moves for Parents and Business Owners.

I am Adeyemi Adetilewa, a content marketing strategist helping B2B SaaS brands grow their organic traffic, improve search visibility, and attract qualified leads through data-driven, search-optimized content. My work is trusted by the Huffington Post, The Good Men Project, Addicted2Success, Hackernoon, and other publications.