College costs keep climbing, and your team feels it every time they look at tuition numbers.

A simple way to help is to offer a 529 payroll deduction program, so employees can send a bit of each paycheck straight into a tax-advantaged college savings plan.

This guide walks through how small business owners can set up a program that is easy to run, simple for employees, and aligned with the rest of your benefits.

Why A 529 Payroll Deduction Is A Smart Small‑Business Benefit

For a small team, every benefit sends a signal about what you value. A 529 payroll deduction program tells employees you care about their family’s future, not just today’s output.

A well-set 529 option can:

- Help attract and keep talent, especially working parents and mid-career staff.

- Support long-term financial wellness, alongside retirement benefits.

- It costs very little to offer if you choose an employee-funded model.

If you want a deeper look at how 529s stack up against other education accounts, this UTMA vs 529 plan comparison guide explains key differences in plain language.

Some small employers even add a modest match, similar to a 401(k), and treat it as a standout perk. You can see how companies structure retirement benefits in this overview of 401(k) matching strategies for small businesses.

Step 1: Understand The Basics Of 529 Plans And Payroll Deductions

A 529 plan is a tax-advantaged account for qualified education expenses, like tuition, fees, and often room and board. Employees contribute with after-tax dollars, then the money can grow tax-free, and qualified withdrawals are tax-free too.

When you add a 529 payroll deduction:

- Employees choose a dollar amount per pay period.

- Your payroll system sends that amount directly to their 529 plan.

- You may, but do not have to, add employer contributions.

Many state programs publish clear employer and employee how-tos. The WA529 program, for example, explains the employee side in its GET Payroll direct deposit overview, including how workers open an account and complete a direct deposit form.

If grandparents also help with college funding in your employees’ families, share this guide on the pros and cons of 529 plans for grandparents. It can help them plug into the same strategy.

Step 2: Choose A 529 Plan Provider That Supports Employers

Not all 529 plans are built equally for payroll use. Before you promise a benefit, check that the provider can handle employer contributions smoothly.

Look for:

- Clear employer onboarding instructions.

- A simple process to send payroll files and contributions.

- Support for multiple employees and multiple accounts.

- Phone and email support if you are a small team without a benefits department.

State plans often have an employer page with templates and forms. Washington’s program offers an Employer Payroll Direct Deposit setup guide that shows what a streamlined process looks like: registration steps, contribution file formats, and tips for keeping employer details current.

You do not need to offer every 529 in the country. Most small businesses pick one primary plan that works well with their payroll system and state tax rules.

Step 3: Set Up Your Employer Account And Connect Payroll

Once you pick a plan, you will open an employer account. Expect to provide:

- Business legal name and tax ID.

- Primary contact for benefits or payroll.

- Banking information if you send contributions by ACH.

After the plan approves your employer account, you will connect it to your payroll process. This is where your payroll provider matters.

If you run payroll in-house with software, check its help center. For example, this QuickBooks article explains how to set up 529 contributions in QuickBooks payroll, including how to create a new deduction type and map it correctly.

A few practical tips:

- Label the deduction clearly in your system so employees recognize it.

- Confirm whether your state offers tax benefits for contributions, and code things correctly.

- Run a test payroll with one volunteer before rolling it out to everyone.

Step 4: Design A Clear Employee Enrollment Process

A 529 payroll deduction only works if employees understand it and trust it. Treat the launch like a mini campaign, not just another form.

Key pieces to put in place:

- Simple instructions: Step-by-step, one-page directions on how to open a 529 account and request payroll direct deposit. ScholarShare 529 offers a helpful example in its Setting Up Payroll Direct Deposit checklist.

- Kickoff meeting: A short lunch-and-learn or all-hands segment where you explain how the benefit works, with a real dollar example for a typical paycheck.

- Enrollment window: Give people a few weeks to sign up, then add the deduction to the next available payroll cycle.

For many employees, college savings feels overwhelming. Framing this as, “Can you spare $25 per paycheck to help future tuition?” makes the choice easier.

Step 5: Run The Program And Keep It Clean

After launch, your 529 payroll deduction program moves into a steady rhythm. Your job is to keep the pipes clear.

Build a simple checklist:

- Reconcile each payroll file with the 529 provider’s confirmation.

- Update contribution amounts when employees submit new forms.

- Remove deductions quickly when someone leaves the company.

- Keep a secure record of all forms and changes.

Some providers publish employer quick guides with timing and file requirements, like WA529’s employer resources linked from its payroll direct deposit setup section. Use these documents as your standard operating manual.

On the communication side, send a reminder about the benefit at least once a year, often during open enrollment. ADP shares helpful ideas in its guide on how to offer a 529 plan that your employees actually use, including how to frame college savings in a way that feels personal.

Step 6: Compare Manual 529 Saving To 529 Payroll Deduction

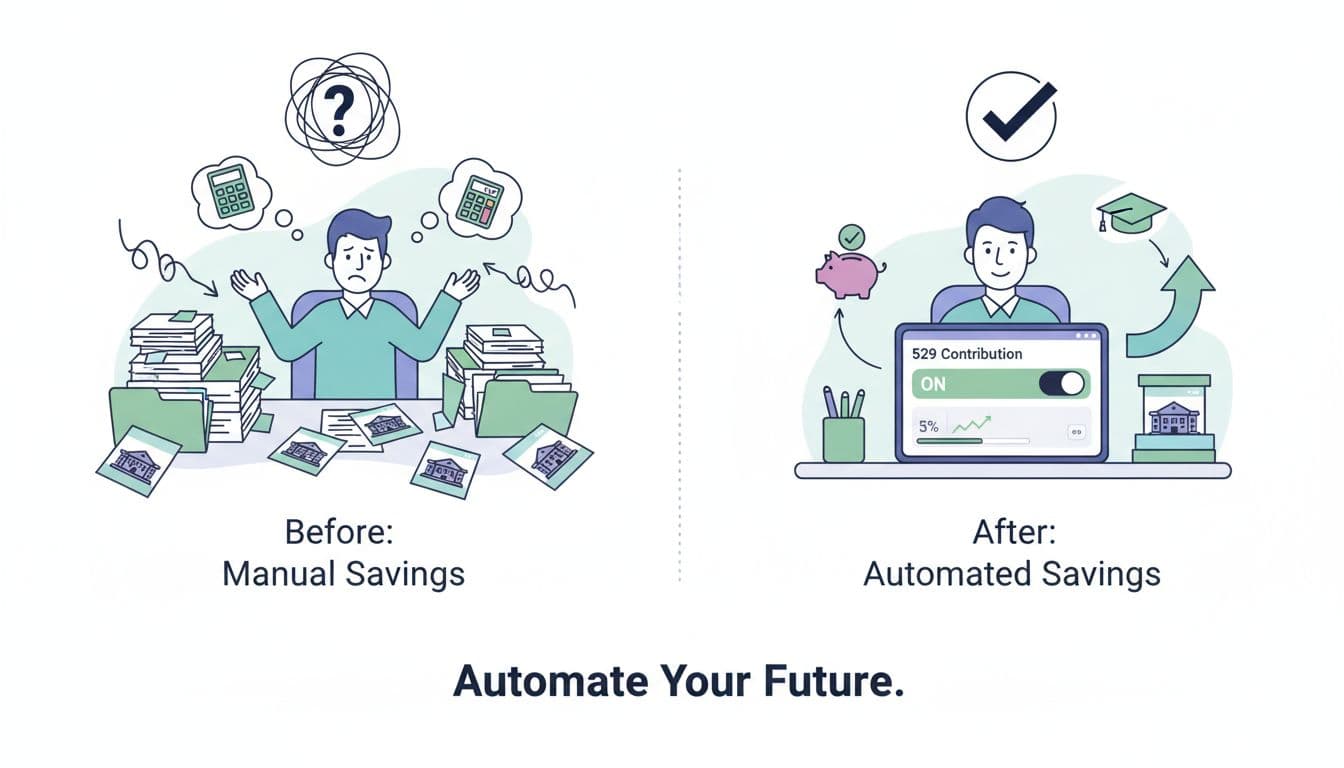

Many employees already know they “should” save for college. The hurdle is moving from intention to action. That is where 529 payroll deduction shines.

Here is a quick comparison:

| Approach | How Contributions Happen | Employer Effort | Employee Experience | Best For |

|---|---|---|---|---|

| Manual 529 contributions | Employee logs in and transfers money manually | None | Easy to forget, inconsistent | Self-directed savers |

| 529 payroll deduction program | Money moves automatically from each paycheck | Light setup, ongoing admin | Set-and-forget, consistent savings | Busy employees who want structure |

For your business, the program feels similar to adding a new voluntary benefit line in payroll. For your employees, it feels like a quiet system that keeps working in the background, one paycheck at a time.

For your business, the program feels similar to adding a new voluntary benefit line in payroll. For your employees, it feels like a quiet system that keeps working in the background, one paycheck at a time.

Conclusion: Turn 529 Payroll Deduction Into A Signature Benefit

Setting up a 529 payroll deduction for a small business is not a big-company move. It is a practical, low-cost benefit that pairs well with retirement plans and health coverage.

You choose a plan, connect payroll, give your team clear instructions, and then keep the process tidy with a simple checklist. Over time, you help families chip away at a major expense, using money they were already earning.

If you already offer retirement savings and want your next benefit to stand out, a 529 payroll deduction program can be that quiet upgrade that makes your workplace feel more supportive and future-focused.

Adeyemi Adetilewa leads the editorial direction at IdeasPlusBusiness.com. He has driven over 10M+ content views through strategic content marketing, with work trusted and published by platforms including HackerNoon, HuffPost, Addicted2Success, and others.